Bitcoin (BTC) price sped up to highs of $55,300 on Oct. 6 as bullishness returns to the market following the prior months’ slump. Bitcoin’s surge to highs last seen since May 12 comes amid a series of positive developments. First, the SEC chairman, Gary Gensler in a hearing of the House Financial Services Committee reiterated previous comments made by Federal Reserve chairman Jerome Powell, stating that he has no plans to ban cryptocurrency and that a ban would be up to Congress.

Investors also await SEC approval for a Bitcoin futures ETF as soon as this month. While Bitcoin price rose, stocks were falling as investor concerns about rising rates, higher inflation, the state of the reopening took over the traditional markets.

Alternative cryptocurrencies referred to as ”Altcoins” tried to match up Bitcoin’s price action, howbeit with many tokens remaining in yesterday’s trading trade. Ethereum, the largest Altcoin barely rose to highs of $3,632, up nearly 5%.

Selected tokens such as Shiba Inu (SHIB, +25.23%), Bitcoin Gold (BTG, +13.26%), IoTeX (IOTX, +21.01%), Bitcoin Standard Hashrate Token (BTCST, +97.07%), Badger DAO (BADGER, +45.54%), Hive (HIVE, +54.64%) were significantly up in the last 24 hours.

Shiba Inu (SHIB) extended its move to highs of $0.00002494 today, thus marking the 8th day of bullish action. Shiba Inu consequently rose through the rankings, at the time of writing, SHIB was the 21st largest cryptocurrency by market capitalization.

BTC/USD Daily Chart

Bitcoin Standard Hashrate Token (BTCST), a project that collateralized the Bitcoin hash rate with each token representing 0.1 TH/s of Bitcoin mining power rallied nearly 168% to highs of $49.95 on Oct. 6 following the latest increase in Bitcoin hash rate.

A key gauge of Bitcoin mining activity, the hash rate, has recovered from a steep plunge in early July when China began a sweeping crackdown on the crypto industry.

Here Are the Predictions!

