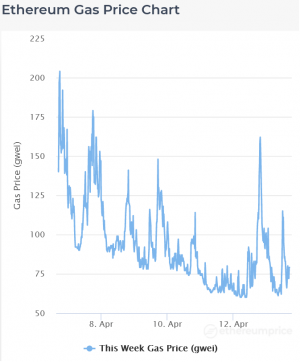

Ethereum (ETH) average transaction fees have plunged by as much as 50% in two weeks, falling from a fourteen-day high of USD 22.9 to a low of USD 11.4 on April 11, before increasing again. Analysts have pinned the fall on a shift in the types of bots used by traders, with flashbots replacing the priority gas auction (PGA) bots that tend to increase Ethereum fees by bidding up gas prices.

Other potential factors highlighted by commentators include the possibility that users are moving from Ethereum to Binance Smart Chain (BSC), as well as a general drop in usage.

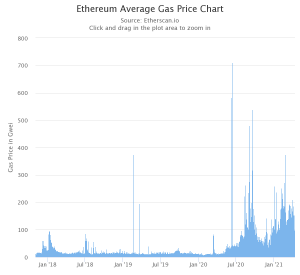

However, while Ethereum gas prices have declined in recent days, they still remain high by historical standards, even when accounting for the rising value of ETH. Also, as ETH hit another all-time high against USD today, the gas prices spiked again.

Ethereum fees decline = new trading bots?

At the end of February, Ethereum transaction fees hit an all-time high of USD 38, as demand for non-fungible tokens (NFTs) and the ongoing popularity of decentralized finance (DeFi) platforms pushed network traffic to new heights.

Fees then dipped in early March, but proceeded to rise again, pushing to USD 22.9 on March 31.

Since then — and particularly in the past seven days — they seem to be in something of a mini-freefall. Not only did they hit an average of USD 11.4 on April 11, but Etherscan put the average gas price (in gwei) at 85 on April 11, while ethereumprice.org put it at a low of 65 today before it jumped again.

The word on crypto Twitter (and elsewhere on the web) is that this drop in gas prices is due to change in bots used by traders and miners.

Traders have reportedly begun dumping PGA bots and shifting to flashbots. Standing for ‘priority gas auction,’ PGA bots are used by arbitrage traders to monitor their competitors’ behavior and bid up their own gas prices in order to get priority treatment (i.e. to get to the front of the transaction queue). In other words, they cause fees to go: up.

And blockchain analytics platform Nansen data scientist Alex Svanevik shared data providing evidence for an increase in the use of flashbots, which tend to reduce fees (rather than increase them).

Other suspects

Not everyone in the wider crypto community is convinced by this explanation. And unsurprisingly, people with a stake in seeing Ethereum fail have flagged up other potential causes.

As the above reveals, a significant proportion (nearly a third) of people suspect that fees are falling because certain users are getting fed up with high Ethereum transaction fees and are moving to Binance Smart Chain as a result. At the very least, this would cohere with reports which suggest that BSC is growing partly because of Ethereum fees.

At the same time, it may be possible that a general decline in use is dampening fees. As Ethereum developer Ryan Berckmans suggested, NFT volume appears to have dipped over the past few days.

4. the activity of ethereum’s NFT markets seems down a bit yesterday, which may have contributed to ethereum’s reduced fees. Any good time series for NFT metrics?https://t.co/vpn64jVVLY

— Ryan Berckmans (@RyanBerckmans) April 12, 2021

To be fair, all of these factors may be combining to reduce Ethereum transaction fees, something which could potentially provide ETH with a price boost (insofar as it’s cheaper to transact ETH). That said, fees still remain at historically high levels, even with the recent comparative reduction.

So as the above graph shows, Ethereum 2.0 and proof-of-stake can’t really come quickly enough for Ethereum, since even a much-discussed dip can’t substantially reduce its fees.

At 14:15 UTC, ETH trades at USD 2,226 and is up by 4% in a day and 6% in a week. The price is up by 15.5% in a month and 1,301% in a year.

____

Learn more:

– No Optimism For Ethereum In March – L2 Scaling Solution Delayed

– Ethereum Fees To Stay High Even With EIP-1559 – Another Analyst Says

– Ethereum Moves Ahead With Plans for Earlier Transition to Proof-of-Stake

– Ethereum Fans Brag About All-Time High Fees As L2 Solution Coming

– Ethereum 2.0’s Phase 0 Goes Live ‘Successfully’, ETH Drops