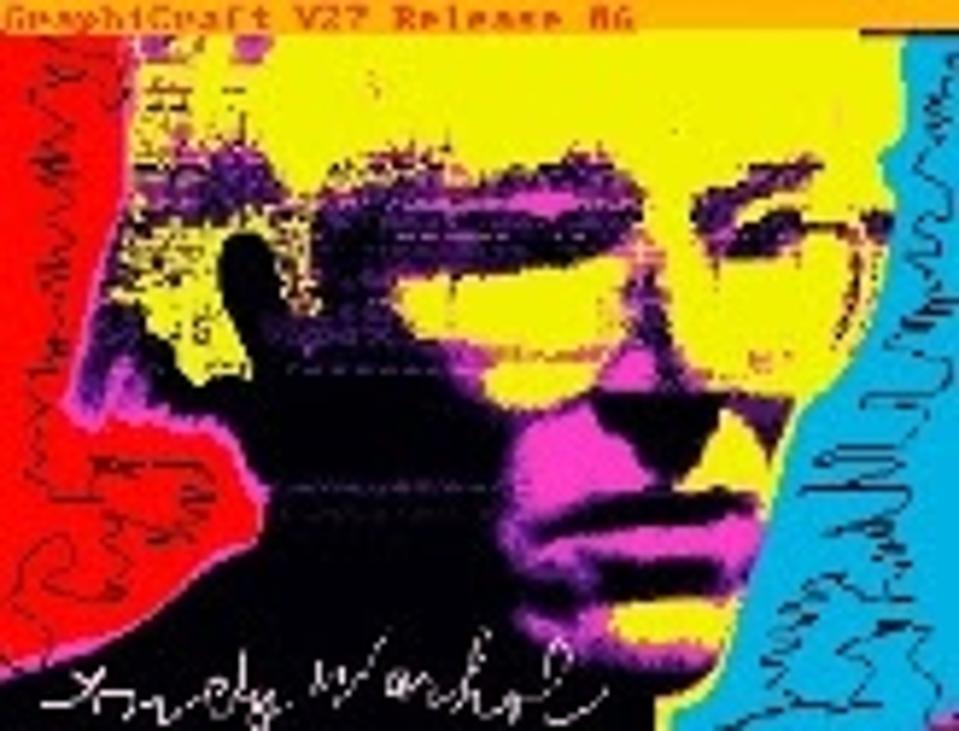

Andy Warhol ‘Untitled (Self-Portrait)’ non-fungible token (tif) 4500 x 6000 pixels (bytes) Executed … [+]

Property from The Andy Warhol Foundation (Christie’s)

The nascent use of Ethereum to buy digital artworks as non-fungible tokens dove deeper into uncertainty today with the abrupt sell-off of nearly every cryptocurrency after China doubled down on its ban on crypto services for its financial institutions.

Bitcoin’s price this morning sank to a low of just above $30,000, before rebounding to $37,000, amounting to a loss of 12 percent for the day. Ethereum and Dogecoin tumbled at about the same time and are down 27 percent and 29 percent, respectively.

The extreme absurdity of the NFT market — from the $69.3 million sale by Christie’s of a JPG file of a digital photo collage by South Carolina-based graphic designer Mike Winkelmann, known to the art world as “Beeple”, to Brooklyn-based film director Alex Ramírez-Mallis’ $85 sale of One Calendar Year of Recorded Farts — is rivaled only by its implicit and deeply-rooted woes.

Compounding the battering by China’s move, Ethereum has been forced into remodeling its underlying infrastructure to slash carbon emissions by a hundredfold. Proof-of-work cryptocurrencies have been widely condemned for being obscenely harmful to the environment, because each transaction or recording of an artwork requires massive computing power. Bitcoin, Ethereum, and some other proof-of-work cryptocurrencies require gargantuan amounts of energy, due to the computations needed for mining. The Bitcoin network consumes as much energy annually as Argentina. Dogecoin is also a proof-of-work currency, but it uses the scrypt algorithm, which favors high-speed random access memory over processing power and can be used on less powerful computers that waste less electricity.

The clamor for NFTs across art, entertainment, and consumer retail industries has ushered in a new era of potential fraud and misuse, including unauthorized creation of NFTs of artists’ works. Online galleries, such as Nifty Gateway, SuperRare, MakersPlace, Foundation, KnownOrigin, and Async Art, are proliferating and selling NFTs for ETH, a frenzy that won’t make a dent on the coffers of players with the deepest pockets but leaves many artists wondering if they can benefit from the burgeoning trend. Besides speculation, the market is rife with creative, often cynical or comical, attempts to seize any chunk of the bloating share.

Ethereum is an open-source, blockchain-based, decentralized software platform used for its own cryptocurrency, Ether. Launched in 2015, the digital token (ETH) quickly ignited into the second-largest cryptocurrency in the world by market value after Bitcoin. NFTs are cryptographic assets with unique identification codes and metadata to differentiate each one. Unlike cryptocurrencies, such as ether and Bitcoin, NFTs cannot be traded or exchanged at equivalency. Cryptocurrencies are identical fungible tokens used for commercial transactions in place of traditional paper money.

“Bitcoin is known as a volatile speculative asset, but (yesterday’s) extreme swings unnerved many investors. The collapse in Ethereum was even greater, but that was mainly due to its outperformance this year (Ethereum YTD +252 percent vs Bitcoin’s YTD +33 percent),” said Edward Moya, a senior market analyst for world-leading online multi-asset trading services, currency data and analytics provider OANDA, said in an email interview. “After Bitcoin fell over 50 percent from the record highs, the panic selling ended and many institutional traders got back in.”

Celebrated blue chip artists who died long before any such market was imagined join newcomers into this fluid, evolving space.

Andy Warhol ‘Untitled (Self-Portrait)’ Non-fungible token (NFT) 4500 x 6000 pixels (bytes) … [+]

Christie’s

Christie’s announced yesterday Andy Warhol: Machine Made, a sale of five digital works created in the mid-1980s by the Pop Art master and recovered in 2014 from floppy disks. The original works which existed only as digital files will be resurrected as NFTs and offered for sale individually on behalf of The Andy Warhol Foundation for the Visual Arts, with all proceeds to benefit the non-profit philanthropic foundation established by Warhol. Christie’s will accept payment in Ether or U.S. dollars, with a starting bid of $10,000 for each work in an online-only sale from May 19- 27.

“The NFT market will take a hit from today’s cryptocurrency market plunge as many long-term crypto investors just lost a good percentage of their wealth, but the long-term outlook still is upbeat,” Moya said. “NFTs continue to draw fresh interest and are attracting old art, such as Andy Warhol. Today’s crash was necessary given market positioning, but it doesn’t change anything regarding growing blockchain demand and growing interest in digital assets.”

Many cryptocurrency experts were hesitant to speak specifically about how the crash will impact the use of ETH for NFT art sales.

“I can’t speak to the dynamics of that market. But typically NFTs are priced in crypto, so a decline in crypto is a net negative for NFTs.” Bankrate.com analyst James Royal said via email.