Trading has boomed in cryptocurrency markets while volumes in stocks and derivatives have tumbled with an increasing number of daytraders and institutional investors setting their sights on more speculative assets.

A slowdown in equities trading last month contrasted with a frenzied first quarter, during which activity jumped in “meme” stocks like GameStop and AMC, turbocharging the profits of banks, brokers and market makers at the heart of global markets.

Monthly data from exchanges, and public filings, indicated retail investors, who had helped fuel the surge in share trading for much of the last year, turned their attention to betting in cryptocurrency markets.

Trading on major crypto exchanges soared to $1.7tn last month, from $1.2tn in March and less than $100bn in April 2020, according to CryptoCompare data collated by The Block Crypto.

Activity also picked up in some crypto derivatives. Trading volumes in ether futures on the CME, a preferred tool of many institutional investors seeking exposure to one of the hottest digital coins, soared to a record of almost 6,500 contracts on Tuesday compared with fewer than 1,000 on April 1.

But it has been even more speculative crypto assets like dogecoin, which started as a joke and has been promoted by entrepreneur Elon Musk, that have garnered particularly abrupt spikes in demand.

“Dogecoin is surging because many cryptocurrency traders do not want to miss out on any buzz that stems from Elon Musk’s hosting of Saturday Night Live,” said Edward Moya, senior market analyst at Oanda. The Tesla founder is due to host the popular US television programme this weekend.

The price of other coins including PancakeSwap and BakeryToken has also rocketed as interest in so-called “alt-coins”, tokens lesser known than industry leader bitcoin, has grown rapidly.

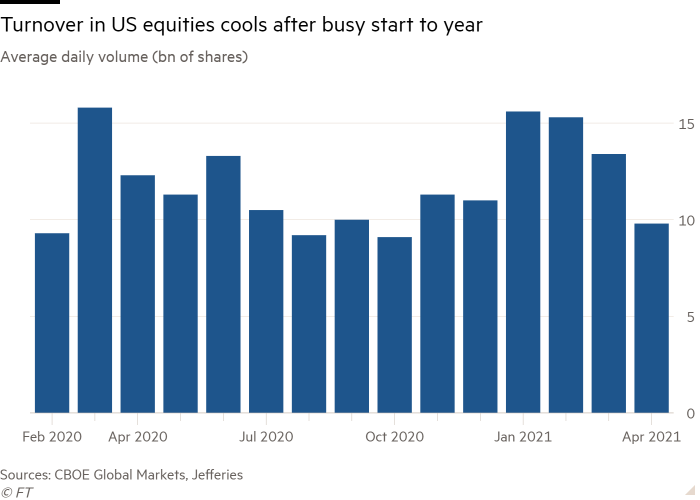

In stark contrast to the crypto fervour, turnover in US equities fell 27 per cent and equity options activity fell 14 per cent in April compared with March to reach their lowest levels since October, according to investment bank Jefferies.

In Europe, Deutsche Börse said cash trading volumes totalled €147bn in April, compared with €206bn in March. Turnover on Switzerland’s stock exchange over the month of April fell 20 per cent to SFr110bn.

“The quarter ended and almost to the day it felt like everyone went on vacation,” said James Masserio, co-head of equities at Société Générale. “In the US there has been a strong connection between vaccines hitting their stride and spring break season, and I think a lot of people’s attention has been pulled away from the market.”

April’s equity trading volumes were also curtailed by the Easter break. Still, the slowdown suggests investors are growing exhausted after many stock markets have struck a series of record highs, with some more speculative accounts seeking returns in other markets such as real estate and commodities.

Volatility in equities markets has also cooled and remains subdued compared with the often huge swings in the crypto market. The Vix index, which measures expected volatility on the blue-chip S&P 500 index, dropped below its long-term average of 20 last month, pointing to a period of market calm. Some large funds are betting on that stability holding at least for the coming weeks.

Corporate and sovereign bond market trading levels also slowed. Average daily volume on Tradeweb, the bond and swap trading venue, fell to just under $900bn a day compared to just over $1tn a day in March, when investors’ concerns on inflation and the timing of US interest rate increases led to market volatility.

Rich Repetto, an analyst at Piper Sandler in New York, pointed out that, in spite of the drop, US cash equities volumes remained above pre-pandemic levels. Average daily volumes in US equity options fell 14 per cent in April but remained above 2020’s record average daily volume of nearly 30m contracts a day.

John Canavan, an analyst at Oxford Economics, said government bonds and equity markets had struggled for direction over the past month as trading activity had slowed, but he did not expect the ranges to hold for much longer.

“Friday’s April [US] employment report will likely provide a spark that could generate some new life and direction in the markets,” he said.