The crypto market is in the midst of its second green day in a row, with Bitcoin and Ethereum strengthening and notable altcoins, such as Avalanche and Terra, enjoying double-digit price pumps.

Needless to say, that could all change in a crypto minute – which, by rough calculations, is about 60 times faster than a New York one.

Fears about the global repercussions of China’s wobbly property market haven’t exactly disappeared, nor has the US regulatory-based FUD (fear, uncertainty and doubt).

But, for now, several crypto bulls are puffing out their chests again and flooding Twitter with hopium, and indeed news about BTC tipping on Twitter.

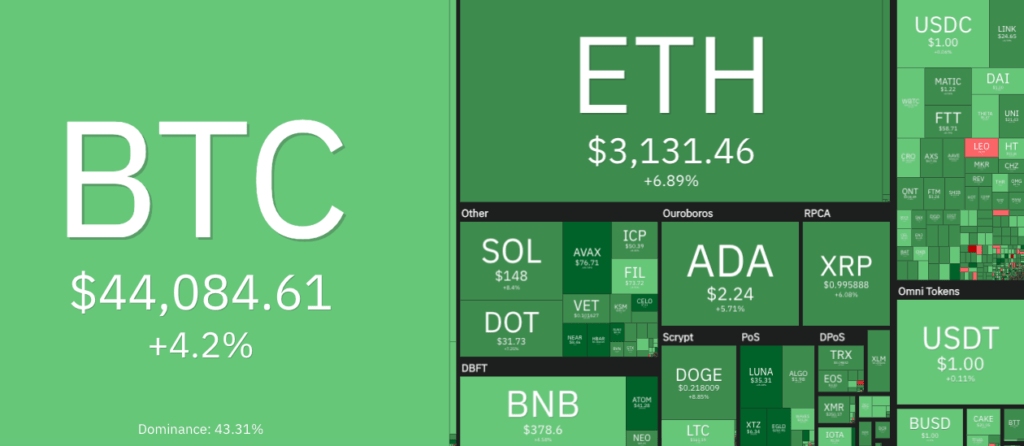

The entire market cap is looking much healthier than a couple of days ago, presently sitting at about US$2.07 trillion, which is a 6.3 per cent higher level from this time yesterday.

And, at the time of writing, Bitcoin (BTC) has recovered well from its sub-$40K price dump earlier in the week. It’s reclaimed US$44K and is currently changing hands for US$44,144, up 4.25 per cent.

Several analysts are now eyeing a push above US$45K and, in particular, a monthly close above that level, for things to really start looking juicy again come October. (Headwind caveats: Evergrande, Gary Gensler and pals, or some other “black swan” event – maybe a centralised asteroid on a collision course with Earth.)

Speaking of Earth, MicroStrategy’s Michael Saylor has called Bitcoin a “moral imperative” for everyone on the planet. Treading as cautious a line as ever, then…

#Bitcoin is growing ever stronger. https://t.co/LBiIM2Tp6i

— Michael Saylor

(@michael_saylor) September 23, 2021

Note, just to keep things a little balanced, not all crypto-industry commentators are quite as bullish right now…

$BTC 4H chart

We have a lower high in price, with a higher high on the MACD. This is a hidden bearish divergence, which signals a possible trend continuation. In this case, that means down.#Bitcoin #BTC pic.twitter.com/PGBHWlxPW2

— Bitcoin Charts by Mick (@MICKrypto) September 23, 2021

US Securities and Exchange Commission (SEC) boss Gary Gensler, meanwhile, reckons the way to really excite the the kidz is to talk traditional savings advice…

“Start investing early, and invest regularly!”

Fixed it for you Sir Gary https://t.co/CWkzMHkHr9

— Gee ? (@BigGerm34) September 22, 2021

Of course, saving’s not such a bad idea. And the 0.04 per cent APY you’ll get from a typical bank these days – that’s something… right?

Mooners and shakers

Swiftly moving on, then, to the realm of 200 per cent APY, DeFi exploits, pump and dumps, “shadowy super coders”, hopium and moon missions… In other words, altcoins.

Looking at the top 100 by market cap first, several notable projects are in a double-digit price-pumping mood. These include: Terra (LUNA) +27.5%; Arweave (AR) +25.7%; Cosmos (ATOM) +24.3%; Tezos (XTZ) +23%; Elrond (EGLD) +19.7%; THORChain (RUNE) +15.3%; and Solana (SOL) +12.6%.

All at the time of writing, of course.

Further down the charts, there are some even bigger short-timeframe winners, including the new Solana-based decentralised exchange Orca (ORCA) +84.42%; and under-the-radar Ethereum layer 2 scaling solution Celer Network (CELR) +51.74%.

$CELR is an absolute monster.

— Michaël van de Poppe (@CryptoMichNL) September 23, 2021

Flipping the coin, TwoFace style, we’re not seeing too many significant daily losers right now. But here’s a token effort (here all week) on that front…

NFT launchpad Bondly (BONDLY) is down 4.4% since this time yesterday; while entertainment and esports protocol Verasity (VRA) and decentralised exchange dYdX (DYDX) are both about 3% to the negative.

Before we sign off, one last thing… the Fear & Greed Index. As George Costanza once said: “It moved”.