Crypto has taken a hit of late after a plateau, this article isn’t a reactive article but instead an objective piece, which we’ve long wanted to write. We delayed this article as we thought that it wouldn’t sit well with readers during a crypto boom. The purpose of this article is really to warn investors on what they’re buying by outlining key risks, and fundamentals, which are moving the asset class, and Ethereum (CRYPTO:ETH) in particular.

Grayscale Ethereum Trust (OTCQX:ETHE) is an actively managed fund, which provides investors with exposure to Ethereum. The fund holds and trades the product for investors in order to manage drawdown and maximize returns. The trust has a 2% management fee and 1 share buys exposure to 0.0103 of Ethereum.

Froth In The Market

The fund’s beaten the S&P 500 all end up in the past year but prior to that, it lagged the index by a significant amount. This is the first red flag in our opinion as markets have become somewhat irrational during the pandemic.

Source: Gurufocus

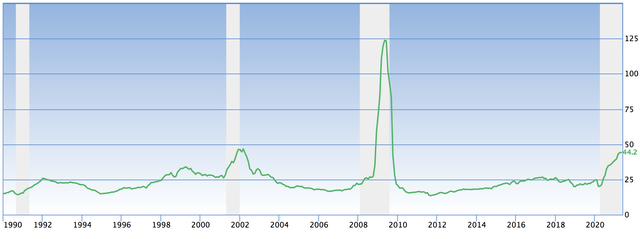

Above we have a graph, which illustrates the historic P/E ratios of the S&P 500. The market has plenty of froth in it at the moment and is trading at a really high P/E multiple. Throughout history, the market tends to correct itself in order to reach efficiency. We expect overcooked assets in the U.S.’s broader market to experience losses moving forward whilst underbought assets will gain a small amount.

Grayscale is an asset that we think has experienced unreasonable gains in the recent crypto boom, and we think that it will sell off along with other assets, which lack fundamental value.

Government Intervention

Governments and developed country governments have lost control of their currencies during the past year. The dollar spot index has suffered severely.

As the dollar has lost value and inflation has risen, investors have looked towards alternative stores of Wealth. Grayscale’s Ethereum Trust has benefited from the fact that investors have turned to crypto as the primary inflation hedge. Governments are seeking to regain control of inflation as well as their currencies, which has resulted in them intervening in the crypto market to create dollar demand. A few examples of recent intervention:

- Govcoins, which is still only a term but could mean the end for permissionless crypto is a potential central government cryptocurrency, which could replace the existing fiat system. More than 50 anonymous government officials met a few weeks ago to discuss the prospect.

- China has banned the deposits of cryptocurrency to their local banks. China has been working on the digital Yuan, which looks to be the first fiat digitalized currency.

- The U.S. government has placed a tax law on crypto, with transactions above $10,000 now needing to be reported to the IRS.

Ethereum has been one of the cornerstone hedges against inflation. We think that the price will be driven down as governments continue to create dollar demand through regulation.

Ever since the crypto sell-off has happened, the trust has lost more than a third of its value.

Noise As True Parameters

A way to describe the poor fundamentals to investors would be through an example in data simulation. It’s said that an under-fitted model treats noise as true parameters. We feel as though Ethereum’s fundamentals can be compared to an under-fitted model. The poor fundamentals cause a reaction to the news (even celebrity news) with extreme volatility, which is indicative of a speculative environment instead of fundamental-driven investing.

The “E” In ESG Isn’t All That Matters With Crypto

Tesla Inc (NASDAQ:TSLA) turned against Bitcoin (CRYPTO:BTC) due to environmental concerns. Tesla’s case is idiosyncratic, the company’s value-add is environmental sustainability. The issues with regards to “S” (Social) and “G” (Governance) are more of an issue in crypto than “E” (environmental). Here’s why:

- Social and Governance issues when combined are more important to institutional investors than Environmental. Environmental issues are important but only to a subset of investors.

- Crypto and Ethereum in particular are permissionless. This leads to tremendous governance and social issues, including terrorism, tax evasion, etc.

- Cathie Wood has used the environmental concern as an excuse, which can be resurrected, renewable energy can be used and systems can be modified, but she’ll never admit to the fact that she overlooked the social & governance issues, just as Elon Musk missed a trick with environmental concerns regarding crypto.

A Few Positives Still Remain

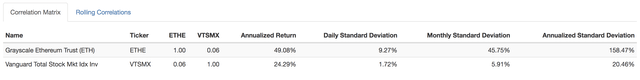

- Grayscale could still provide investors with diversification benefits as its uncorrelated with traditional assets.

Source: Portfolio Visualizer

- Grayscale manages the fund on an active basis and manages drawdown, the firm has been successful in doing so with some of their other funds. An example would be the Grayscale Bitcoin Trust (OTCQX:GBTC), which has reduced volatility whilst beating the index since 2017.

- Nobody really knows for sure that crypto in its existing form will be completely demolished. We’re very confident that it won’t be gaining much in value as governments have stepped in, but we think it will still exist in the longer term, who knows, some event can drive up the price again?

Final Word

A lot of investors probably won’t agree with us as the risks outlined are probably not what they want to hear. Some will disagree due to engineering or other technical arguments. But on a political, fundamental, and data analysis front we’re very bearish on Grayscale, we think investors should preserve their portfolios and not be overweighted in crypto, Grayscale Ethereum Trust is probably the first asset we’d sell.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.