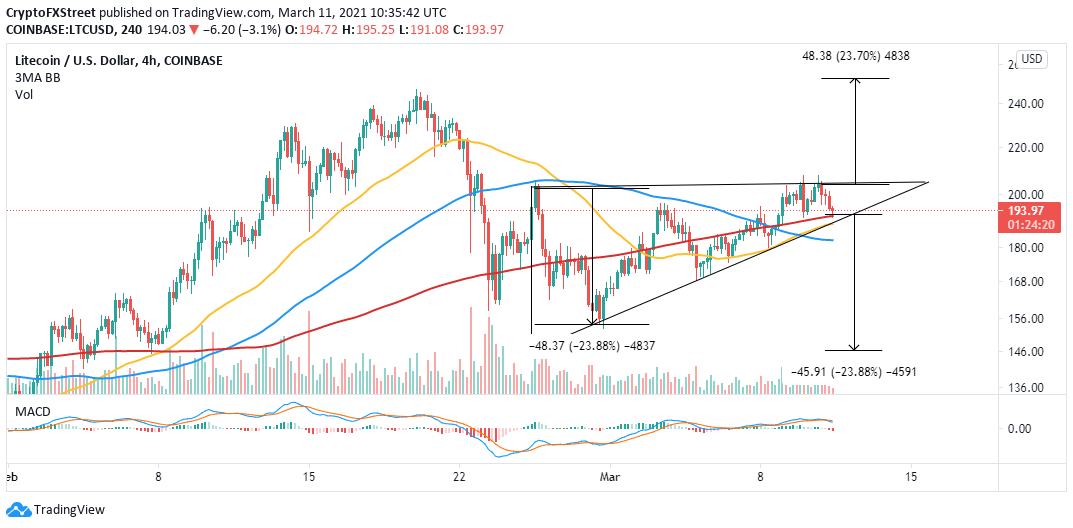

- Litecoin suffered another rejection at $200, opening the door to the ongoing retreat.

- An ascending channel failed to make a breakout at the x-axis, allowing bears to increase their position.

- Support at the 200 SMA on the 4-hour chart could ignore the bearish narrative in favor of a recovery move.

Litecoin has made an appreciable move upward this week, adding to last week’s recovery. However, the uptrend lost energy slightly above $200. LTC suffered another rejection at this level, pushing the price under $200. At the time of writing, Litecoin is exchanging hands at $195, and it has lost 2.5% of its value on the day.

Litecoin bulls fight to reclaim the uptrend

LTC is holding above the 200 Simple Moving Average (SMA) on the 4-hour chart. The most recent rejection sabotaged Litecoin’s possible 24% upswing. Hence, holding above the moving average could bring that chance back.

However, other technical levels reinforce the bearish sentiment. For instance, the Moving Average Convergence Divergence has started cementing the sellers’ increasing dominance. A stronger bearish grip will befall LTC if the MACD line (blue) crosses under the signal line. Note that slicing through the triangle’s hypotenuse may result in a 24% downswing to $145.

LTC/USD 4-hour chart

The 12-hour chart brings to light a sell signal presented by the Sequential Indicator. The call to sell occurred in a green nine candlestick. The indicator shows that the bullish momentum is reaching an end, and a correction is likely. If validated, Litecoin could in one to four candles on the same 12-hour chart.

LTC/USD 12-hour chart

Looking at the other side of the fence

The IOMAP shows that Litecoin is sitting on top of immense support areas. This means that the downswing to $145 could be ignored in favor of either a gradual recovery or consolidation. The most robust support runs from $184 to $190. Here, roughly 116,000 had previously purchased about 2.8 million LTC.

-637510587419699887.png)

Litecoin IOMAP model

On the upside, Litecoin has a relatively smooth path toward $220. However, the model brings our attention to the subtle seller congestion zone between $196 and $201. Here, nearly 89,000 addresses had previously bought 1.9 million LTC.