These metaversal/macro crypto pieces I have been writing have generated quite a following not just on Virtue of Selfish Investing (VSI) but also on other websites.

I know some like to use metrics as a rough guide so find my updates in this area of use in terms of how much exposure they want to have in crypto as while some of their holdings are core holdings which they have held for a number of years, the other part of their holdings is speculative thus can move in and out of their exposure to crypto depending on where we are in the bull or bear market cycle.

In today’s piece, I wanted to take a moment to include some technical analysis which I will start doing when timely in a macro sense while the crypto reports on VSI, some of which are geared toward shorter time frames, will also continue.

Prior major entry points during corrections

In October 2020, we had a small stock market induced correction in Bitcoin and Ethereum where both corrected 15.1% and 36.5%, respectively.

Alt coins lost much more as the delay in the stimulus package wore on. They are far more sensitive to QE stimulus than BTC or ETH. Alts crashed typically between 67-90% peak-to-trough from early September to early November.

But BTC, being the leader, showed an entry point where the daily chart of BTC first showed a pocket pivot on Oct 12 then a base breakout on Oct 21.

With stocks, pocket pivots and base breakouts often fail in this QE-riddled environment thus buying a pocket pivot on constructive weakness can provide a breakeven or even slightly profitable trade should the stock not continue much higher.

However, with crypto, pocket pivots and base breakouts for major names such as BTC and ETH have a higher success rate so should be bought on strength, much as this was the way back in the 2000s with stock pocket pivots.

ETH issued its first entry point after the correction in September on Oct 7, 21 then Nov 4.

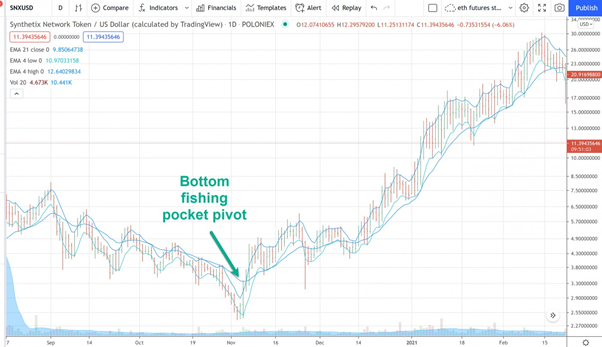

The top performing alt coins such as AAVE and Synthetix (SNX):

So while many day and swing traders – which comprise the majority of crypto traders – prefer the one and four-hour bar charts, the biggest money is made using the dailies because you can see the forest for the trees.

Is the bull alive?

A number of members and non-members on other platforms have asked for my outlook on BTC, given the strong drop-off in hash rate, transaction volume, new addresses, along with the major Grayscale BTC unlocking this month.

The steep drop in hash rate, transaction volume, new addresses, etc are all due to China’s move to kick out their miners. Miners have expenses so need to sell their Bitcoin to pay for relocation expenses etc. This is one of the reasons Bitcoin gets sold when it reaches the 35-36k level of resistance.

That said, China’s miners have mostly made successful moves to other countries as shown by recent miner activity.

The Grayscale unlocking in July should not create a big sell-off in Bitcoin because they would be selling at a discount. Most are likely to hold onto their Bitcoin, but then once its price moves higher, this could create some headwinds of selling by those who want to breakeven.

Alex Mashinsky thinks we will see one more wave of selling in late July due to unlocking, but Willy Woo correctly states: “That’s not how GBTC inventory works. It’s Hotel California for BTC, it can enter but never leave, apart from the 2% annualised fee which is deducted regularly. Keep an eye on the GBTC Premium for underlying demand as demand is climbing.”

But perhaps whale buying absorbs the selling since long term holders are quietly accumulating Bitcoin while the shorter term retail investors are selling. Maybe GBTC holders sell less BTC due to the current Grayscale discount, and maybe altcoins and ETH outperform BTC as they have in prior bull markets once the bull market resumes.

Meanwhile, I’ve discussed other metrics in prior reports such as NUPL, miners ribbon compression, the GBTC discount heading back to neutral which shows BTC is being bought, ETF investors buying Bitcoin, network growth at ATH, and BTC moving from weak to strong hands. All are at significant turning points based on prior corrections since 2012 so are suggesting the 28-30k as a major floor in the price of Bitcoin.

There is also an ongoing supply shock not seen since Q4 2020 which should squeeze Bitcoin higher. Just as in Q4 2020, Bitcoin supply continues to fall despite Bitcoin moving sideways to lower.

Stay tuned. Buy signals will emerge if the last decade of price history is any guide.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, bestselling author/top 40 charted musician/PhD nuclear physics UC Berkeley/Record breaking audited accts: stocks+crypto/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr. Kacher bought his first bitcoin at just over $10 in January-2013 and participated in early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in bitcoin since 2011. He was up in 2018 vs the median performing crypto hedge fund at -46% (PwC) and is up quadruple digit percentages since 2019 as capital is force fed into the top performing alt coins while weaker ones are sold.

Virtue of Selfish Investing Crypto Reports

TriQuantum Technologies: Hanse Digital Access

https://twitter.com/VSInvesting/ & https://twitter.com/HanseCoin

https://www.linkedin.com/in/chriskacher/