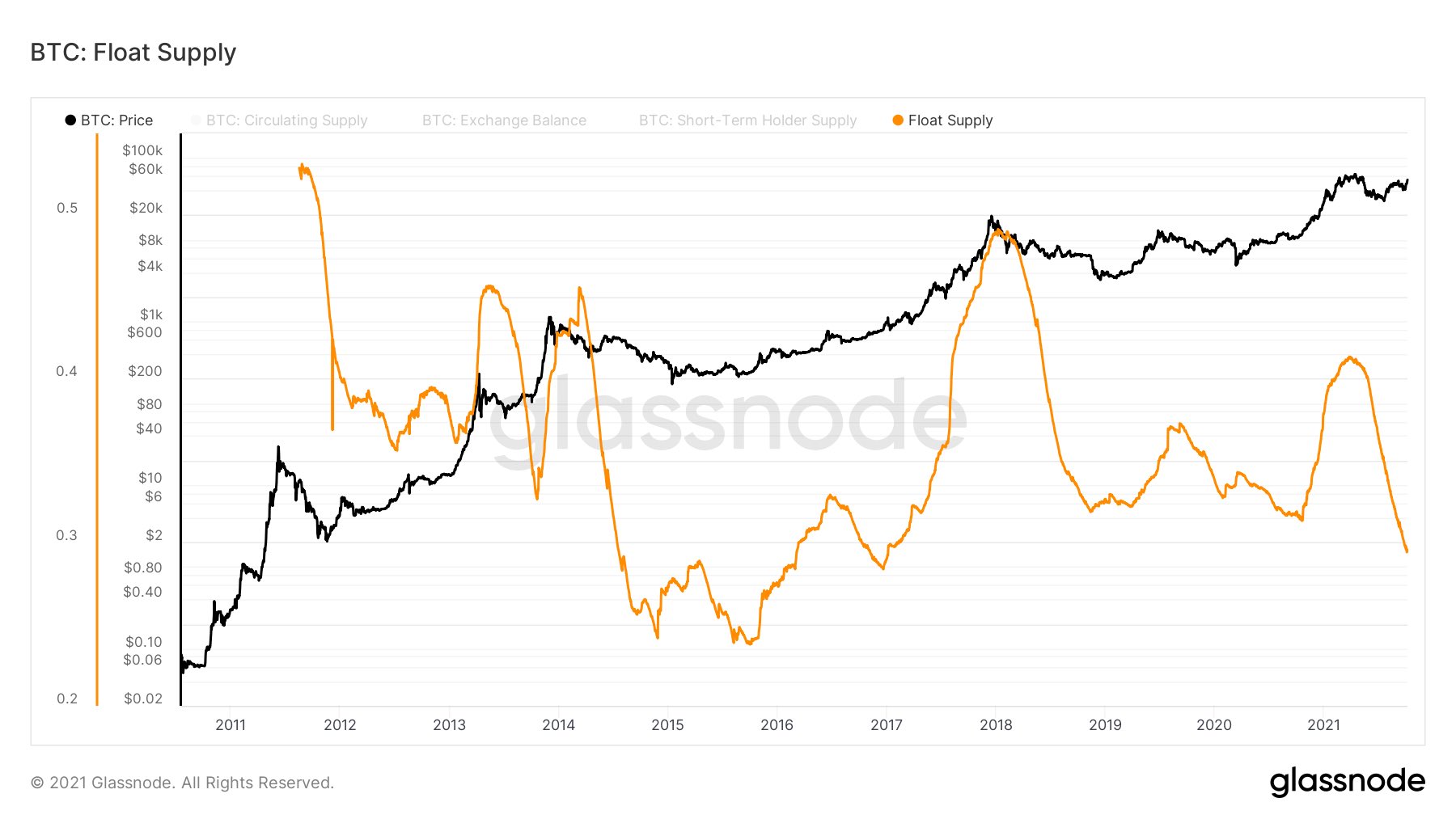

Bitcoin’s latest breakout past $55,000 seems to be backed by renewed institutional demand. Crypto analyst Will Clemente notes that ”The amount of Bitcoin supply being HODLed right now is at an all-time high. With Bitcoin’s “float” so low, we will see these price moves when there are spikes of demand, especially if these supply dynamics continue”.

In the Twitter thread, on-chain analyst TXMC affirmed that Bitcoin’s current outlook remains strong stating ”The “float” supply, shown here as the % of all Bitcoin held by Exchanges + Short-Term Holders, is at its lowest point since January 2017, and has been in a larger macro decline since 2018”.

BTC Float Supply, Courtesy: Glassnode

BTC Float Supply, Courtesy: Glassnode

Amid the ongoing bullish action, various calls for Bitcoin price range presently from $57,000 to be hit in the very near term and then $63,000 in October as predicted by stock to flow creator, PlanB.

Cryptoanalyst, Rekt Capital predicts a train of events for Bitcoin price ”Based on historically recurring #BTC price tendencies across cycles…Bitcoin could rally to ~$63,500 in October. Then retrace to the low/mid-$50,000s in November. Then break out to new All-Time Highs”

A Twitter user opined that a $100k Bitcoin might come faster than what most imagine, stating ”IMO, Bitcoin will face only two resistances till it reaches the next major one at $100k. 1-$59.9k 2-$64.5k (last ATH). Note that it can happen literally in a couple of days. Be prepared”

Lark Davis@ Crypto lark sees ”Bitcoin going to 180 to 200k either in late Q4 or early Q1”

He continued ”when this happens your Altcoin gains are going to be beyond what many of you can imagine”.

Bitcoin traded at $54,961 as of press time. The expectations of a retracement remain in the short term but analysts expect the dip to be limited in scope.

Image Credit: Glassnode, Shutterstock