Are concerns of energy scarcity holding blockchain technology back?

New discoveries in science and technology typically come with hopes of rapid adaptation. Things rarely work out that way. A classic logic/math model can predict this result, known as the “Anna Karenina Principle.” This fundamental principle states: “A deficiency in any one of a number of factors dooms an endeavor to failure.”

Originally theorized from Leo Tolstoy’s, “Anna Karenina (1877),”1 which opens, “All happy families are alike; each unhappy family is unhappy in its own way.” Consider the assumption that happy families share common attributes which lead to happiness, while different attributes may cause unhappiness, thus, failure. In blockchain technology, we feel the attributes of Energy Consumption, Governance and Politics, Regulatory Compliance Consulting, Timing, and Technology are paramount attributes to consider.

We view blockchain through an analogous lens to Tolstoy’s work. Consider resemblance between blockchain and industry professionals as members of a not quite happy family. This family (financial and commercial transactions industry) have within it a teenager named Blockchain. It’s frustrating for mature family members to watch powerlessly as this teen tries to find her way in life. Their natural reaction is to grab for control, reduce independent choices and compound the frustration. This common story is even more frustrating for the teen, full of creative energy and passion but lacking in clear direction due to a fundamental lack of relevant experience. But our teen is defiant to allow her dreams to be stifled, causing cycles of yet more power grabbing and frustration. We discuss challenges and advise this “teenager” to help find the environment in which the family can be happy. To help the teen avoid self-destruction along the way, and still allow space for creative development, we offer this first of a series of articles that address what we believe defines blockchain’s current challenges and offer suggestions to maneuver around them to achieve full potential as an important contributor to business and society. Let’s examine Energy Consumption.

Energy consumption concerns: “Only entropy comes easy”2

Entropy simply defines how a system left unconstrained will seek to randomly dispersed into chaos. For blockchain, the order is maintained by timestamping transactions as they are recorded and that requires resources to maintain them in the form of electrical energy.

In early civilization, the world seemed to hold an infinite wealth of resources and it seemed impossible for people to see how they could really cause irreparable damage. In recent history, we overcame obstacles and used resources to constrain chaos and create luxurious lives in the most inhospitable places on earth—hot and humid Florida, the dry deserts of Arizona and the snowy mountains of Alaska. Developing regions of the world fight to “catch-up” to a higher standard of living by investing more in “old school” power generation using more resources, typically in the form of limited fossil fuels.

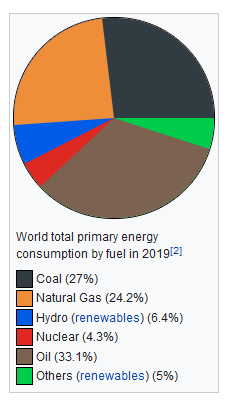

Now, competing for limited energy comes blockchain. Launched as “comments” in source code for Bitcoin in January 2009, blockchain technology has now become its own relevant technology demanding a share of the world’s electricity. No one predicted the appetite of this new technology to consume energy like a child eating candy. In fact, Bitcoin is now calculated to consume more energy than the entire country of Sweden daily, and growing.

A few large-scale mining operations have emerged and consolidated. An emergent dilemma however is that miners measure success by how many nodes they own and control, not how efficient they are. They exist to make money on a technology they assume will be sustainable with a constant source of affordable electricity. We see this belief as naïve and irrational without holding control over the resource providing their presence (namely: sustainable, affordable, and reliable power supply into perpetuity). As future purposes demand more “clean energy,” sustainable clean energy will become increasingly rare, the price will increase and blockchain will be put to a test: can it continue with unavoidable increasing energy cost.

Most energy used by blockchain goes to sustaining the mining. However, we don’t believe this will always be the case. In the future, managing transactions will become the major energy requisite. It will become obvious that immutable databases like a blockchain ledger are expensive to maintain and “read only” queries will create bottlenecks as they compete with “insert new block” queries for energy.

As the cost of energy to sustain blockchain increases, this cost will become a significant burden. In fairness, we feel it should be paid for by those benefiting from the use in proportion to their level of consumption. Possible solutions include building private, dedicated power sources, or “power hubs,” designed ground-up to serve the blockchain energy demand, OUTSIDE of the normal, public power grid as their primary purpose. These power hubs must be funded privately using advanced, efficient, reliable, and renewable power generation methods. Funding of hubs may be recovered by charging a fee on each transaction (“read only” and “insert new block”) into perpetuity. The funding model we propose is fundamentally different from the contemporary view in which “read only” queries are free. This is a mindset shift to be sure, but we believe it creates a more fair and equitable way to managing the entropy within blockchain, by being built and paid for in a fair and sustainable basis.

Since building power sources is not easy or inexpensive, entrepreneurial investors would be required. This requires incentivized private participants with significant wealth to commit and cooperate in managing the risks/rewards. We envision hubs naturally developing in historically free societies to avoid being overpowered and consumed by exploitive and corrupt political extremes. These considerations will remain important to protect the whole blockchain industry from collapse or threats as global politics evolves. Initially, power hubs must be developed within existing laws to guarantee stability and ensure likely longevity, but the system must also recognize that even the most stable systems can become influenced, corrupt, and unstable in a long-range view.

Obviously, questions of power hub design location remain open. Alternatives to using the existing public power grid for energy, becoming independent from geopolitics, overbearing influences will be examined in more detail to follow. In addition to the considerations of Energy Consumption, we plan to discuss Governance and Politics, Regulatory Compliance Consulting, Timing, and Technology in subsequent articles and encourage you to consider our opinions on these arguments and other possible attributes that give clues as to why blockchain has not yet become widely used and what it will take.

***

[1] – Leo Tolstoy, author 1877 novel “Anna Karenina,” published 1878 by The Russian Messenger

[2] Entropy – Entropy is rooted in the 2nd law of thermodynamics which states disorder, characterized as a quantity (entropy) always tends to increase. A simple explanation is things containing an excess of energy above a natural state (hot) tend towards the natural energy state (cool) over time in an environment in which to settle (no more energy added). Analogous is that data will naturally seek to settle in safe harbors (blocks). Reference: NewScientist

New to Bitcoin? Check out CoinGeek’s Bitcoin for Beginners section, the ultimate resource guide to learn more about Bitcoin—as originally envisioned by Satoshi Nakamoto—and blockchain.