Crypto at a glance

After a brief dip yesterday, Ethereum has come roaring back to another new all-time high of more than $4,300 this morning. It now has a market capitalisation of just below $500 billion, which makes it the 16th largest asset in the world. That puts it above JP Morgan and Visa and means the smart contracts giant is now bigger than any bank. How much further can it climb?

Ethereum’s latest push puts its market dominance at over 20 per cent – the highest it’s been since February 2018. The swing away from Bitcoin comes as the leading cryptocurrency continues to trade sideways. It’s up three per cent over the last 24 hours to $57,000, remaining in that corridor between $50k-$60k where it’s spent much of the past three months.

None of this is to say that things are quiet with Bitcoin at the moment, with institutions and the retail market alike continuing to pile in. It was reported yesterday that software giant Palantir is now accepting Bitcoin as payment and that investing in it as a treasury reserve asset is “definitely on the table”.

A new NYDIG survey also found that roughly 17 per cent of the adult population in the US own at least some Bitcoin – about 46 million Americans. Has Bitcoin finally gone mainstream?

The big gainer yesterday was eos (EOS), which is up 44 per cent at time of writing – an 83 per cent gain over the last seven days. Blockchain software firm Block.one has announced plans to launch a cryptocurrency exchange subsidiary — dubbed “Bullish Global” — will run on the EOS blockchain. The EOSIO developer revealed that it had raised capital to the tune of $10 billion for the crypto exchange.

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com ??

In the Markets

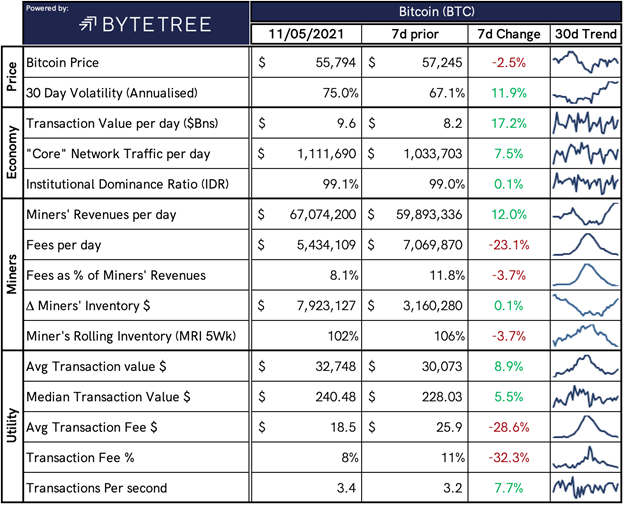

The Bitcoin economy

*Definitions and insights can be found at https://bytetree.com/insights/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $2,537,973,102,588, up from $2,413,548,767,170 yesterday.

What Bitcoin did yesterday

We closed yesterday, 11 May, 2021, at a price of $56,704.57, down from $55,859.80 the day before.

The daily high yesterday was $56,872.54 and the daily low was $54,608.65.

This time last year, the price of Bitcoin closed the day at $8,601.80. In 2019, it closed at $7,204.77.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $1.07 trillion, down from $1.038 trillion yesterday. To put that into context, the market cap of gold is $11.646 trillion and Alphabet (Google) is $1.534 trillion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $62,341,270,503, down from $74,229,970,352 yesterday. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 58.74%.

Fear and Greed Index

Market sentiment today is at 68, up from 61 yesterday.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 43.98, down from 45.35 yesterday. Its lowest ever recorded dominance was 37.09 on January 8, 2018.

Relative Strength Index (RSI)

The daily RSI is currently 49.83, up from 46.17 yesterday. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“Well, you probably don’t remember this joke, but five or six years ago, I said that that crypto was a solution in search of a problem. And that’s why I didn’t play crypto the first wave because we already have the dollar. What do we need to look for? Well, the problem has been clearly identified. It’s Jerome Powell and the rest of the world, central bankers. There’s a lack of trust. So sort of groping for an answer for a central case.”

– Billionaire hedge fund manager Stanley Druckenmiller

What they said yesterday

He knows his onions…

Incoming…

It is indeed…

This tweet aged well…

Crypto AM Editor writes

Ethereum yet to take off and is on track for $5,200 soon say experts…

Ethereum punches through $3,000 with market cap bigger than Bank of America…

Ethereum closing in on $3,000 as Bitcoin eases off the throttle…

Cardano teams up with Save the Children for humanitarian initiative…

HMRC were not clamping down on crypto…

Binance jumps on the NFT market…

Ethiopia overhauls its educational system with IOHK blockchain partnership…

Crypto AM: Longer Reads

City AM Markets: What is Decentralised Finance (DeFi) by Aave

Crypto AM: Conversation with James Bowater

Crypto AM: Market View

Crypto AM: Technically Speaking

Crypto AM: A Trader’s View with TMG

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Talking Legal

Crypto AM: Spotlight

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Definitively DeFi

Crypto AM Parliamentary Special

Part one of two – April 2021

Part two of two – April 2021

Five Part Series – March 2021

Part one

Part two

Part three

Part four

Part five

Crypto AM: Recommended Events

Crypto AM DeFi & Digital Inclusion Online Summit powered by Cointelligence Fund

May 20 2021

AIBC World

May 26 to 26 2021 – Dubai

https://aibc.world/events/uae/general-info/

Bitcoin 2021

June 3 to 5 2021 – Miami

Crypto AM City of London Roundtable

Crypto AM DeFi & Digital Inclusion Summit

&

Crypto AM Awards 2021

September 29 and 30 2021

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:30am GMT.