The Bitcoin price rally has caught the attention of the investment community in recent weeks. But while some coins are benefiting from the Bitcoin ETF bullishness, others are struggling.

Litecoin is one of the coins that is lacking a spark in its recent rally. BTC is back at the all-time highs, while newer coins such as Solana also hit new peaks. Ethereum has also done well getting close to its highs, but LTC is trading at half of its previous record. This is despite the coin seeing promising on-chain metrics.

Data provider Santiment has said that Litecoin (LTC) now has more active addresses than Ethereum (ETH).

“Litecoin has just flipped Ethereum in terms of address activity for just the third time this year. We’ve also discovered that Litecoin’s payment count, which quantifies the number of addresses receiving $LTC, has hit an ATH,” they said.

“We might suggest that Ethereum’s on-chain activity is under pressure because of high fees, sure. But what’s driving Litecoin in opposite direction? How could a UTXO [unspent transaction output] cryptocurrency coin flip over the biggest DeFi and NFT ecosystems token, ETH? Apparently almost 600K people are using LTC on a daily basis.”

For Litecoin, the chain is seeing a high number of daily users, but the coin is seeing its price affected by the competition for investment. Axie, Solana and Shiba Inu are three examples of coins that are attracting investment flows recently.

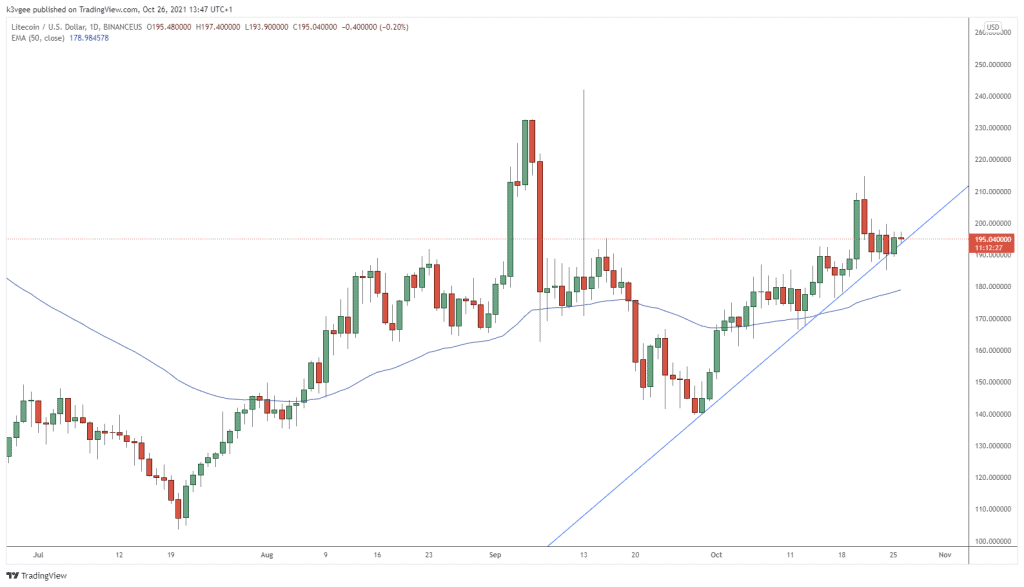

Litecoin Price Analysis

Litecoin has kept pace with other distinguished altcoins during the BTC frenzy but the uptrend is steep and risks a pullback. Despite this, the coin has seen support yesterday in what could be a base for a move back above the $200 level. Resistance for LTC then sits below $220 and at $240. The all-time high is above $400 so LTC is really trading at a 50% discount from the May highs, while BTC is back at its own May ATH.

Litecoin Price Chart (Daily)