Dogecoin (DOGE) may have had its origins in a joke but it has “remarkably strong fundamentals and powerful forces supporting its rise” according to a report titled “Dogecoin: The Most Honest Sh*tcoin” from Galaxy Digital Research.

Alex Thorn, the head of firmwide research at Galaxy, used a set of metrics and compared the joke cryptocurrency with Bitcoin (BTC) — the leader of the cryptocurrency pack in terms of market capitalization, to make his case.

Doge In Numbers: The Galaxy Digital report points to increased user adoption through the current bull run in DOGE. Thorn noted that there are nearly 3.6 million addresses holding any amount of the cryptocurrency. He noted that an “enormous” — more than 60% of the total supply— has moved in the last year.

See Also: How to Buy Dogecoin (DOGE)

“This indicates a significant transfer of coins from older holders into the hands of newer entrants.”

Transaction counts have “generally increased,” as per Thorn and he noted a run-up in on-chain activity, coinciding with recent price action.

The analyst pointed to merge mining of DOGE with Litecoin (LTC) and the fact that miners are now deriving more revenue from DOGE than from LTC.

LTC-DOGE Merged Mining Revenue, Courtesy, Galaxy Digital Research

However, Thorn also said that the profitability of mining DOGE has also led to a sharp increase in the price of mining equipment. He wrote that the price of a Bitmain Antiminer L3 has risen from $83.26 to $547.71 since the beginning of the year.

