Cryptocurrency Buy Levels for Ethereum (ETH), Litecoin (LTC) and Solana (SOL)

Ethereum (ETHUSD)

Above: Ethereum (ETHUSD)

Riding on the current success of Bitcoin’s intraday rally from the BITO ETF opening trade, Ethereum has maintained a steady 1.5% – 2% gain for Tuesday. It has struggled to push beyond the $4,000 value area, but it could be very close to doing so and extending the rally it’s had since September 21st. If you want to get very specific, then a daily close at $3,975 would be the price level to watch. Oddly, the RSI remains in technical bear market conditions and has yet to have a clear close above 65, so any breakout by Ethereum above the $4,000 level will likely have a lot of momentum behind that could be sustained. The projected profit target range on a breakout above $4,000 is the 100% Fibonacci Expansion at $6,215.

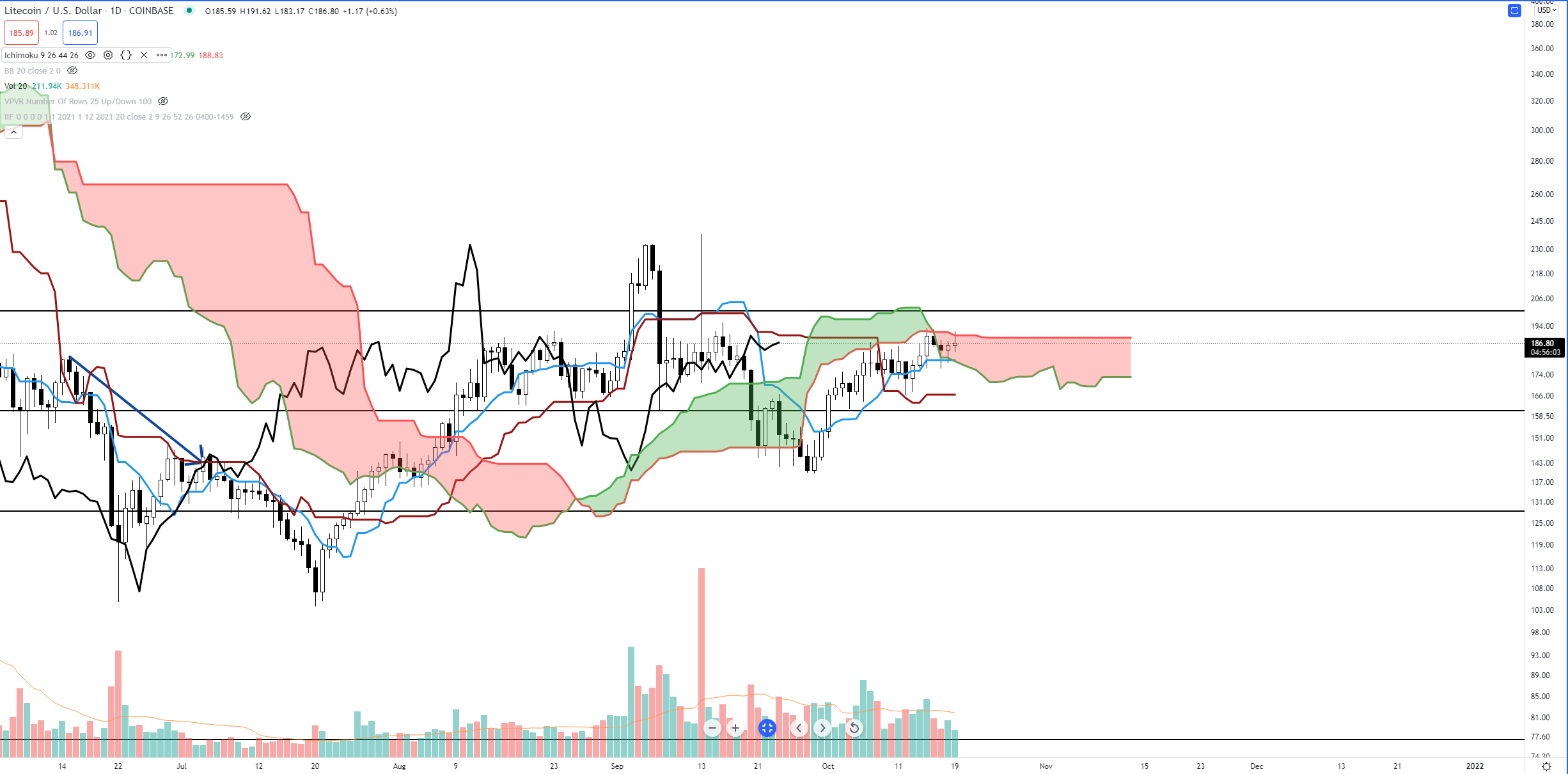

Litecoin (LTCUSD)

Above: Litecoin (LTCUSD)

It remains to be seen whether Litecoin is going to be relegated to the dustbin of cryptocurrencies most pointless cryptocurrencies. At the present, it still maintains a strong following and use case. Additionally, it is a big laggard with its price action when compared to its peers. The breakout level for Litecoin is based on the Ichimoku Kinko Hyo system. Normally, a close above the Cloud with the current setup on Litecoin’s chart would be sufficient enough of a reason to go long, but there is one level above the Cloud that could halt Litecoin: the 38.2% Fibonacci Retracement at $200. The ideal close on the daily chart for Litecoin would be at $203. This would put Litecoin above the Cloud and above the 38.2% Fibonacci Retracement. It would also position the Lagging Span into a range where it would remain above the Cloud as long as Litecoin maintained a level above $200.

