An estimated 2.3 million UK adults now hold cryptoassets such as Bitcoin – despite warnings of the risks involved – according to the City watchdog.

The figure from the Financial Conduct Authority (FCA) represents a rise of 400,000 since last year.

It is based on a survey of more than 2,000 people taken in January which also suggested that the level of overall understanding of cryptocurrencies was declining.

Most users tended to be men aged over 35 in the “AB” social grade covering managers and professionals, the FCA said.

They typically hold around £300 – up from £260 previously – while 14% said they had borrowed to invest and 18% said they did so due to fear of missing out.

The study also found fewer crypto users regard the tokens as a gamble – 38%, down from 47% last year – while increasing numbers see them as either a complement or an alternative to mainstream investing.

It also suggested enthusiasm for the assets growing, with more than half of users reporting a positive experience so far and fewer regretting having bought cryptoassets.

The FCA research came at a time of heightened interest in the sector and a rise in the price, as well as well as more widespread involvement of financial services firms and institutional investment in the market.

The watchdog said that it had issued a number of warnings about the risks involved.

Sheldon Mills, the FCA’s executive director for consumers and competition, said: “The market has continued to grow, and some investors have benefitted as prices have risen.

“However it is important for customers to understand that because these products are largely unregulated that if something goes wrong they are unlikely to have access to the FSCS [Financial Services Compensation Scheme] or the Financial Ombudsman Service.

“If consumers invest in these types of products, they should be prepared to lose all their money.”

The most popular form of asset was Bitcoin, held by 66% of users, followed by Ethereum at 35%, according to the survey.

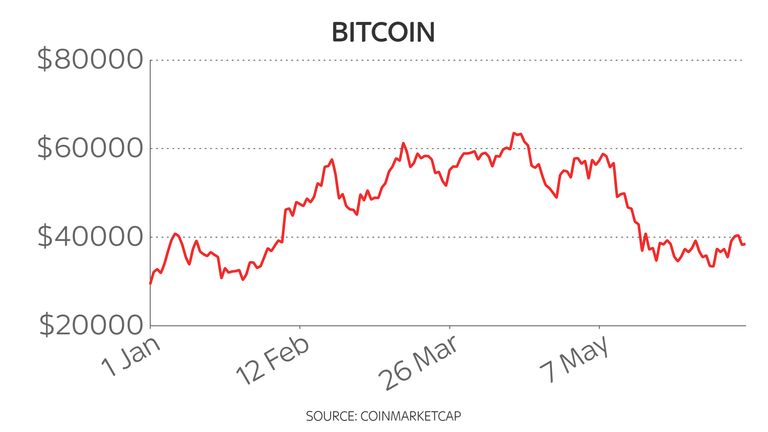

Bitcoin hit a record high of $65,000 (£47,000) in April but has since been hit by fears of a crackdown on the sector in China, as well as Tesla boss Elon Musk’s reversal of a decision to allow the electric car maker to accept payments in the cryptocurrency.

That prompted a sharp fall to about $30,000 (£21,180), though it has since partially recovered.

Bank of England governor Andrew Bailey has previously expressed concerns about cryptocurrencies, also saying people should only invest in them if they are prepared to lose all their money.

Last week, El Salvador became the first country to approve of the use of Bitcoin as legal tender.

Laith Khalaf, financial analyst at AJ Bell, said the FCA research “paints a broadly positive picture and shows most consumers are using crypto sensibly and moderately”.

“However, there is a dark underbelly lurking in the figures, which suggests there is still potential for widespread consumer harm,” Mr Khalaf added.

“The fact that 14% of crypto buyers have borrowed to invest is simply terrifying.

“The extreme volatility and uncertain long-term outlook for crypto means holdings can be wiped out, leaving borrowers with nothing but their debt as a memento.”