The Litecoin price darted higher on Friday as investors waited for the upcoming US jobs numbers. The coin rose to $185.20, which was slightly below this week’s high of $193. LTC has a market capitalization of more than $12 billion, making it one of the most popular cryptocurrencies in the world.

Litecoin and Bitcoin correlation

Litecoin is a first-generation cryptocurrency that is often seen as a good alternative to Bitcoin. Besides, the two cryptocurrencies use a relatively similar technology and are both mainly used as an investment.

As a result, the two coins have a close correlation. When Bitcoin rallies, Litecoin follows close by and vice versa. In fact, the LTC is currently in a consolidation phase because Bitcoin has found some resistance at the highest level since last week. Bulls have struggled pushing Bitcoin above the $50,000 mark.

This situation could change during the weekend or after the latest US non-farm payroll numbers scheduled for later today. These numbers will likely show that the labour market activity eased slightly in August as the country faces a surge of Covid cases. For example, on Wednesday, data published by ADP showed that the private sector added less than 375k jobs in August.

Extremely strong numbers will be bad for Litecoin prices, at least briefly, because they will signal that the Fed will start tightening. If the numbers disappoint, the Fed will likely be relatively patient.

Litecoin price prediction

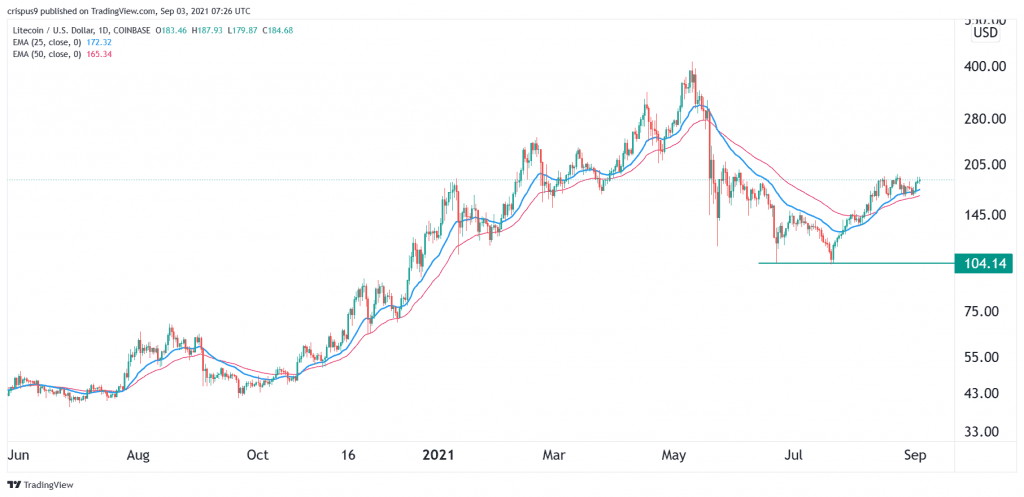

Turning to the 1D chart, we see that the LTC price has been in a strong bullish trend in the past few weeks. At the same time, it has formed what looks like a bullish flag pattern. This pattern tends to be a bullish signal in price action analysis. It has also formed what looks like an inverted head and shoulders pattern.

Therefore, the Litecoin price will likely break out higher as bulls target the key resistance at $250. On the flip side, a drop below $150 will invalidate this view.