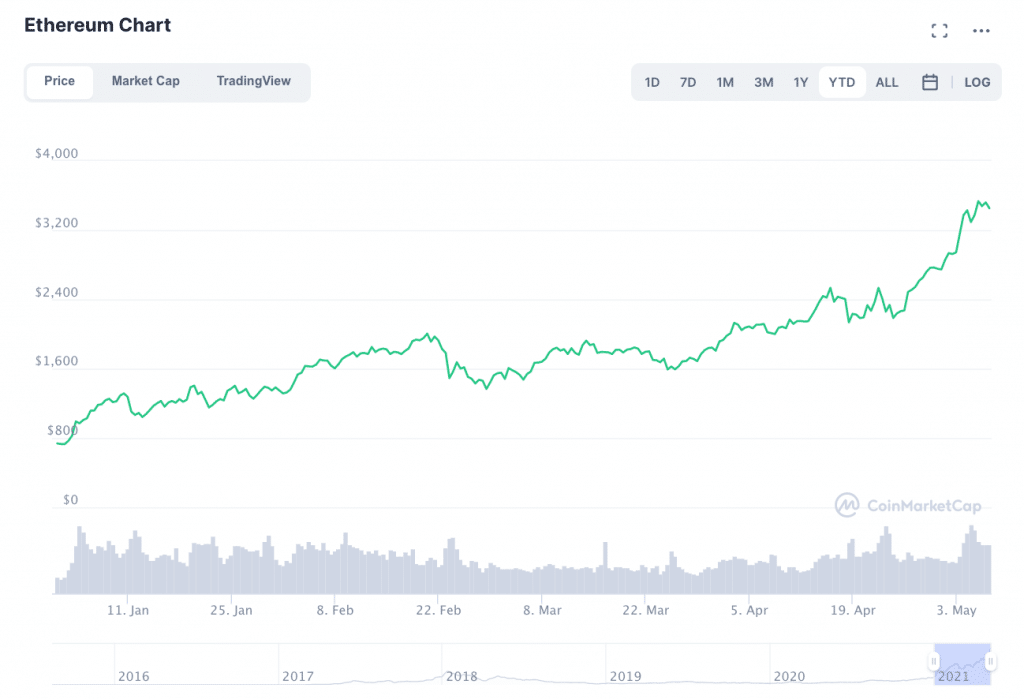

Bitcoin continued to trade sideways this week as Ether and other altcoins took the spotlight. ETH’s most recent all-time high (ATH) of $3,541.46 took place on Wednesday; by Friday, the price had settled at around $3,460.27. Dogecoin (DOGE) also hit a new ATH yesterday of roughly $0.69; CoinTelegraph called DOGE’s rise “the leading indicator for alt season.”

Matthew Unger, the Founder of iComply, told Finance Magnates that DOGE’s rise is “the biggest news of the past 3 months.”

Looking Forward to Meeting You at iFX EXPO Dubai May 2021 – Making It Happen!

“We can expect to see DOGE become a major contender as it enters the top 3 cryptos. The network continues to be underestimated because it was ‘made as a joke,” he said, adding that: “Fundamentally, DOGE has a lot going for it and that simply has not yet been priced in.”

Either way, DOGE is on the move, and altcoin markets are abuzz. Whether or not a ‘true’, capital-A ‘Alt season’ is underway seems to be up for debate. Still, it seems that the winds of change are blowing.

Everyone wants to know where we are at in my “Path to Altseason” chart.

We’re in the Phase 2-3 overlap. Large caps are starting to move. Phase 2 has heated up and we’re seeing early signs of Phase 3. PHASE 3 incoming! pic.twitter.com/tCZdNx995c

— Secrets (@SecretsOfCrypto) May 6, 2021

Bitcoin Dominance Is Falling

For one thing, the wealth distribution of cryptocurrency markets seems to be shifting. Michael Dalesandro, Founder and Chief Executive of Chicago-based RockItCoin, told Finance Magnates that he believes that: “we are starting to see a maturing of the crypto marketplace.”

