Ethereum becomes the new top favorite cryptocurrency of institutional investors, and is posting a healthy recovery

Ethereum (ETH) along with many other cryptocurrencies continues to be in a recovery mode post the crypto market crash of May 19, which effectively halved its price from an all-time high of $4,400 to around $2,400. It has been in a consolidation phase since then, and is set to potentially break-out of the $2,930 resistance level soon. ETH was trading at $2,500 on a path upwards, at the time of writing, with a new found support level at $2,378. Let’s conduct a brief analysis of Ethereum’s price and understand which way it can be expected to swing by the end of June 2021.

Widely considered as the second most significant cryptocurrency after Bitcoin, Ethereum had a market cap of $302.2 billion at the time of writing. Ethereum’s blockchain enables developers across the world to create and deploy decentralised apps (dApps). The ETH network is widely used for the creation of NFT (Non Fungible Tokens) and has numerous applications in the DeFi industry.

What is the current price of ETH, and how did it reach this point?

At the time of writing this piece, Ethereum’s Price was hovering around $2,500, well on course for a rebound, and the token looked all set to breach the $2,787 and $2,930 resistance at FIB 0.618 and FIB 0.702 respectively. It started the month well, by opening at $2,708 on June 1, after having touched a low of $1,716 on May 23. It has been steadily maintaining a $2,500+ value since then, touching a high of $2,893 on June 3, where it also met the gradually rising 50 SMA for the first time since May 27.

ETH/USD Daily Chart. Source: TradingView

Thereafter, the ETH price retreated on June 4, touching a low of $2,550 after an Elon Musk tweet suggested a breakup with Bitcoin. This also proved a strong correlation between BTC and other altcoins. Another reason behind its recent decline could be the latest US non-farm payroll numbers. As the number of US citizens filing for jobless claims dropped below the 400k mark for the first time since the start of the Covid19 pandemic, there’s a good possibility of Fed turning hawkish, something that doesn’t augur too well for Ethereum and other cryptocurrencies.

Even though the first week of June proved productive for ETH, ensuring that its recovery from the May lows stays on course, the market seemed frustrated by the crucial $2,900 level. The trading volumes also dropped in the first week, which made sense considering last month’s decline.

Despite the fact that ETH/USD witnessed a good bull run overall during the past six months, the coin’s price could not escape the negative sentiment of the market. It has been engaged in a good bear-bull tussle recently and is set to push upwards, testing the resistance levels of $2,787 and $2,930 at FIB 0.618 and FIB 0.702 respectively. Let’s find out where it may find itself by the end of this month.

Ethereum Price Forecast for June 2021 and What May Impact it

ETH/USD is shadowing the $2,582 support level at the time of writing. Though it’s gradually making an upward move despite the headwind, any dip below the $2,378 (FIB 0.382) and $2,125 (FIB 0.236) levels is going to produce an immense sell pressure that may make $2,000 within the reach of the bears. In the unexpected circumstances that $2,000 level is also breached, Ethereum holders will come into the picture and may start unloading their holdings, before the market discovers any new lower support level.

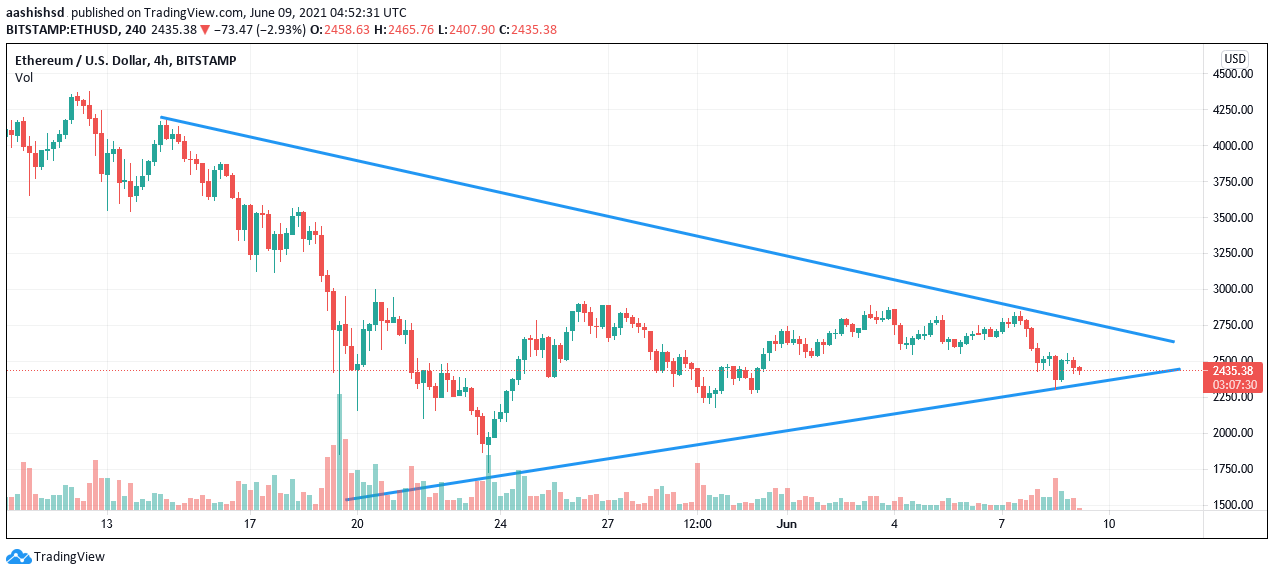

Taking a close look at the ETH/USD price chart, it is clearly evident that ETH/USD is presently inside an ascending triangle pattern. It’s the first concrete structure to have formed on the chart after the price correction witnessed last month. In spite of the fact that a triangle pattern such as this one, usually emerges during bearish conditions, and comes with the continued breakout move towards the downside, it looks like the ETH price might stay well within this triangle support, and push for a rebound, resulting in a bullish breakout move. A decisive move to push beyond the $2,787 and $2,930 resistance levels would suggest that Ethereum is well on course to resume its bull rally that started this year. The obvious next targets will be $3,078 and $3,450 at Fibonacci retracement levels of 0.786 and 1 respectively.

ETH/USD 4-Hour Chart. Source: TradingView

It’s also worth mentioning that the RSI is hovering around the 50 mark at the time of writing and MACD is just crossing above the signal line, both accentuating a bullish grip. The 50 SMA is also curving upwards, almost touching the FIB 0.702 level at $2,932, pointing to a possible uptrend soon.

Other events that might move ETH price in June 2021

There are many external developments that are pointing towards a potential bullish run soon in the ETH/USD market. The first is the ongoing upgrades to the Ethereum blockchain, in an effort to move it to the Proof of Stake consensus algorithm. Vitalik Buterin, the Ethereum founder recently stated in an interview to Bloomberg that making this switch has become more urgent for them considering how Ethereum has grown over the last year. Another story published in Coindesk suggested that the upgrade may actually come about sooner than expected.

Apart from that, ETH price will react accordingly to the developments in the DeFi industry and the crypto regulatory restriction unfolding in China too. Goldman Sachs has in fact predicted that ETH will surpass BTC over the long-term. On another note, Ethereum is about to undergo a major network upgrade called EIP-1559, in July, targeted at reducing the network’s high transaction fee. Lastly, as per the recent Glassnode data, the amount of Ether available at exchanges is also dropping gradually, indicating the holding sentiment of investors.

All of the above suggests that a bull run may be just round the corner.

Please keep in mind that this is a purely opinion-based article, based on relevant market data available for Ethereum. It is not meant to be treated as investment advice.