Greetings from London where finally I am back from my travels sporting a new blue tick on my Twitter account. Yay! Thanks Jack! As City AM‘s Crypto Insider I am by definition involved in a number of projects and I am protocol agnostic – only by working together and shedding tribalism can the blockchain, crypto, defi & digital asset space truly flourish.

By coincidence rather than by design it’s become a very significant week in my calendar and one that puts paid to the myth that Cardano is a ghost chain.

I have been working closely with World Mobile pretty much since inception and recognised the synergies between its ambition to connect the unconnected and Charles Hoskinson’s desire to bank the unbanked which starts with a DID (digital identity) and of course blockchain, so I made the introduction and the rest is history.

World Mobile Token has been minted on Cardano and goes live on July 4 – Independence Day – with the sale starting on Monday July 5.

READ MORE: Using blockchain to overcome the challenge of universal connectivity

I am also very excited to be an advisor to MELD who have designed and implemented (with a fully supportive legal opinion) the concept of an ISPO (Initial Stake Pool Offering) where Ada coin holders can stake them to invest their rewards into a project. So zero risk which is such a rarity. MELD itself is the first ISPO which goes live on Thursday July 1. In the meantime Ada holders have been delegating and at the time of writing the total is 4.5m ADA.

READ MORE: MELD: The Banking Stack for the Cardano Ecosystem

The ISPO method is truly groundbreaking within the Cardano Ecosystem and is being avidly embraced by the Cardano Community and as such I can exclusively reveal that at the end of the MELD ISPO, the MELD Foundation is releasing its ISPO Methodology to the Cardano Foundation in the form of a paper for the benefit of the community and forthcoming Cardano based projects.

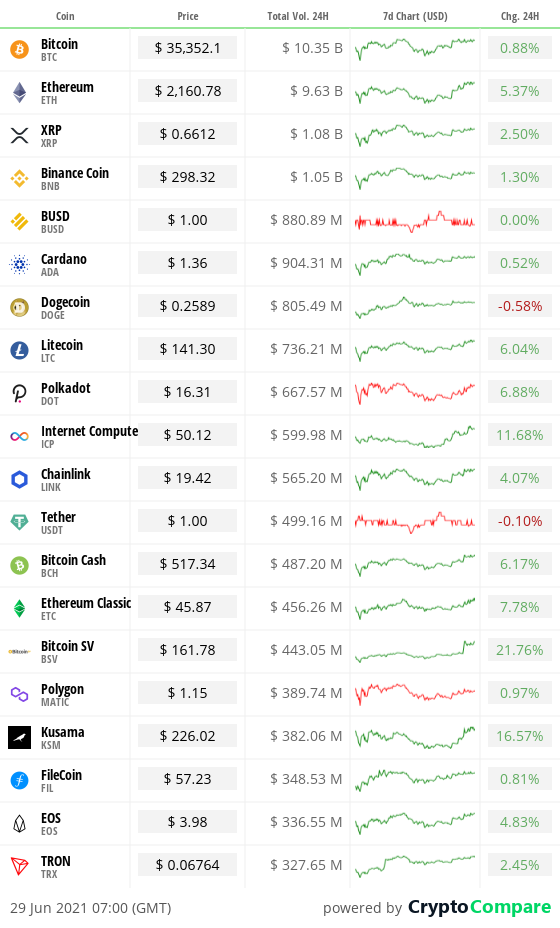

Crypto at a glance

The crypto market continues to limp toward something that resembles a recovery this morning, with Bitcoin and Ethereum prices both up slightly. Ethereum, in particular, is making headway. The second-largest cryptocurrency is at its highest price since 21 June, up another four per cent over the past 24 hours to $2,150. Can it recover to the $2,500 it held for so long?

The change in fortunes marks something of a turnaround for Bitcoin, which had been recovering market dominance lately. The leading cryptocurrency had fallen to a market share of just 40 per cent in the run-up to May’s price crash, as the hype around alt coins reached fever pitch. It’s since bounced back to a market share of around 46.5 per cent, but is down from over 47 per cent yesterday. Will it need to recover for the bull run to get back on track?

Market sentiment also continues to languish in Fear, where it’s now sat since mid-May, while trading volumes continue to be low. This suggests weak support for any price movements. This is despite increasingly bullish sentiments from investors, particularly Mexican billionaire, Ricardo Salinas, who is making quite the impression on Twitter. There’s also a host of pundits pointing to supposedly-bullish market indicators, including Plan B and Lark Davis. Will they be proved correct, or is fear still the order of the day?

Other big gainers today include Bitcoin Cash (+7 per cent), Internet Computer (+14 per cent) and Ethereum Classic (+14 per cent).

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the markets

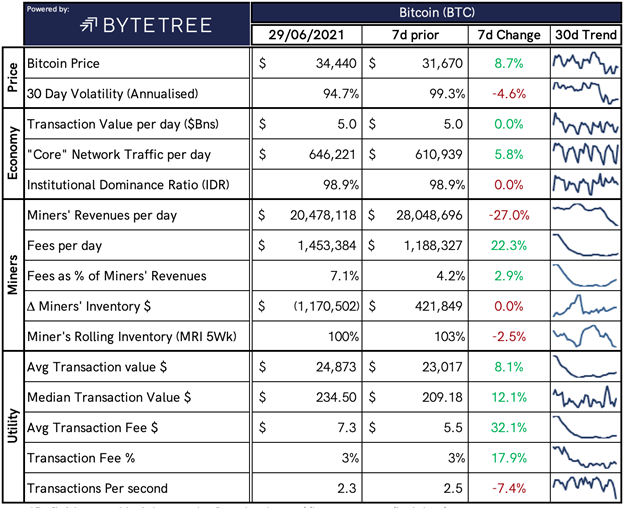

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $1,409,118,720,330 up from $1,373,166,038,130 yesterday.

What Bitcoin did yesterday

We closed yesterday, June 28 2021, at a price of $34,434.34, down from $34,649.64, the day before.

The daily high yesterday was $35,219.89 and the daily low was $33,902.08.

This time last year, the price of Bitcoin closed the day at $9,190.85. In 2019, it closed at $11,959.37.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $648.75 billion, up from $619.31 billion yesterday. To put it into context, the market cap of gold is $11.276 trillion and Facebook is $1.008 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $34,724,436,285 up from $33,297,567,171 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 80.53%.

Fear and Greed Index

Market sentiment today is 25.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 46.76, Its lowest ever recorded dominance was 37.09 on January 8, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 48.76. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“The monetary emission went to the moon, you understand, the Dollar as hard money is a Joke.”

– Ricardo Salinas, Mexican billionaire and bitcoin hodler.

What they said yesterday

The bitcoin romance we all wanted…

She knows…

It begins…

Get your tickets while they’re hot…

Crypto AM editor’s picks

Nukkleus acquires London based Match Financial

Binance given the boot by UK financial watchdog

Ripple outpacing Bitcoin among UK crypto investors

Cardano bridges the gap to China by teaming up with Nervos Blockchain

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View in association with Ziglu

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five-part series – March 2021

Part one…

Part two…

Part three…

Part four…

Part five…

Crypto AM Events

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.

The USA can be the beneficiaries of the CCP’s mistake (but we must be careful not to make equally stupid mistakes in our handling of financial innovation.)

The USA can be the beneficiaries of the CCP’s mistake (but we must be careful not to make equally stupid mistakes in our handling of financial innovation.)