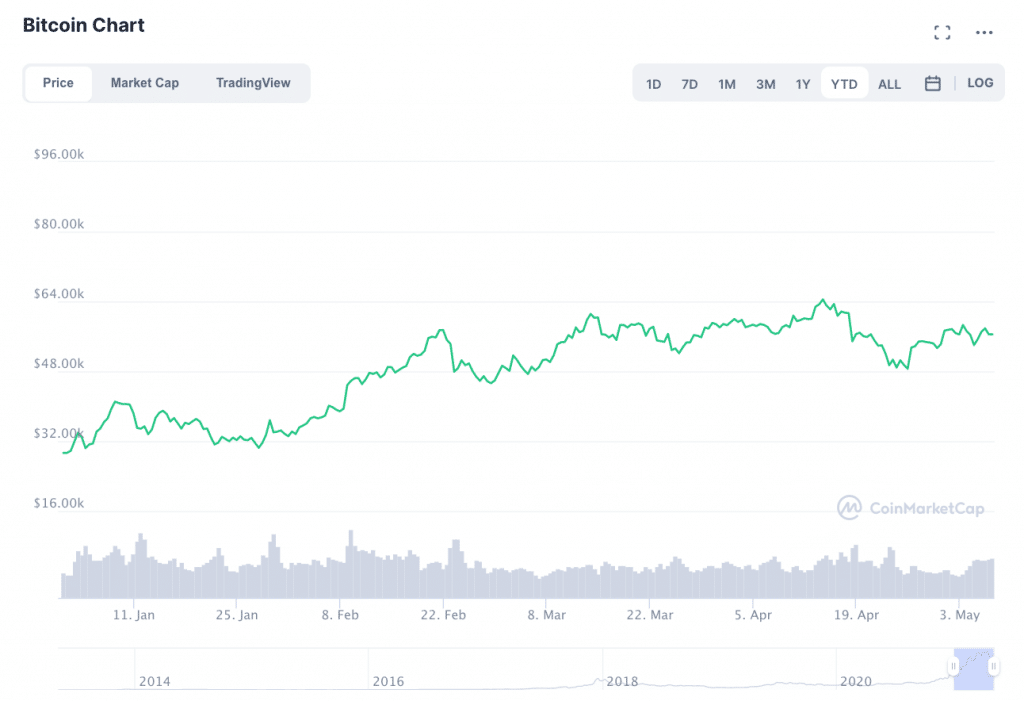

“Bitcoin’s dominance by market cap has dropped from 75% to below 50% in 2021 so more capital is flowing to the opportunities that exist in altcoins which have shown dramatic increases,” he added. “But, I think this is just the usual cooling-off we have seen with Bitcoin in the past; I fully expect it to continue its climb.”

Still, the dynamics in the market are shifting so much so that some analysts believe that crypto markets are in an ‘alt season’. Chad Steinglass, Head of Trading at CrossTower, told Finance Magnates that: “as BTC has been struggling to find direction for weeks, ETH and many other altcoins have taken over traders’ attention.”

“After consolidation in BTC towards the end of April, bulls got their hopes up for an announcement of another company adding BTC to currency reserves during the heart of tech earnings season,” he said. “However, earnings reports came and went with no mention of BTC, and in fact, of the major companies that had already been involved, TSLA trimmed their holdings somewhat and MSTR did not add during the recent dip.”

Still, there was “some positive news for BTC this week” when NYDIG and Fidelity announced that they would be “partnering to offer crypto services to retail bank customers,” a factor that Steinglass believes will “further the narrative of mass adoption.”

Bitcoin Trades Sideways as Altcoins Soak Up Investor Capital in Crypto Markets

Benjamin Leff, Chief Operating Officer of Sheesha Finance, told Finance Magnates that: “Bitcoin has taken a backseat while altcoin season picks up.”

In other words, the strong performances of many altcoins over the last several weeks seem to have drawn an increasing number of investors.

“People believe they can make more money in other cryptocurrencies and are looking at short-term plays in order to ride the bull market. Bitcoin is a much more resilient coin that people see more as a store of value than an opportunity to flip and make a quick and hefty profit, or loss depending on what one chooses to invest in.”

