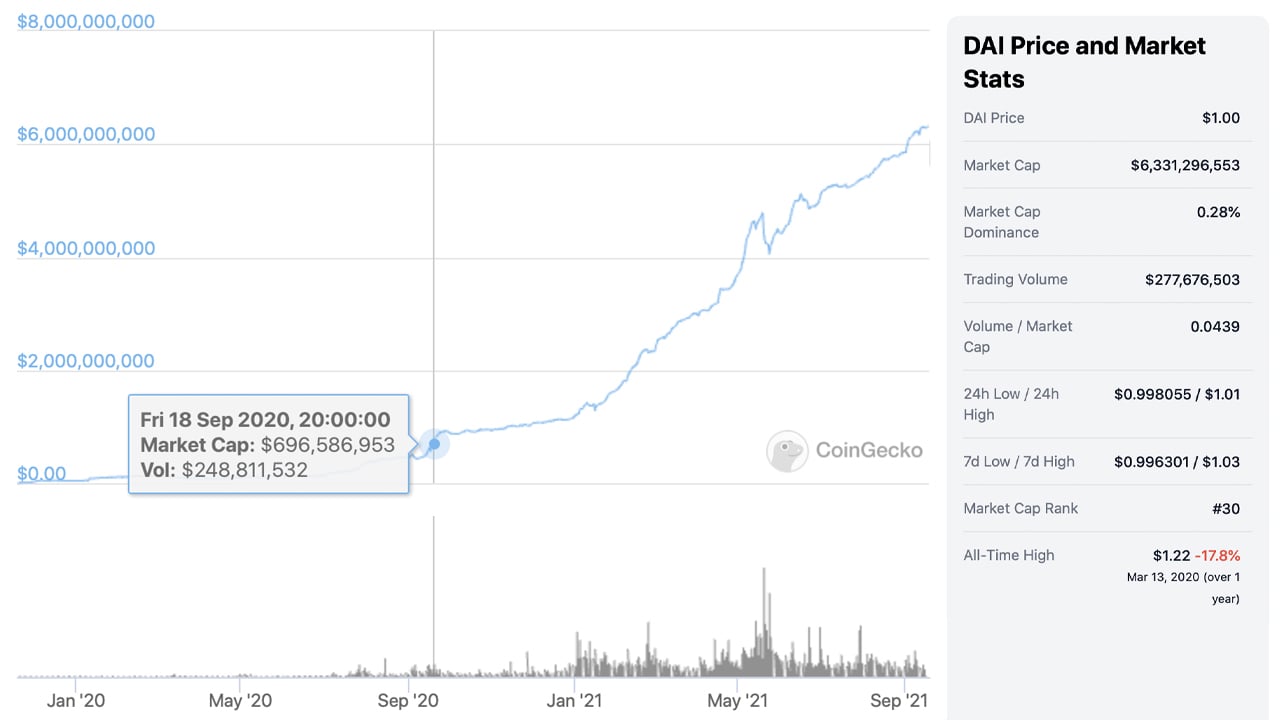

Recently Bitcoin.com News covered the stablecoin tether and how the crypto asset’s market valuation jumped more than 1,500% in just over 500 days. In addition to this exponential increase, the decentralized stablecoin DAI’s market capitalization has also swelled significantly as DAI’s market valuation jumped more than 800% during the last 12 months, increasing from $696 million to $6.3 billion today.

Makerdao’s Stablecoin Rises 800% Since September 2020

On Saturday, September 18, 2021, there’s approximately $127.29 billion worth of stablecoins and they currently command $62 billion worth of today’s trade volume. There is no doubt that stablecoins have become huge over the last three years and news outlets and research studies often refer to tether’s (USDT) massive growth.

The thing about tether (USDT) is that there are humans calling the shots when it comes to the stablecoin project’s operations. The stablecoin DAI, on the other hand, is operated by the Makerdao project which is a decentralized autonomous organization (DAO). There are of course people behind the minting of DAI stablecoins, but it is based on participants adding value and overcollateralization to the service.

The Makerdao website says that DAI helps financial freedom “with no volatility” by offering a “price-stable currency that you control.” The website says that users can read the whitepaper to understand how it works and generate DAI on their own terms.

During the last 12 months, the overall DAI supply has increased a great deal, jumping 808.90% since September 18, 2020. At that time, the DAI market cap was only $696 million but today it’s over $6.3 billion.

Coingecko’s stablecoins by market cap stats show that DAI is the fourth largest stablecoin by market capitalization today. DAI is behind tether ($69.5B), USDC ($29.4B), and BUSD ($12.8B). BUSD’s circulating supply is a touch more than half of DAI’s overall supply.

Monthly Stats Show Decentralized Stablecoin Market Cap Increased by Over 10%

On Saturday, DAI saw roughly $279 million in 24-hour global swaps so far and records show that more than 400 decentralized applications (dapps) and centralized exchanges leverage the DAI stablecoin today. DAI is utilized a great deal in decentralized finance (defi) across liquidity pools, swaps, and cryptographic lending apps.

DAI and the Makerdao protocol are not without controversy and in April 2019 the stablecoin struggled to hold its $1 peg. Dai tokens themselves are very dependent on excess collateral and if the price of ether suddenly crashed, back then it could leave DAI holders uncollateralized at a certain price range.

However, after a black swan incident did just that on March 12, 2020, otherwise known as ‘Black Thursday,’ Makerdao developers had to craft new ideas like leveraging other coins for collateral besides ether to offset risk. Unfortunately, for the users who wanted compensation for their undercollateralized investments, a governing vote decided not to reimburse these users.

This decision ultimately led to a class-action lawsuit against the creators of the Makerdao project. Meanwhile, the Makerdao community has moved on and the DAI stablecoin continues to see growth in issuance. Over the last 30 days, the DAI stablecoin has increased its valuation by 10.3%.

What do you think about the DAI stablecoin increasing more than 800% in a year? Let us know what you think about this project in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coingecko

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.