Chesnot/Getty

One day you’re on top of the world, making headlines for your upcoming appearance on SNL. Not long after, you’re the laughing stock of the internet. That’s the curse of DogeCoin which, along with Bitcoin, Ethereum and pretty much every other crpytocurrency, tumbled in value on Monday.

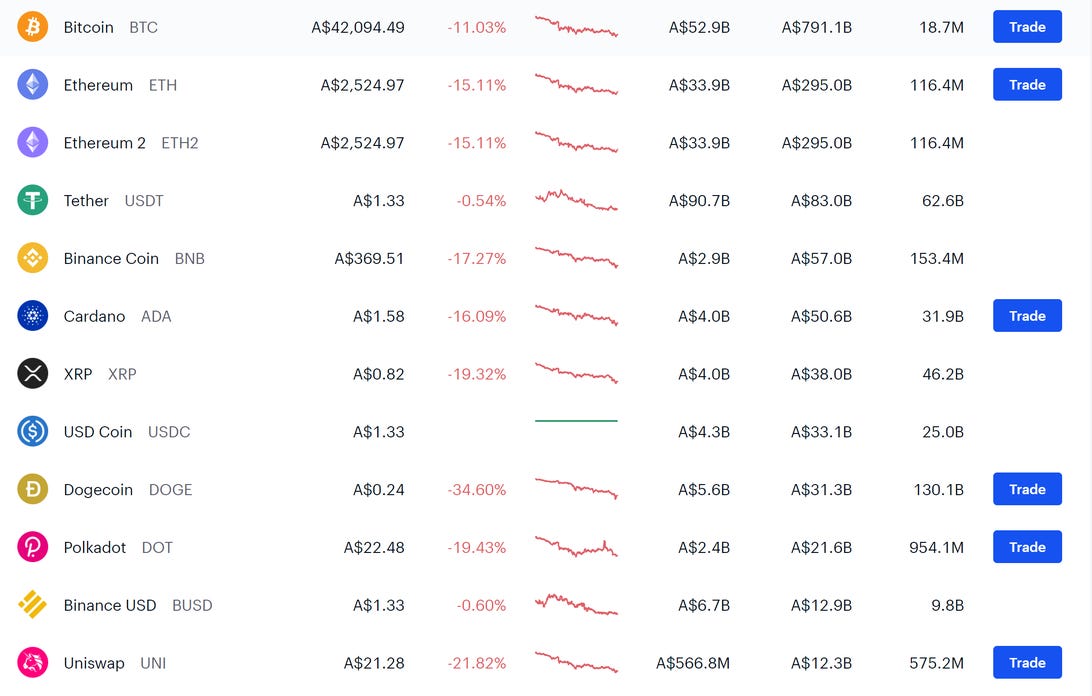

DogeCoin is down over 30%, to 17.6 cents. That’s a huge fall from its stratospheric high of 70 cents back in April. Bitcoin is at $31,500, a fall of just over 10%, while Ethereum has crumbled 15%. Ether’s fall has affected thousands of altcoins, most of which are built off the Ethereum blockchain and have a chunk of their value weighted in Ether coins. The entire market is down 12%, according to CoinBase.

What’s the reason? China — again. Back in May, Chinese officials reaffirmed an old ban that forbids financial firms from actively aiding in the mining and selling of cryptocurrencies. It caused a big dip, but crypto enthusiasts shrugged that the ban is nothing new, that it had enshrined in 2013 and then sparsely enforced.

Everything is down.

CoinBase

On Monday, however, moves made by China indicated the law would be enforced much more seriously. Key banks and financial services companies like Alipay were convened to a meeting by China’s central bank, reports the South China Morning Post, where they were told to crackdown on cryptocurrency trading. It came days after regional authorities ordered the closure of 26 mining operations in Sichuan.

“Virtual currency transactions and speculative activity have disrupted the normal order of the economy and financial [system],” the central bank said in a statement on its website. “They increase the risks of illegal cross-border transfers of assets and illegal activities such as money laundering. “

The decentralized nature of cryptocurrency is anathema to the Chinese Communist Party’s focus on stability — and control. Though shunning Bitcoin, Ethereum and other cryptocurrencies, China is working on rolling out its very own digital currency, the e-yuan.

China’s #bitcoin ban is short-term negative, long-term positive

— Anthony Scaramucci (@Scaramucci) June 21, 2021

The dominant driver of #Bitcoin right now is the crackdown on mining & trading in China that began in May. This created a forced & rushed exodus of Chinese capital & mining from the Bitcoin network – a tragedy for China and a benefit for the Rest of the World over the long term.

— Michael Saylor (@michael_saylor) June 19, 2021

Bitcoin enthusiasts are comparing the cryptocurrency to Google, whose share price continued to flourish after being banned in the People’s Republic back in 2010. They say that China neglects cryptocurrencies to its own peril, and that this will be a long-term positive for the US.

DogeCoin holders are less tranquil. The memecoin entered the year being valued at under 1 cent, and was pumped by Elon Musk and an ironic internet movement hoping to boost it to 10 cents — similar to the movement trying to get GameStop’s stock to $1,000. The 10 cent target was met in April, and then throroughly eclipsed in the month that followed. With hype building around a potential announcement from Elon Musk at SNL, the memecoin hit 73 cents. After Musk referred to DogeCoin as “a hustle” on the show, its value plumetted, a trend that’s continued for the past month.