Ripple once again lost steam during an approach to $1.6. A correction began on Wednesday as bears put pressure on the support areas at $1.5 and $1.4, respectively. The news that Tesla had suspended Bitcoin payments for its electric vehicles sent the market in bloodshed led by BTC’s drop under $50,000.

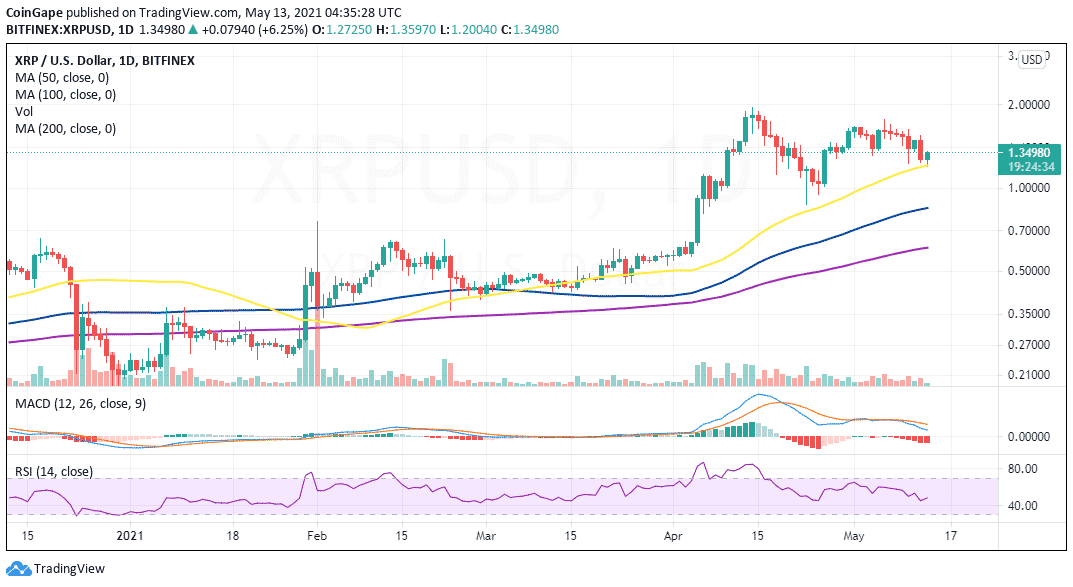

The retreat from highs close to $1.6 embraced an anchor at $1.33, reinforced by the 50-day Simple Moving Average (SMA). This anchor brought back some semblance of stability in the market and prevented Ripple from exploring levels toward $1.

At the time of writing, XRP trades at $1.35 after bouncing off the critical support. On the upside, a delay is expected at $1.4, but once the hurdle is broken, Ripple bulls may start lifting to higher levels.

XRP/USD four-hour chart

The Relative Strength Index (RSI) reveals that the bullish grip is becoming stronger. This move comes after the trend strength indicator bounced off support at 45 and is currently moving to the midline. A continued movement toward the overbought region would affirm to the investors that the slightest resistance path is upward.

It is worth mentioning that Ripple is not out of the woods yet based on the Moving Average Convergence Divergence (MACD). For instance, the MACD line’s divergence under the signal line keeps widening, insinuating that the bearish outlook is apparent. Therefore, it calls for caution and waiting for a validated break before going all-in on XRP.

Ripple intraday levels

Spot rate: $1.35

Trend: Bullish

Volatility: Low

Support: $1.33, $1.2 and $1

Resistance: $1.4, $1.6 and $1.8

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.