After the crash in its price during May, Bitcoin appears to be back in the reckoning. After a 53 percent fall between April 16 and July 21, Bitcoin’s price was up 32 percent just this past week. This sort of volatility is sure to unnerve many investors. But for those that track and invest in cryptocurrencies, it was just another day in office. “We are bullish on the strong fundamentals of Bitcoin. Price fluctuations such as these are just signs of an early market and would stabilise once the market matures,” says Avinash Shekhar, Co-CEO of ZebPay. When you look at a larger time frame, these small price fluctuations would be invisible, he adds.

Reasons for the recent upswing in price

Bitcoin rallied after Elon Musk said in an online event hosted by ARK invest that Tesla may allow bitcoin as payment once bitcoin mining hits the milestone of more than 50 percent green energy usage in near future. “After this positive statement, Bitcoin prices rose,” says Hitesh Malviya, founder of itsblockchain.com.

But experts caution that Bitcoin and cryptocurrencies are among the most volatile of all instruments. “We might see heavy volatility in the markets soon, though not in the same proportion as earlier,” says Gaurav Dahake, Founder and CEO of Bitbns.

Malviya points out that Bitcoin’s recent recovery was also due to some social media reports that speculated about Amazon’s plan of allowing bitcoin as a payment method.

Also read: Want to invest in Bitcoin, Dogecoin and Ethereum? Here’s how you can dabble in cryptocurrencies

Lumpsum or SIPs in Bitcoin?

Now, Rs 1 lakh invested in Bitcoin in July 2020 would have grown to Rs 3.57 lakh by now. But is that reason enough to buy cryptocurrencies?

Not really. But crypto enthusiasts say there is a way to make this volatility work in your favour. They say that savvy investors should opt for systematic investment plans (SIPs). Some exchanges such as Bitbns, Unocoin, Vauld and Zebpay allow you to start an SIP in Bitcoin, Ethereum and other cryptocurrencies.

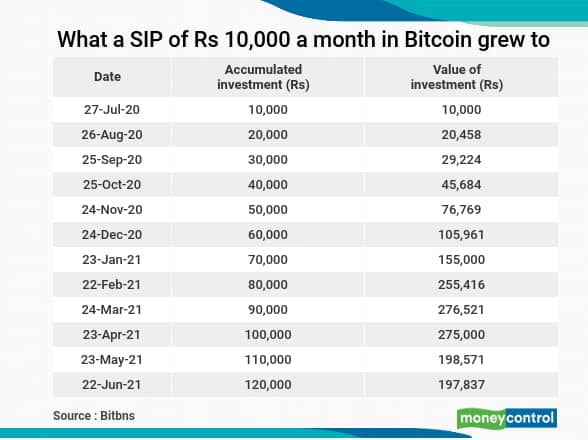

You can start with a minimum of Rs 100 and invest via daily, weekly and monthly SIPs. A SIP of Rs 10,000 in bitcoin started last year would have grown to Rs 1.97 lakh.

“With the Automatic Investment Plans (AIPs, which works like SIPs) strategy, you can average out your buying price,” says Darshan Bathija, CEO of Vauld. An SIP in a cryptocurrency saves you from big losses if the value of your coin were to suddenly crash.

But it’s not as straightforward as, say, a mutual fund SIP. “An SIP (in bitcoin) can work wonders. However, in rising markets, investing via SIPs means that you will be sitting on lesser profits or may not be able to take advantage of a market crash, as your investments are spread out. Otherwise, investing via SIP is always a good idea,” says Rishabh Parakh, a chartered accountant and founder of NRP Capitals.

Also read: Millennials and cryptocurrencies: A story of missed profits, hard lessons and losses

Should you invest in the Bitcoin now?

Don’t get swayed by last week’s price rise. First-time investors must be especially careful. Spend time understanding more about the Bitcoin before investing. “If you choose to invest, deploy small amounts, as low as Rs 100, to try it out. And if you intend to invest significant amounts, you should use averaging strategies as no one can time the market,” says Ajeet Khurana, a cryptocurrency expert and founder of Genezis Network.

“Retail investors should deploy only the amount that they can afford to lose,” says Parakh. You must avoid gambling while investing in Bitcoins. Bathija points out that there are many social media influencers who frequently comment on the merits of cryptocurrencies. “But that could also create an irrational outlook about the asset,” he says.