October 04, 2021, 23:45 pm ET, BY Billy – Contributor |

Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

Source: Stock Traders Daily

Longer Term Trading Plans for COIN

- Buy COIN over target n/a stop loss @ 0. Details

The technical summary data tells us to buy COIN near , but there is no current upside target from the summary table. In this case we should wait until either an update to the summary table has been made (which usually happens at the beginning of every trading day), or until the position has been stopped. The data does tell us to set a stop loss 0 to protect against excessive loss in case the stock begins to move against the trade. is the first level of support below 229.31, and by rule, any test of support is a buy signal. In this case, if support is being tested, a buy signal would exist.

- NONE . Details

NONE .

There are no current resistance levels from the summary table, and therefore there are no Short resistance Plans which tell us to short upon tests of resistance. Resistance levels have broken higher and unless the stock reverses lower and below support levels again short positions look risky.

Swing Trading Plans for COIN

- Buy COIN over n/a, target n/a, Stop Loss @ 0 Details

If n/a begins to break higher, the technical summary data tells us to buy COIN just over n/a, with an upside target of n/a. The data also tells us to set a stop loss @ 0 in case the stock turns against the trade. n/a is the first level of resistance above 229.31, and by rule, any break above resistance is a buy signal. In this case, n/a, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short COIN near n/a, target 222.19, Stop Loss @ 0. Details

The technical summary data is suggesting a short of COIN if it tests n/a with a downside target of 222.19. We should have a stop loss in place at 0 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, n/a, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

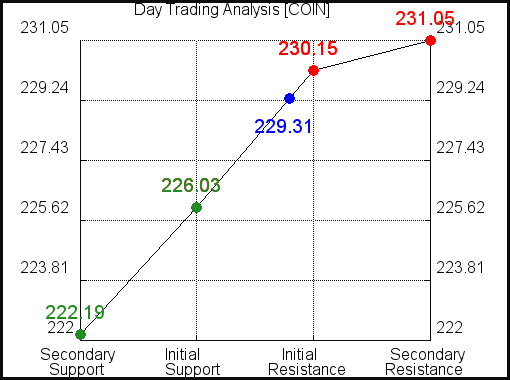

Day Trading Plans for COIN

- Buy COIN over 230.15, target 231.05, Stop Loss @ 229.61 Details

If 230.15 begins to break higher, the technical summary data tells us to buy COIN just over 230.15, with an upside target of 231.05. The data also tells us to set a stop loss @ 229.61 in case the stock turns against the trade. 230.15 is the first level of resistance above 229.31, and by rule, any break above resistance is a buy signal. In this case, 230.15, initial resistance, would be breaking higher, so a buy signal would exist. Because this plan is based on a break of resistance, it is referred to as a Long Resistance Plan.

- Short COIN near 230.15, target 226.03, Stop Loss @ 230.69. Details

The technical summary data is suggesting a short of COIN if it tests 230.15 with a downside target of 226.03. We should have a stop loss in place at 230.69 though in case the stock begins to move against the trade. By rule, any test of resistance is a short signal. In this case, if resistance, 230.15, is being tested a short signal would exist. Because this plan is a short plan based on a test of resistance it is referred to as a Short Resistance Plan.

COIN Technical Summary | Raw Data for the Trading Plans

| Term → |

Near |

Mid |

Long |

| Bias |

Weak |

Weak |

Neutral |

| P1 |

0 |

0 |

ERR |

| P2 |

226.03 |

222.19 |

0 |

| P3 |

231.05 |

230.15 |

0 |

The support and resistance levels for Coinbase (NASDAQ: COIN) define prudent trading and investing plans, which are revealed herein.

Warning:

This is a static report, the data below was valid at the time of the publication, but support and resistance levels for COIN change over time, so the report should be updated regularly. Real Time updates are provided to subscribers. Unlimited Real Time Reports.

