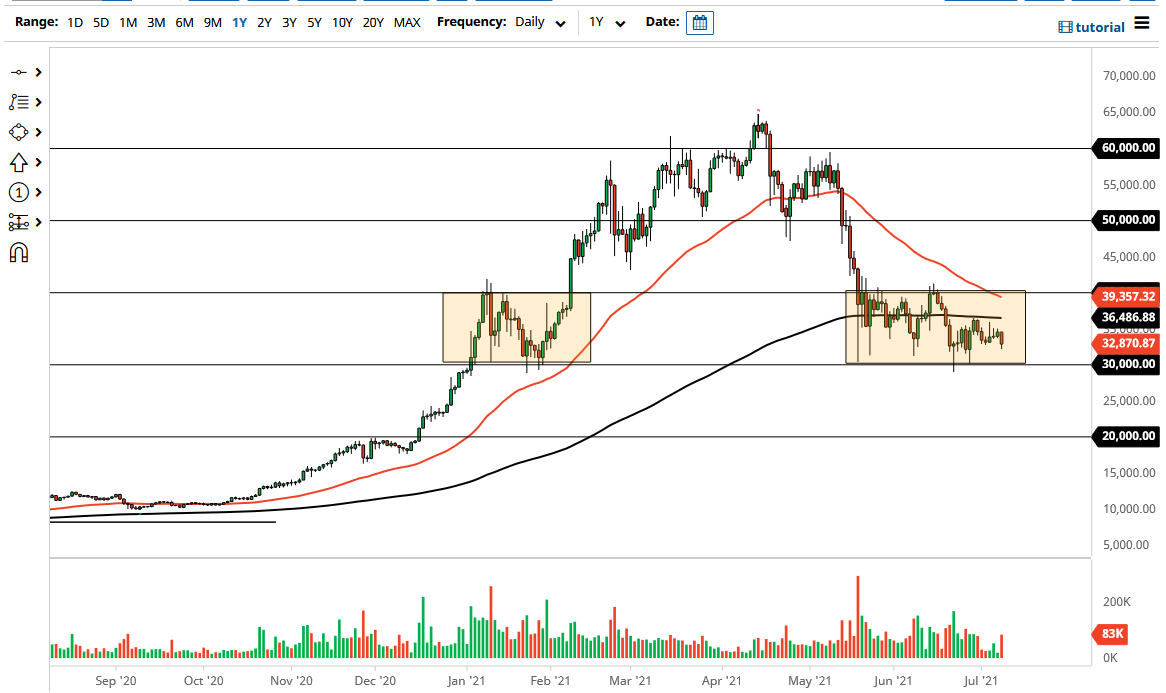

Bitcoin has pulled back a bit during the trading session again on Thursday to reach down towards the $33,000 level

By doing so, it looks as if we continue to see a lot of negativity in the crypto currency markets, and the $30,000 level now looms large. If we were to break down below that level could open up a big move to the downside, roughly $10,000. This is mainly due to the fact that the “measured move” of the rectangle that we are currently in does suggest that big of a move. Furthermore, the $20,000 level underneath is an area that has been important previously, as it was the top of the bubble that we had formed a few years ago.

We have yet to retest that $20,000 level, so perhaps that is exactly what we will do. I anticipate that there should be a lot of support in that area so to be interesting to see how that plays out. For what it is worth, the 200 day EMA sitting just above continues offer resistance, and the 50 day EMA is starting to crash towards it in other words we are getting ready to form a “death cross.” If that does in fact end up being the case, that is not a good look for Bitcoin at all. Beyond that, you also put a lot of pressure on alt coins, perhaps kicking off the possibility of a “crypto winter.”

Granted, Bitcoin tends to be one of the better performers under any circumstance, but if it falls it drives everything else down with it. To the upside, if we were to turn around and break above the $40,000 level, that could open up a move to the $50,000 level, for the same “measured move” that I talked about previously. The $50,000 level was previous support and should now be resistance. In fact, I find it very difficult to believe that we break above $50,000 anytime soon, so with that in mind I believe that even if we do get an opportunity to buy this market, it will probably be more or less for the short term more than anything else. Keep your position size small, pay close attention to the area between $30,000 and $40,000, because the breakout will tell the story.