The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

“The Triffin dilemma or Triffin paradox is the conflict of economic interests that arises between short-term domestic and long-term international objectives for countries whose currencies serve as global reserve currencies. This dilemma was identified in the 1960s by Belgian-American economist Robert Triffin, who pointed out that the country whose currency, being the global reserve currency, foreign nations wish to hold, must be willing to supply the world with an extra supply of its currency to fulfill world demand for these foreign exchange reserves, leading to a trade deficit.” – Wikipedia

The United States, due to its position as the world reserve currency, has suffered the effects that economist Robert Triffin predicted back in the 1960s.

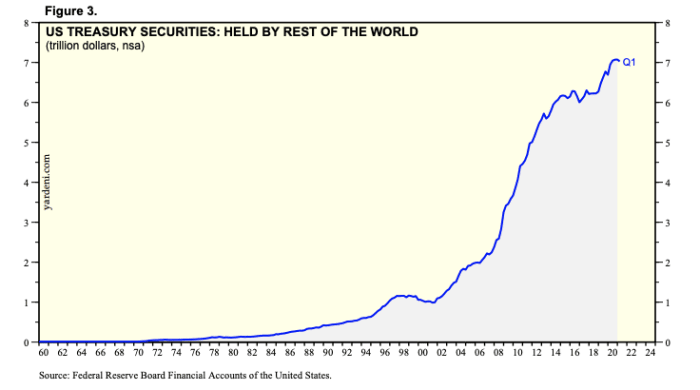

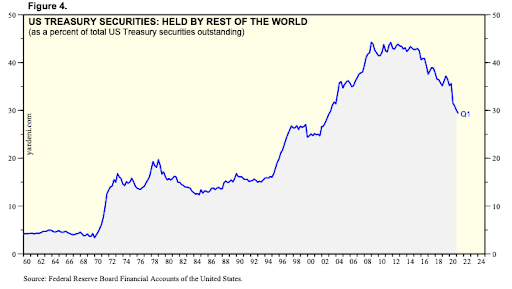

Due to the need to supply the world with dollars, there persisted a need for the United States to supply a steady flow of dollars around the world throughout the last 80 years, especially over the last 50 years after the removal of the gold standard by President Nixon.

Below is the domestic trade balance since 1960:

With free-float fiat currencies, there was a global incentive for countries to debase their local currencies against the dollar to boost economic growth and export markets.

The artificial bid that was placed on the U.S. dollar has been fantastic for capital markets in the United States, as foreign capital that was invested in treasuries also bought U.S. equities and real estate, fueling the great secular asset boom witnessed over the last 40 years.

The Federal Reserve and the U.S. federal government are stuck. If they wish to remain the world reserve currency, then the status quo of ever-increasing disparity between the haves and have-nots will persist, and domestic manufacturing will continue to move offshore to cheaper regions with weaker currencies (and thus, cheaper labor).

The reserve currency status can be viewed as a blessing and a curse. On one hand the United States has been able to have its “paper currency,” the dollar, serve as the country’s main export over the last four decades, remaining able to purchase commodities and hard assets from other nations.

On the other hand, due to the inability for the current accounts deficit to ever self-correct (i.e., the dollar significantly weakening), the United States working class continues to feel the brunt of the damage.

The Triffin Dilemma? Bitcoin fixes this.