This article was written exclusively for Investing.com.

- Crypto asset class striving for mainstream acceptance

- Governments are a roadblock; Technology businesses provide support

- Bitcoin pulls back resuming scary volatility; Opportunity or a warning?

- Ethereum is on a bumpy road

At the $60,000 and $2,030 levels respectively at the end of last week, and pulled back from their recent highs, then snapped right back. Meanwhile, the ascent of the tokens that float around in cyberspace has been nothing short of incredible.

Last March, Bitcoin traded to a low of $4,210, and Ethereum hit bottom at the $124.50 level. Each crypto coin has been a ten-bagger even after the recent corrections from new record highs.

Market participants who believe that higher levels are on the horizon argue that the overall market cap remains small at the $2 trillion level. After all, Apple’s (NASDAQ:) valuation alone stands at over $2 trillion. On the flip side, some critics argue that the tokens have no intrinsic value and will eventually become worthless. Markets need buyers and sellers, of course, but the digital currency landscape is composed of many extremes.

Each time Bitcoin rises to a new high, the bull’s voices become louder. During corrections, the bears seem to come out of the woodwork.

I take an agnostic view of the asset class. I respect trends as they reflect the wisdom of crowds. And the crowd continues to tell us that we have not yet seen tops in the digital currencies.

Crypto asset class striving for mainstream acceptance

Cryptocurrencies are building critical mass. More and more companies are accepting digital currencies as payment.

As of the end of March 2021, the list includes Microsoft (NASDAQ:), AT&T (NYSE:), and many others.

Recently, Tesla (NASDAQ:) announced it would accept Bitcoin as payment for the company’s EVs. Sports teams in the US are also accepting Bitcoin. The Miami Dolphins intend to give home game attendees the ability to pay with and Bitcoin. The Dallas Mavericks and Oakland A’s also accept digital currencies.

As the list grows, the asset class is gaining the support base necessary to challenge traditional money.

Governments are a roadblock; Technology businesses provide support

The US, Europe, and other governments have expressed concerns about the “nefarious” uses of digital currencies. US Treasury Secretary Janet Yellen and ECB President Christine Lagarde have said that the asset class’s volatility and uses for, what President Lagarde called, “funny business,” masks the underlying reason for their opposition.

Governments control the money supply via the traditional currency markets. As digital currencies are a global means of exchange that operate across borders without interference from governments or central banks, they represent a threat to the control of the money supply in countries and worldwide.

Moreover, the philosophy behind the cryptocurrency asset class is to remove government control from money. Therefore, governments will continue to oppose Bitcoin and the other over 9,100 tokens, and the digital currencies will resist any government regulations and attempts to control the market.

Governments are a roadblock for the new currencies, setting up an epic battle as acceptance rises.

Meanwhile, founders and CEOs of businesses that are disruptive technologies are taking sides. Tesla’s Elon Musk, a modern-day DaVinci or at least Thomas Edison, has invested $1.5 billion of Tesla’s cash hoard in Bitcoin. Jack Dorsey, the founder and CEO of Twitter (NYSE:) and Square (NYSE:), has bought $220 million worth of Bitcoin.

Some of the leading technology companies are not only accepting the tokens; they are investors, holding substantial risk positions in the volatile currencies.

Bitcoin pulls back resuming scary volatility; Opportunity or a warning?

Bitcoin’s trend remains bullish as we head into 2021’s second quarter. The leader of the digital currency asset class continues to make higher lows and higher highs.

Source all charts: CQG

On Mar. 15, April on the CME traded to a new all-time high at $62,080 per token. Ten days later, on Mar. 25, the price corrected to a low of $50,595, a drop of 18.5% below the peak. While Bitcoin recovered to around the $60,000 level on Apr. 1, the volatility is scary.

Excessive volatility tends to occur in markets with limited liquidity. Selling often disappears during bullish periods and buying dries up when the price moves to the downside.

Central banks and governments manage the global foreign exchange market with coordinated intervention to provide stability and limit one currency’s volatility versus another. The official sector will continue to argue that digital currencies suffer from far too much price variance to offer an effective and efficient means of exchange.

Meanwhile, digital currency devotees will point out that the cryptos reflect actual value, while the value of the , , and other global foreign exchange instruments are manipulated in the interest of the governments that issue the legal tender.

Time will tell if the high volatility level is an opportunity for investors to buy on dips or a warning sign of impending problems for the asset class.