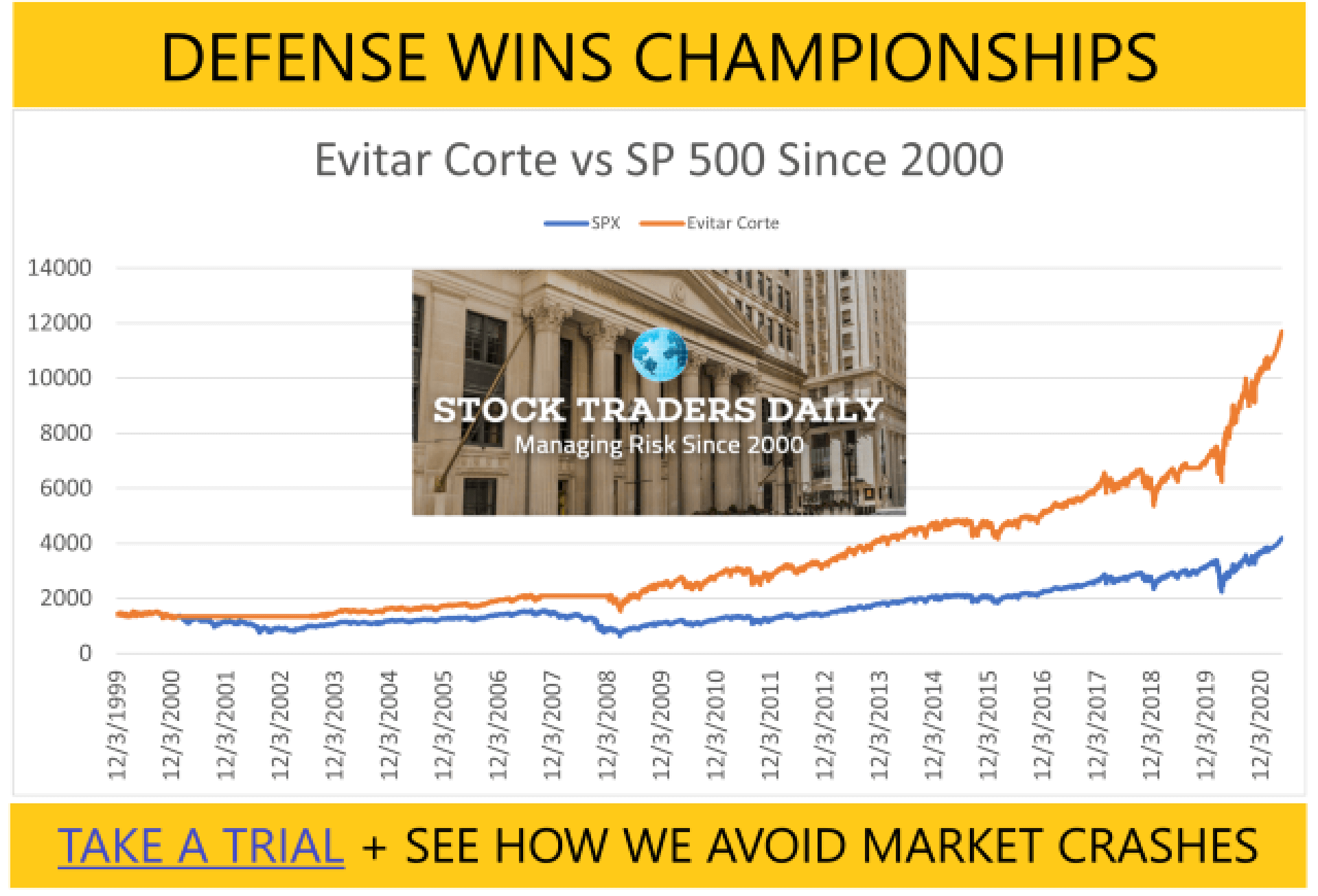

Subscribers also receive market analysis, stock correlation tools, macroeconomic observations, timing tools, and protection from market crashes using Evitar Corte.

Instructions:

The rules that govern the data in this report are the rules of Technical Analysis. For example, if COIN is testing support buy signals surface, and resistance is the target. Conversely, if resistance is being tested, that is a sign to control risk or short, and support would be the downside target accordingly. In each case, the trigger point is designed to be both an ideal place to enter a position (avoid trading in the middle of a trading channel), and it acts as a level of risk control too.

Swing Trades, Day Trades, and Longer term Trading Plans:

This data is refined to differentiate trading plans for Day Trading, Swing Trading, and Long Term Investing plans for COIN too. All of these are offered below the Summary Table.

Graph of Evitar Corte vs S&P 500

Fundamental Charts for COIN