FILE- This Jan. 21, 2017, file photo shows the floor of the main lobby of the Central Intelligence Agency in Langley, Va. The FBI “exercised remarkable caution and candor” in securing search warrants that led to espionage charges against a former CIA employee, prosecutors have told a federal judge presiding over the case. Prosecutors said a court hearing is not necessary to reject Joshua Adam Schulte’s claims that evidence should be tossed out because searches of his New York City residence and various electronic accounts were illegal. (AP Photo/Andrew Harnik, File)

ASSOCIATED PRESS

Bitcoin just received a strong vote of confidence from an unlikely source, a former acting director of the Central Intelligence Agency. In so doing, he put senior government officials who issue public warnings about bitcoin’s alleged use by criminals, such as Treasury Secretary Janet Yellen, on notice.

Michael Morrell, a 33-year veteran of the agency, published an independent paper commissioned by the newly formed lobbying group Crypto Council for Innovation directly refuting this well-traveled narrative. In an expansive study, Morell came to two key conclusions:

- The broad generalizations about the use of bitcoin in illicit finance are significantly overstated.

- Blockchain analysis is a highly effective crime fighting and intelligence gathering tool.

But that is not all. In speaking with Forbes before the paper’s release, Morell made it clear that there will also be severe geopolitical repercussions for the U.S. vis-a-vis China if it wastes energy and resources chasing a ghost as opposed to leveraging blockchain, and fintech more generally, to build the country’s technological and economic base. Specifically, he said that “we need to make sure that the conventional wisdom that is wrong about the illicit use of Bitcoin doesn’t hold us back from pushing forward the technological changes that are going to allow us to keep pace with China.”

Michael J. Morrell testifies before a House Permanent Select Committee on Intelligence hearing on Capitol Hill in Washington, Wednesday, April 2, 2014 on The Benghazi Talking Points and Michael J. Morell’s role in shaping the administrations narrative. (AP Photo/Manuel Balce Ceneta)

ASSOCIATED PRESS

Setting the Record Straight

When he began this study, Morell would be the first to tell you that he did not expect to reach these conclusions. In our discussion, he said that one of his key assumptions was that people like Secretary Yellen and Christine Lagarde, President of the European Central Bank, were some of the most informed people on the planet and that their perspectives were grounded in facts. However, in doing his analysis he discovered “just the opposite, that [bitcoin and crypto] weren’t rife with illicit activity. In fact, there was probably less illicit activity in the Bitcoin ecosystem than there is in the traditional banking system.”