Ethereum is on a bumpy road

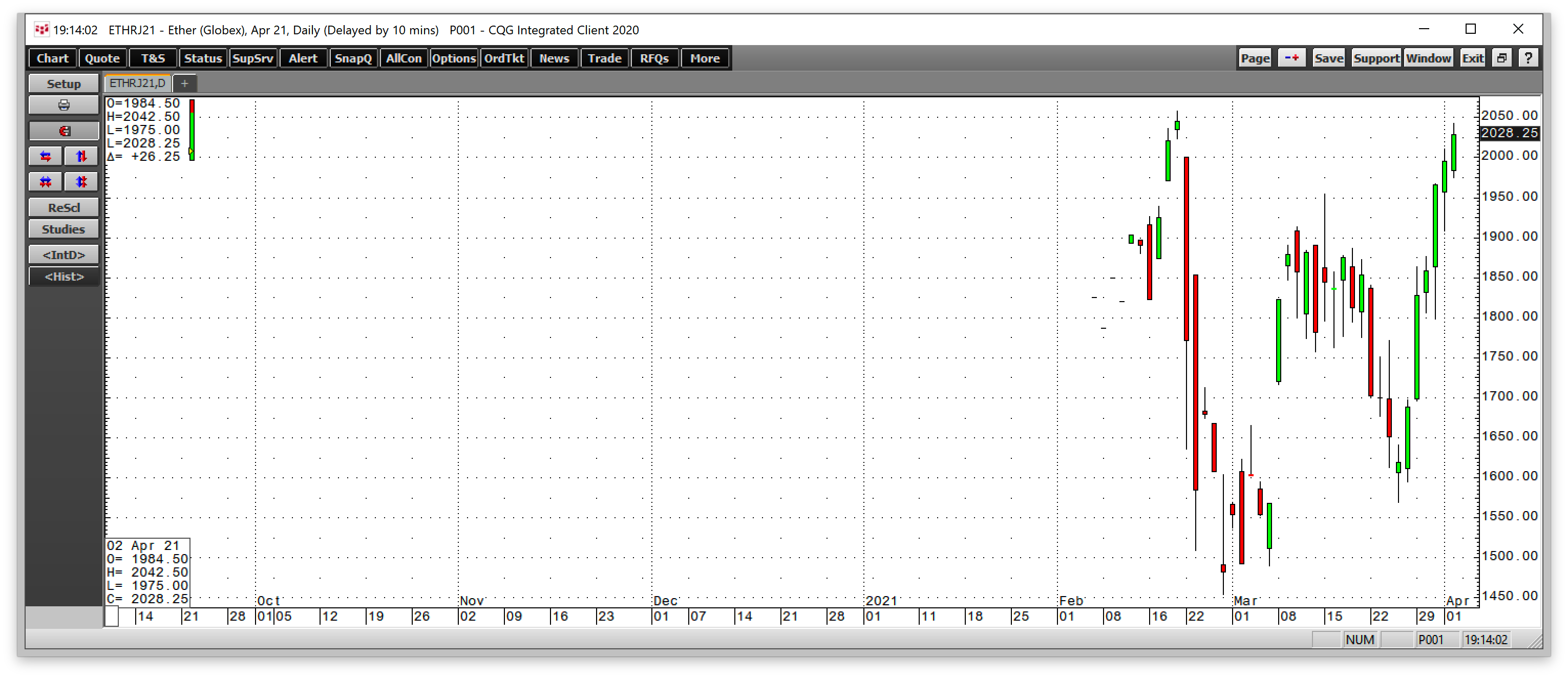

began trading on the CME on Feb. 8. When Bitcoin appeared in the futures arena in late 2017, it pushed the price to over $20,000 per token for the first time. Ethereum experienced a similar rally, rising to a record high of $2,057.75 on Feb. 19 before falling 29.3% to $1,454.75 on Feb. 26.

Source: CQG

As the chart shows, Ethereum futures recovered to just over the $2000 level on Apr. 1. While the price data is far more limited than for Bitcoin, the same bullish trend of higher lows is emerging in Ethereum since late February.

Anyone involved in trading or investing in Bitcoin, Ethereum, or any of the other 9,100 digital currencies needs to realize that volatility could increase as governments and central banks seek to flex their muscles to control the worldwide money supply. The road ahead will be very rocky.

However, the more businesses accept cryptocurrencies as payments, the rise of high-profile investors is bullish for the asset class with a market cap just below the $2 trillion level at the end of Q1 2021. While the number seems sky-high, it is not.

Consider that US government just spent $1.9 trillion on stimulus, and will spend another over $2 trillion on infrastructure rebuilding. As well, Apple’s market cap is over the $2 trillion level.

Digital currencies have room to move far higher. The road to the upside will be dangerous as the market builds critical mass. Though the trend is higher, the risk of downdrafts rises with prices.

Digital currencies represent technology’s impact on the money and banking system. Do not expect governments to accept the asset class any time soon. They will continue to fight for control of the world’s purse strings, which will only exacerbate price volatility.