It took Microsoft 44 years to reach a market cap of $1 trillion. It took Apple 42 years, Amazon 24 years and Google, which has been renamed Alphabet, 21 years.

It took bitcoin less than 12 years.

And Ethereum’s native currency ether (ETH) looks like it might get there even sooner than that.

Bitcoin is currently worth $1.04 trillion and ether $289 billion. The total market cap of all cryptos – and there are more than 5 000 of them – has shot past the $2 trillion mark, which means bitcoin accounts for roughly half the value of the total crypto market. This is a substantial change from five years ago, when bitcoin made up roughly 82% of the overall market’s value. This demonstrates that the alternative cryptocurrencies, called altcoins, which include all cryptocurrencies other than bitcoin, have increased in value at a significantly faster rate than bitcoin.

The next biggest crypto is Ethereum, which makes up about 14% of the total crypto market cap. Binance Coin follows with 4.3%, Ripple’s XRP token comes in next with 3%, and Cardano makes up 1.75% of the total crypto market’s value.

Research out of leading global universities shows that the rate at which fortunes are being made in the crypto space is historically unprecedented.

Sean Sanders, CEO and founder of crypto investment platform Revix, which is backed by JSE-listed Sabvest, explains: “The growth in the altcoin market has outpaced Bitcoin’s impressive gains over the last 12 months by nearly 50%. All the bitcoin in existence are now cumulatively valued at around the same as what Apple – the world’s most valuable company – is worth. Smaller cryptocurrencies such as Ethereum, Cardano, Polkadot and Chainlink are worth only a fraction of what Bitcoin is worth, but the upside potential for some of these projects is considerable since the markets they’re trying to disrupt are as big, if not bigger, than Bitcoin’s addressable market. If you’re investing in crypto, we think it’s smart to include a diversified basket of altcoins in addition to Bitcoin so that you have exposure to this sort of upside potential.”

What are altcoins, and how do they differ from bitcoin?

Bitcoin was the first cryptocurrency and is known as a first-generation crypto. This means that it has a lot of trading history and robust network testing but does not use the latest blockchain developments, which could speed up network payment processing times and lower transaction fees, amongst other opportunities.

“Ethereum and Bitcoin Cash were viewed as second-generation cryptocurrencies with technological advancements made over Bitcoin, while Cardano, Polkadot and Chainlink are viewed as third-generation cryptocurrencies which offer multiple advancements of first and second-generation cryptocurrencies.

“Bitcoin has opened Pandora’s box with all the new crypto assets that have emerged. Now that the box is open, there’s no going back, and as clichéd as it sounds – the future has arrived,” says Sanders.

He continues: “The word cryptocurrency is a bit of a misnomer since not all digital currencies are used for payments. A better term would be crypto-asset since different cryptocurrencies have vastly different objectives and functions.”

Bitcoin’s primary utility is to act as a payment system as well as act as a store of value.

Ethereum, up an impressive 953% over the last 12 months, has a goal to become a global platform for ‘decentralised applications’, allowing users from all over the world to write and run software that is peer-to-peer, resistant to censorship and fully automated. It is already being used extensively for applications like lending (using cryptocurrencies as collateral), borrowing, earning interest, and more recently for the issue of non-fungible tokens (NFTs), which provide verification of ownership of digital or physical property.

All of this is based on smart contracts – pieces of computer code that eliminate the middleman. But the use cases for smart contracts and the blockchains on which they reside go way beyond borrowing and lending.

In time, smart contract developers envisage a world where these systems will be used to run the global economy – everything from insurance payouts without the need for an agent, inter-continental trade tracked in real-time or even real-time audits to verify the accuracy of financial transactions. The possibilities are limitless.

Two other cryptocurrencies nipping at the heels of Ethereum for dominance of this space are Cardano and Polkadot, both of which were breakaway projects designed to address the scalability and efficiency issues that bedevilled Ethereum (and which are now being addressed through blockchain protocol upgrades). For all of its perceived clunkiness and high costs of use, Ethereum still has first-mover advantage and runs more than 90% of all smart contracts operating today.

For these smart contracts to work, they need reliable external data – for example, weather data for insurers or farmers.

Chainlink provides this external data through what it calls oracles to the smart contract blockchain. It also has a cryptocurrency, which has shot up about 1 000% over the last year, that incentivises data providers and data verifiers to provide accurate real-time data in return for a fee.

