(Photo by Yuriko Nakao)

Getty Images

They say you should never trade drunk and that is true, and recently I have added to that idea by saying you should never invest or trade when you are ill. So here is an example of what you can end up thinking when you are sick, in my case after a right beating up from the Pfizer vaccine, which I’m happy to say is simply worth suffering to avoid a go-round with Covid. Been there, done that, nearly bought the t-shirt.

So here is the set up. First let’s get some vertigo spun up.

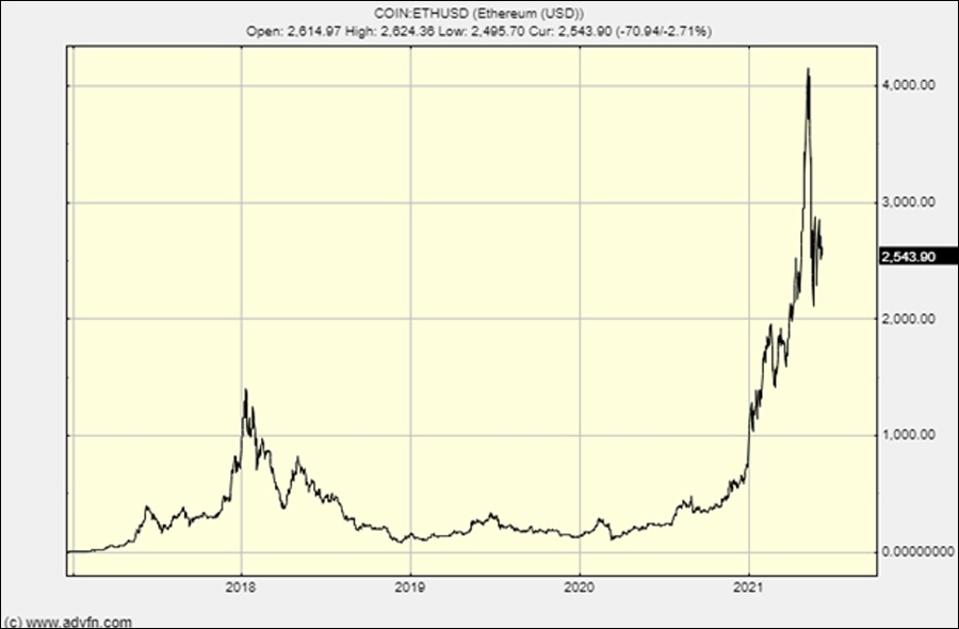

Ethereum:

The ethereum chart shows a drop of 25%

Credit: ADVFN

A crash is 25% off but for crypto a 25% drop is nothing. A bubble crash is 75%. We have had a top to bottom crash of 50% already.

Now let’s get bitcoin in the picture for context and you can play with all these charts yourself on ADVFN:

Ethereum and bitcoin charts

Credit: ADVFN

You can match these trends how you like but they do not look bullish. Now in my delirium, I see this:

My feverish prediction for the ethereum and bitcoin price

Credit: ADVFN

I admit that’s extreme, but it’s not just 102 degree fever driving this, it’s something I’m surprised to see in the data.

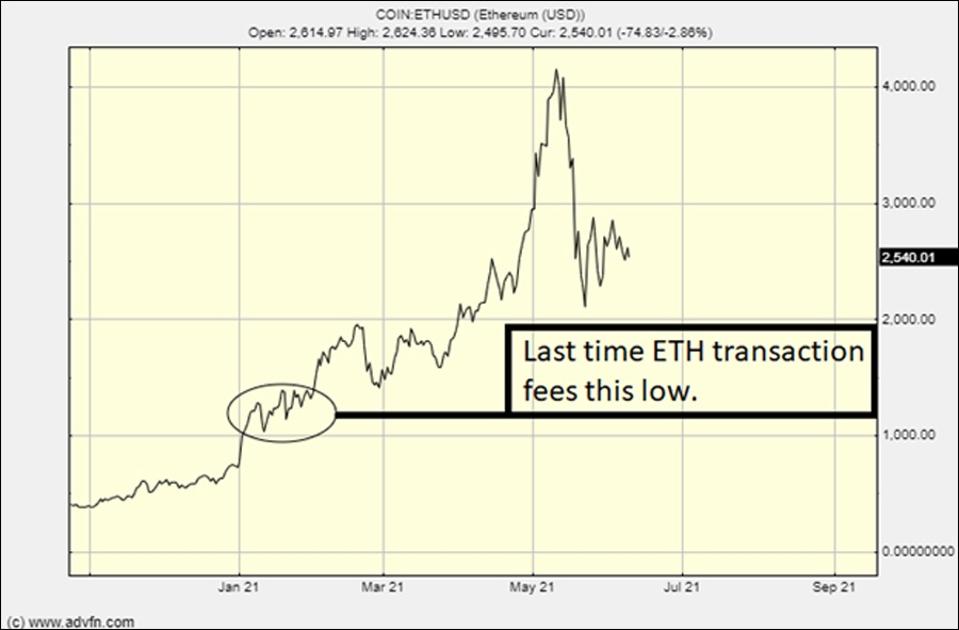

Ethereum transaction costs have dived. Hurrah, I can now do small transactions without being nailed by the cost, that great, isn’t it? Maybe. Transaction costs were tightly bound to the price of ethereum on the way up, are they going to be decoupled now? Maybe.

Transaction costs are a good signal of the utility of the system and the robust health of its ecosystem. High value for the coin comes from this utility, but if it goes into a tail spin, so does the price.

To an extent ethereum transaction costs are a limiting case for the network, especially for low value transactions, but they are also a ratchet of value for high value transactions. Ethereum transaction fees are back to January levels when ethereum was $1,000-$1,200 a coin.

It’s hard for me to let go of the transaction fee signal when it so clearly telegraphed ethereum’s rise:

The last time the ethereum’s transaction price was as low as it is now

Credit: ADVFN

Until the crypto bust has run its course it seems an easy call to say the bottom is a lot further down. Ethereum has a lot of catalysts ahead of it, with the miners getting fired, a deflationary model put in place and the proof-of-stake system to be implemented. This is the land of unintended consequences, which to me is always bearish.

On the bullish side, no one is hauling ethereum into the limelight with wild claims, crazy hype or bringing it to the attention of regulators as a threat to humanity.

Even so, the crypto autumn is here and the winter is coming and the next leg down seems pretty close.

As a sickly bear, this is a time to lie in wait.

———

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.