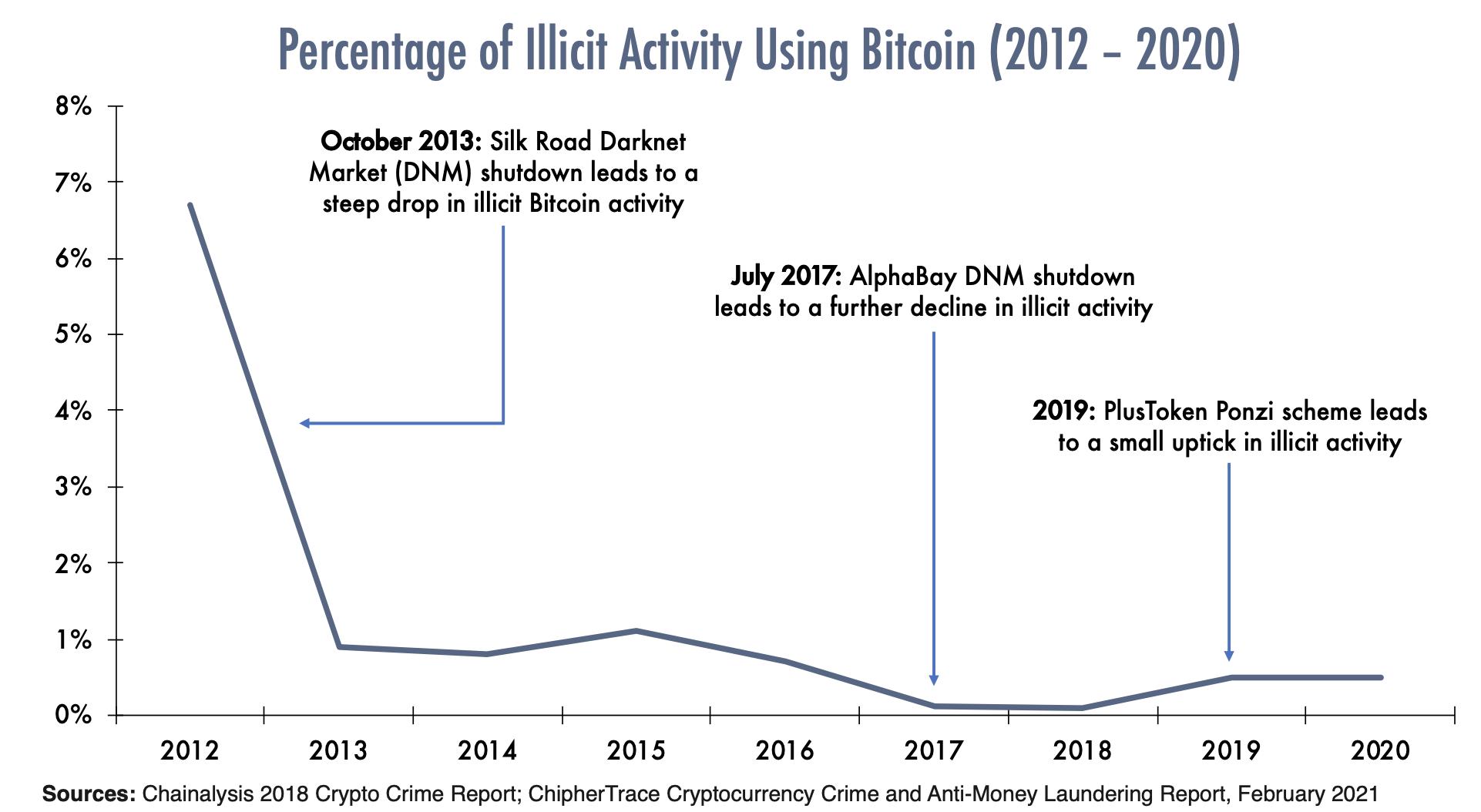

So, what did he find? Simply put, the percentage of illicit transactions in crypto is minimal (less than 1% according to one report from Chainalysis), and falling. For additional context, he notes that estimates of illicit activity conducted through traditional intermediaries range between 2-4 percent of global GDP.

Percentage of Illicit Activity Using Bitcoin (2012-2020)

Beacon Global Strategies, Chainalysis, CipherTrace

These findings will not surprise readers who have been following this industry for a long time and have encountered this narrative before, but they have never been refuted so directly by such an authoritative figure.

If the Internet is Written in Ink, Blockchains are Written in Stone

But that is not all. Perhaps even more interesting to Morell was how analytic firms such as Chainalysis, CipherTrace, and Elliptic can employ forensic and artificial intelligence tools to find illicit actors and activity on blockchains. In fact, he said that he was “literally blown away by how they find illicit activity…this is great intelligence work.”

He also made sure to point out that this analysis works on multiple levels because it can be used to track the actions of known actors as well as identify previously unknown people of interest.

Much Work Still To Do

Despite pushing back against these narratives, Morell still made it clear that we must always be cognizant of the national security implications of any technology, crypto included. In fact, when I asked him what a hypothetical sequel to the paper would cover, he quickly mentioned privacy coins, such as monero, that can obscure identifying data such as wallet addresses and transaction amounts. He has already seen illicit actors move in that direction in response to government scrutiny.

Additionally, I asked him about how intelligence and law enforcement communities should approach non-financial applications that can be built on top of blockchains, such as messaging, file sharing, or social networking programs. Although this question was beyond the scope of this report, he offered a nuanced response highlighting the delicate balance between protecting civilians without infringing on certain rights such as privacy. In particular he said that the “Fourth Amendment is critically important, and it is important that we maintain the privacy and civil liberties of Americans. I happen to believe that although it’s sometimes difficult, it is always possible to do both.”

Keeping Things in Perspective

But all of that said, Morell was clear that given the relatively low prevalence of illicit transactions in crypto, care should be taken to ensure that forensic work and law enforcement/intelligence does not override the need for the US to keep pace with China with regard to financial innovation. In fact, he fears that the U.S., which is already going at a glacial pace with regards to the development of a digital dollar, will slow down even further if it becomes overly concerned about this issue.

Of course, much remains to be worked out between now and then. For instance, it is unclear whether or not sovereign digital currencies will run on top of blockchains, especially decentralized platforms such as Bitcoin, Ethereum, etc. It seems likely that they will operate in more tightly controlled environments, at least for initial launches.

That said, there are natural gravitational pulls towards globalization, which lends itself to decentralization (nobody actually controls the internet), so Morrell’s broader point is worth taking.

It does us no good to have your eyes open if your head is stuck in the sand.