The third largest cryptocurrency by market cap is Binance Coin (BNB), which is the native coin of the controversial Binance cryptocurrency exchange. It has been surging over the last six months due to a perception that Binance may become a leading player in the emerging crypto-based financial system now being rolled out; however, concerns over Binance’s operations and regulatory structuring has resulted in some volatility in the cryptocurrency.

XRP (also called Ripple) is an up-and-coming digital payment currency that works more like the SWIFT payment system used by banks and financial intermediaries. Transactions can be sent internationally and cleared in seconds and at a very low cost. This is different to today’s banking clearing systems, which can take five to 10 days to clear an international payment at a significant charge.

Litecoin is an offshoot or ‘fork’ of bitcoin that is often referred to as the ‘silver’ to bitcoin’s ‘gold’. It was developed to address some of bitcoin’s perceived shortcomings and make it easier to use as a global payment method. In many ways, Litecoin competes directly with bitcoin as a payment-focused cryptocurrency.

And if the world as we know it is about to be upended, why not video streaming and entertainment? The Theta network is designed to reward users for lending their spare bandwidth and resources to store and speed up the relay of high-quality videos, while royalty distribution apps can be used to reward entertainers directly. The Theta Coin has been the outstanding performer of the last year with a nearly 12 000% surge in price.

Which ones will be the winners a year from now?

“No one knows,” says Sanders. “And fortunately, you don’t have to as our ready-made diversified crypto baskets that we call ‘bundles’ provide you with exposure to all the top cryptocurrencies through a single investment.

“Our bundles aim to deliver on one promise: to make sure that our customers own the top cryptocurrencies, whatever they may be.”

The Top 10 Bundle is like the JSE Top 40 or S&P 500 for crypto and provides equally weighted exposure to the top 10 cryptocurrencies making up more than 85% of the crypto market. This bundle includes all the cryptocurrencies mentioned in this article and has significantly outperformed bitcoin over the last 12 months.

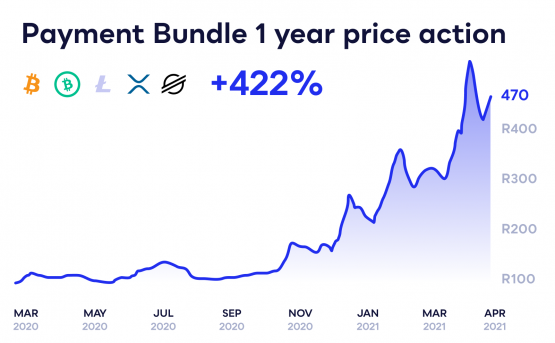

The Payment Bundle provides equally weighted exposure to the top five payment-focused cryptocurrencies looking to make payments cheaper, faster and more global. These cryptos include the likes of bitcoin, Ripple, Bitcoin Cash, Stellar and Litecoin.

The Smart Contract Bundle provides equally weighted exposure to the top five smart contract-focused cryptocurrencies like Ethereum, EOS or Tron that enable developers to build applications on top of their blockchains, similar to how Apple builds apps on top of its OS operating system.

Revix’s bundles have outperformed an investment in bitcoin alone over one, three and five-year periods.

Sanders explains: “The altcoins have outperformed bitcoin for multiple reasons, but the main reason is that there is far more to crypto and blockchains than just digital payments, and this is why our bundles have performed so well — as we equally weigh each of the cryptocurrencies within the bundles, which gives you more exposure to smaller cryptocurrencies that have performed so well, which also diversifies your crypto portfolio lowering your risk in an already highly volatile investment category.”

What else does Revix offer?

In addition to Revix’s crypto bundles, it offers:

- Bitcoin: The largest and most well-known cryptocurrency.

- Ethereum: The second-largest crypto asset and leader in the smart contract space.

- Paxos Gold: A regulated token that is backed 1:1 by physical gold held in fully insured London Brinks vaults, and

- USDC: A US dollar stablecoin called that is backed 1:1: by US Dollars.

What fees does Revix charge?

Revix doesn’t charge monthly subscription fees but rather a simple 1% transaction fee for both buys and sells and a 0.17% per month rebalancing fee (which amounts to 2.04% a year only) on the total bundle value held.

So whether you want to invest in a slice of the entire crypto market or a specific niche sector in the crypto space, Revix has a low-cost and easy to use investment option to suit your needs.

Brought to you by Revix.

For more information, visit Revix.

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing please take into consideration your level of experience and investment objectives, and seek independent financial advice if necessary.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.