2021 Has Been a Year of All-Time Highs for ETH

What are the other cryptocurrencies that may have a higher earning potential than Bitcoin? All eyes this week were on Ether (ETH). The native token of the Ethereum network reached yet another all-time high.

Suggested articles

Market Trading Ideas for May 10-14Go to article >>

Indeed, this whole year has been a series of new ATHs for ETH, and, as such, ETH has outperformed BTC several times over. Dalesandro told Finance Magnates that: “Bitcoin is purely a cryptocurrency, whereas Ethereum is a cryptocurrency and a decentralised software platform.”

“It also supports many ERC20 tokens, which I believe is drawing funds away from Bitcoin and toward Ethereum,” he added.

Steinglass told Finance Magnates that Ether’s rise is “definitely a combination of many factors.”

“The value of ETH that is locked in DeFi staking pools has reduced the supply of coins available for trading, which has increased its scarcity,” he said. Combined with the anticipation of the move to Eth2.0, “which will move the network away from Proof-of-Work and towards Proof-of-Stake and deflationary characteristics, and many investors are looking to accumulate ETH in advance of the changes in the network.”

“Lastly, purely from a technical standpoint, any crypto that is making new highs is generating its own buzz and the move can become a self-reinforcing phenomenon, at least for a little while,” Steinglass added.

Ripple’s Court Battle with the SEC Continues

As ETH continues to surge, XRP, another popular altcoin, is continuing to trade sideways. Some analysts believe that this may be because of the ongoing battle that the currency’s creato, Ripple Labs, is fighting against the U.S. Securities and Exchange Commission.

Indeed, Ripple’s battle with the began in December, when the Commission announced a lawsuit against Ripple Labs. At the time, the SEC claimed that Ripple Labs had unlawfully sold unregistered securities (XRP).

Throughout the duration of the case, Ripple Labs has maintained that Ripple remains a currency, and, at times, it seems that Ripple may be leading in the legal battle. Analysts have claimed that several court victories may have boosted the price of XRP throughout 2020: when the lawsuit hit in December, XRP’s value fell to roughly $0.20. At press time, the price had increased to $1.58.

However, the outcome of the case is still unclear, and it could be that investors are biding their time before making big decisions about what to do with their holdings. After a peak of $1.91 in April, XRP has traded sideways for most of the last three weeks.

What could the future hold for XRP? Benjamin Leff, Chief Operating Officer of Sheesha Finance, told Finance Magnates that: “there has been discussion that Ripple may go public once the case with the SEC settles.”

Leff also pointed to recent reports of large purchases of XRP. Citing data from Santiment, CryptoSlate reported on April 29th that the number of addresses holding more than 1,000,000 XRP, colloquially known as ‘XRP whales’, had increased 1.25%. This equated to approximately 19 new ‘whales’.

What’s Next for XRP?

However, the fate of XRP still hangs in the balance of what happens next in court. Steinglass explained to Finance Magnates that: “XRP has had its ups and downs for quite some time, with a strong cohort of fierce defenders on one side, and often the SEC and the long arm of the law on the other side.”

“Recent sentiment that Ripple might survive its current legal battle with the SEC has bolstered the confidence of XRP defenders. Combined with the fact that XRP was delisted from most major US exchanges following their legal trouble, and it’s quite possible that liquidity is sparse, as well as most of the supply being under the control of a small number of traders. Those two factors can make for volatility spikes and big runs both up and down.”

Regardless of the outcome of the lawsuit in the United States, Ripple Labs appears to be continuing to build its networks beyond the USA.

Dalesandro explained that: “outside of the US, [Ripple] has been aggressively going after new opportunities and new business,” he said.

He also pointed to “recent news reports about the weakness of the SEC’s case, and that the SEC causing confusion as a consequence of its actions against Ripple,” he said.

Additionally, Dalesandro pointed out that the leadership of the SEC changed hands after the Commission brought the lawsuit. “Now we have a somewhat crypto-friendly chairman,” he said. Additionally, he believes that: “the SEC’s recent announcement that it may take enforcement action against XRP investors makes them look amateur and reinforces the sense that their case is weakening.”

Do you agree or disagree? Let us know in the comments below.