Ah yes, the blockchain, a word that’s become synonymous with most of the leading digital innovations taking the world by storm today. But, unlike its big brother, the Internet, blockchain technology promises possibilities far beyond its older sibling’s reach.

The Internet brought upon a revolution that would change the way the world operated forever, and since its conception in 1960s, it has evolved from a simple military communication network to the world’s central cyberspace. However, comparing the Internet to blockchain is almost a given in every conversation involving either of the two, seeing as both technologies boil down to being protocols for connectivity and sharing data.

While one of the primary factors for the creation of the Internet was to make the transfer of data between computers effortless and seamless, one could argue that blockchain’s purpose is to verify the authenticity of digital data, and in some cases attach a monetary value to it — but even then, providing such a simple definition for this technology would be doing it a serious disservice.

Blockchain technology is structured in the form of a chain of blocks that contain information, compared to the Internet, which can be described as “formless”. In a blockchain, one “block” of information is entirely dependent on the other blocks in the chain due to its use of the Hash system, which in layman’s terms just means that one can’t exist without the other. On top of that, blockchains also incorporate an algorithm called “proof of work”, which slows the creation of new blocks and helps to prevent tampering with any information found in the chain.

Simple maths

A bit of simple maths later, and it’s clear how this technology could grow to benefit society in many ways by improving sectors where the Internet provided a strong foundation to build on but may have fallen short in some cases. Blockchains are decentralised, and because they enable the storing of data between all operating devices in a network — which essentially provides each device with an identical copy of the information that won’t get lost if one device were to crash — its use case becomes incredibly invaluable when taking sectors such as banking, cybersecurity and healthcare into consideration. Imagine a massive digital record keeper and a decentralised value exchange combined into one kickass entity — that’s a blockchain.

The rise of blockchain technology, along with its crown cryptocurrency, bitcoin, is incredibly similar to that of the early days of the Internet. The early Internet was a combination of a bunch of weird technologies that proved to be very difficult to adopt for many users, yet while people struggled to understand many of the things being developed at the time, it didn’t really matter. Why? Because there was excitement for it in the market. Sound familiar?

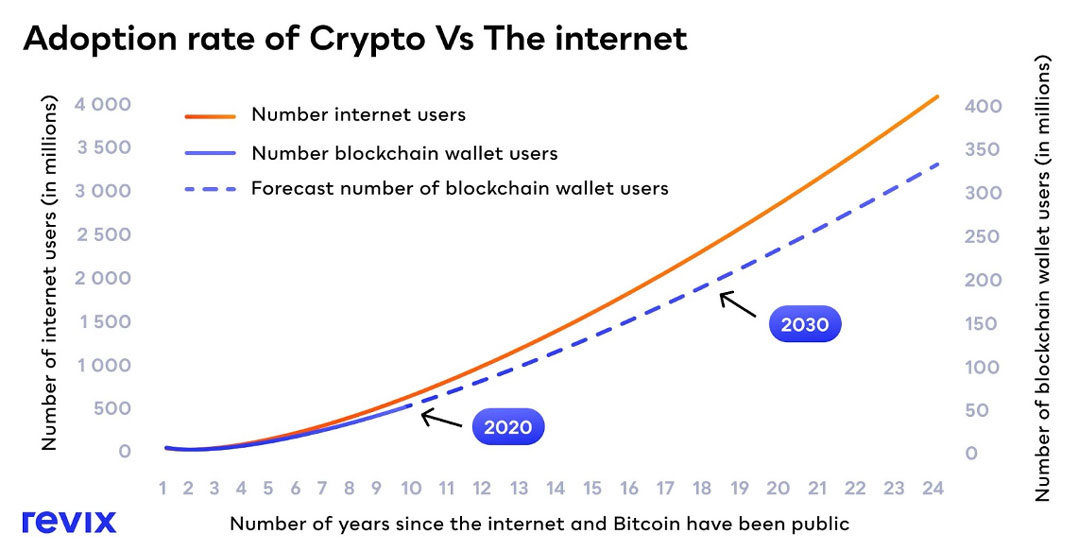

While the two technologies share certain similarities, they differ in rate of adoption. One of the most compelling arguments for blockchain’s potential to become even larger in scale compared to that of the Internet, is the speed at which blockchain technology is being adopted and pushed even further into the mainstream by big corporations and Internet personalities.

Source: Revix

The mass adoption of blockchain technology is being pushed forward at lightning speed, thanks to the continued rise of the public’s interest in cryptocurrencies such as bitcoin, ether and cardano — all built on blockchain technology, albeit on different iterations of it. Since the official release of bitcoin in January 2009, the growth of this technology has been exponential, growing at a much faster rate than the Internet did back in the early days.

On the 5 April 2021, the market capitalisation of all cryptocurrencies reached US$2-trillion, doubling in just three weeks and, in doing so, cryptos became the fastest-growing asset class of the last decade. At the time of writing, more than 10 000 registered cryptocurrencies are listed on CoinMarketCap, and that’s not even counting the ones that aren’t officially listed.

The technology’s enormous growth can be attributed to the fact that it is ushering in a new era of finance, something the Internet established a strong foundation for but could be improved upon by blockchain’s enhanced focus on security and record keeping.

Just like many of the Internet’s early projects, however, many cryptocurrencies and experiments on blockchains will fail. However, if the Internet has taught us anything it’s this: Market excitement will help anything reach for the stars.

What does Revix offer?

Revix offers three crypto Bundles to reduce the amount of research you need to put into each individual crypto asset by using our proprietary software and Bundle methodology to ensure that you always have the top-performing assets in your portfolio by rebalancing our Bundles monthly.

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market.

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, ripple, bitcoin cash, stellar and litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like ether, EOS and tron that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of iOS.

Revix’s Bundles have outperformed an investment in bitcoin alone over one, three and five years.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time. For more information, please visit www.revix.com.

Disclaimer

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose and, before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

- This promoted content was paid for by the party concerned