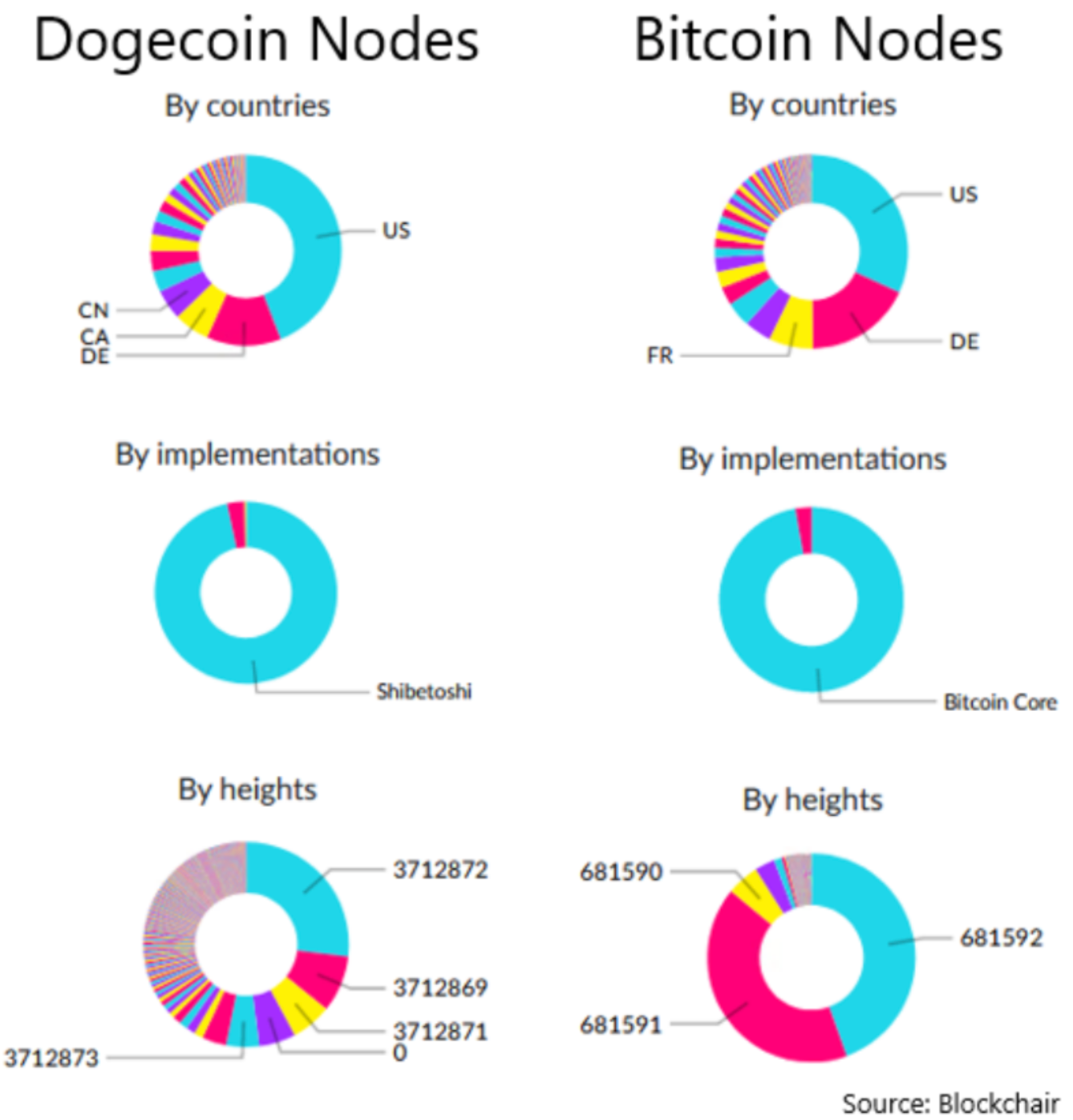

DOGE Under The Hood: The report noted the lack of activity in the Dogecoin GitHub repository since 2017, which according to Torn is a “lack of development effort for the project.” He also pointed to the vast majority of DOGE coin nodes not being fully synced with the network.

According to Thorn, only 26.8% of DOGE coin nodes are fully synced with the network. In comparison, 44% of Bitcoin nodes are fully synced.

Dogecoin and Bitcoin Nodes As Per Galaxy Digital Research

Dogecoin and Bitcoin Nodes As Per Galaxy Digital Research

Thorn claimed that the small number of nodes and the dearth of fully synced nodes made it difficult for new mode runners to effectively connect and sync to the Dogecoin blockchain.

See Also: Dogecoin Creator Says Meme Coin’s Development Has Kept Pace With Bitcoin

Of Memes and Digital Gold: Comparing DOGE with BTC, Thorn laid out several disadvantages that afflict the meme cryptocurrency. These include a lack of robust market infrastructure and a missing “robust ecosystem” of wallet solutions.