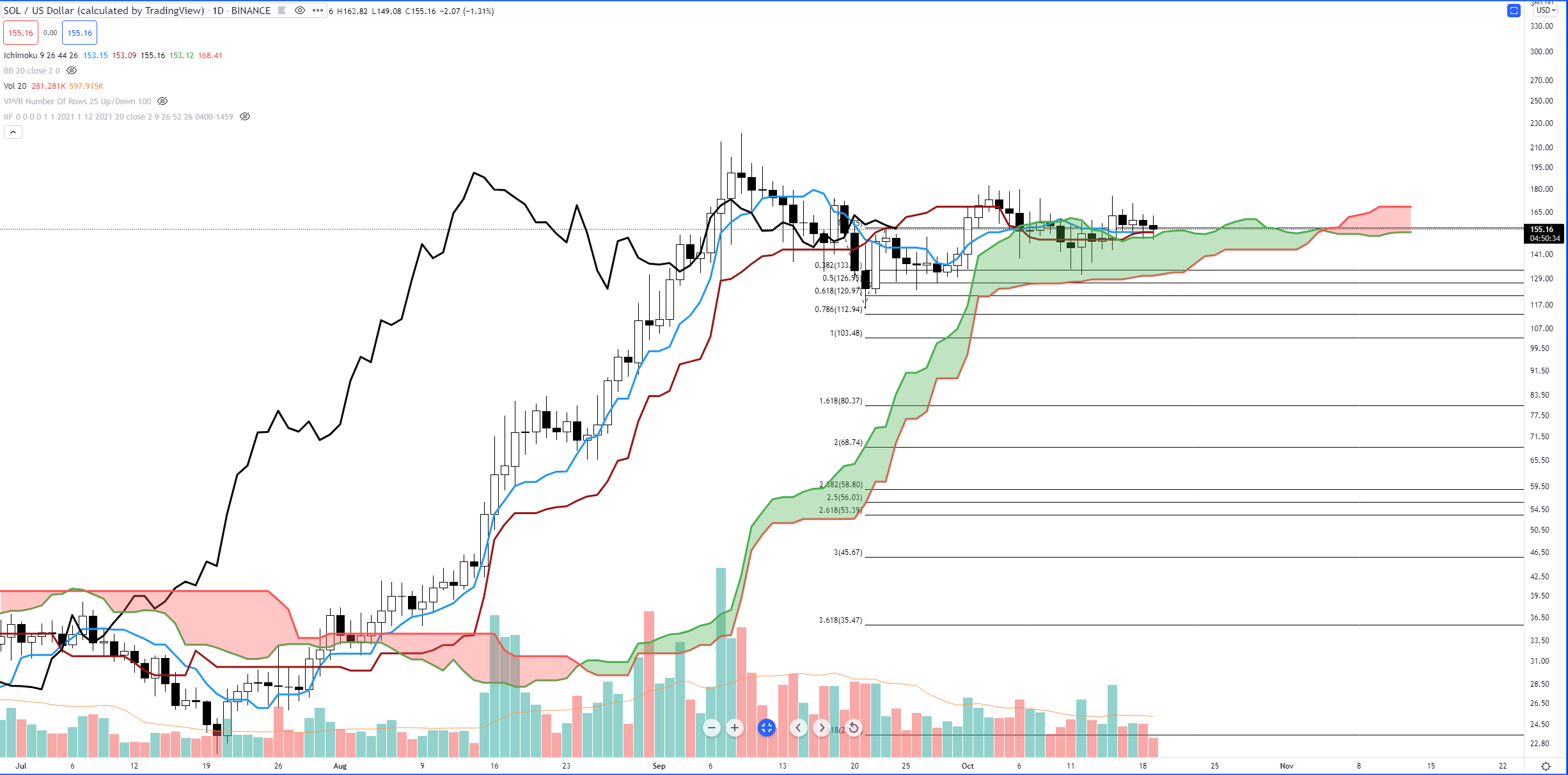

Solana (SOLUSD)

Above: Solana (SOLUSD)

Solana is directly on top of some key support levels that, if breached, would likely trigger some violent moves to the south. Overall, the pattern of consolidation that Solana shows is a very standard looking bullish pennant. The buy entry level for Solana would be a daily close at or above $175. A close at $175 would fulfill the rules for a bullish entry of a breakout of a triangle. Additionally, it would ensure that the Lagging Span is trading in open space. It is very likely that Solana will move with some ease towards new all-time highs and may see an easy move through the $200 and go straight for the $300 level.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.