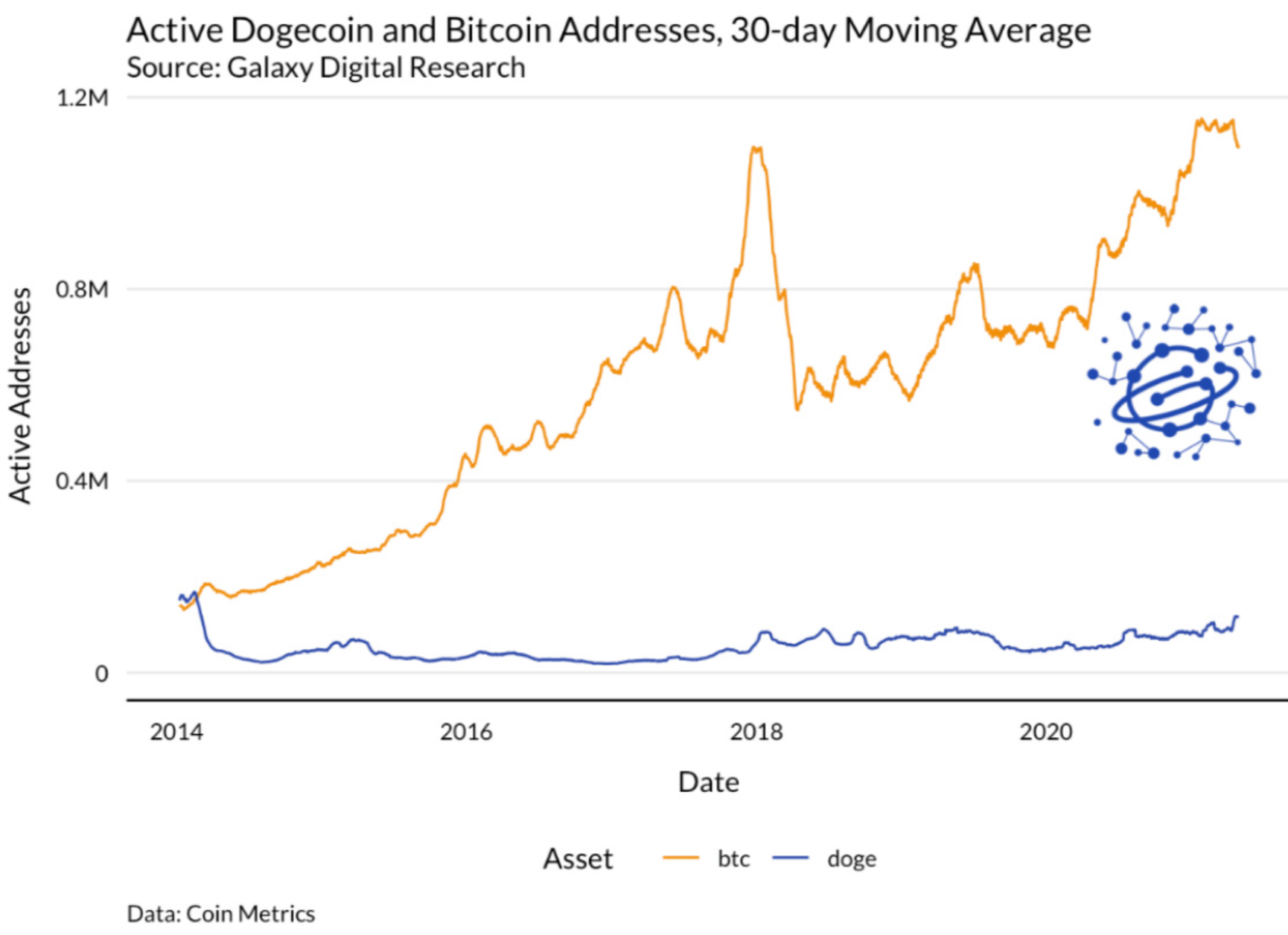

Thorn wrote that the number of addresses that hold BTC outweighs DOGE by “more than an order of magnitude.”

The analyst said that DOGE does not have a supply cap and its current annualized inflation rate is “substantially higher” than BTC.

Active Dogecoin Vs Bitcoin Addresses, Courtesy: Galaxy Digital Research

Active Dogecoin Vs Bitcoin Addresses, Courtesy: Galaxy Digital Research

Another issue highlighted by the writer was the concentrated supply of DOGE, which he says is “skewed heavily towards larger holders.”

BTC also has a number of other advantages like a substantial lead in transaction count and daily transfer value and faster settlement of transactions, despite DOGE’s network having shorter block times.

Thorn also claimed in the report that a 51% attack on Dogecoin would be relatively shallower compared to Bitcoin and result in a permanent loss of funds, while in the case of Bitcoin recipients “will be made whole” eventually.

Long Live The DOGE: Thorn laid out the case of DOGE’s survival, noting it being the best performing major digital asset year-to-date, alongside a widening ownership base and increasing settlement.

The analyst also brought up mining profitability and the fact that Elon Musk, CEO of Tesla Inc (NASDAQ: TSLA), has been bestowed the title of “CEO of Dogecoin” by the community.

See Also: Dogecoin Hits Another All-Time High Just Below 45 Cents Amid Elon Musk-SNL Speculation

Calling it an “admirable project” capable of rallying significant support, Thorn was all praises for the coin’s honesty and said, “Dogecoin’s longevity is ensured so long as one truism remains: people love a good joke.”

Price Action: DOGE traded 39.04% higher at $0.58 at press time, while BTC traded 1.16% lower at $55,143.63.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.