- Visa confirms support for Ethereum based USD Coin transactions following increasing demand.

- Bitcoin starts to close the gap toward $60,000 after breaking out of a descending parallel channel.

- Ethereum focuses on the upswing to $2,000, reclaiming the ground above $1,700.

- Ripple looks forward to a massive liftoff if the seller congestion at $0.6 is dispersed.

The cryptocurrency market reacted positively after Visa Inc. announced support for cryptocurrency transactions on its platform. A USD Coin has been singled out to enjoy this groundbreaking milestone, showing digital currencies are gaining traction in mainstream adoption.

Ethereum shines with Visa announcement

Ethereum, the leading smart contract token, has found itself in the spotlight because the USD Coin executes on its blockchain. This support will ensure that users spend money in crypto without the need to convert to fiat.

Visa confirmed that it had completed the testing process following a partnership with digital asset bank anchorage as well as completed the first transaction, whereby Crypto.com sent USDC to the company’s Ethereum address. Cuy Sheffield, head of crypto at Visa, told Reuters:

“We see increasing demand from consumers across the world to be able to access, hold and use digital currencies and we’re seeing demand from our clients to be able to build products that provide that access for consumers.”

Ethereum renews uptrend to $2,000

Ethereum has been on an upward roll since support was embraced at $1,540. Price action past the 50 Simple Moving Average (SMA), the 200 SMA and the 100 SMA on the four-hour chart has reinforced the ongoing upswing.

At the time of writing, Ether is trading at $1,785 as bulls eye liftoff above $2,000. The Relative Strength Index (RSI) on the four-hour chart cements the bulls’ presence in the market while entering the overbought region. Note that a break above $1,800 would see buy orders triggered, adding pressure to the tailwind.

ETH/USD four-hour chart

The bullish outlook will be invalidated if Ether fails to break above $1,800, as discussed earlier. Support is expected at $1,700, but if losses extend further, Ethereum will freefall toward $1,540.

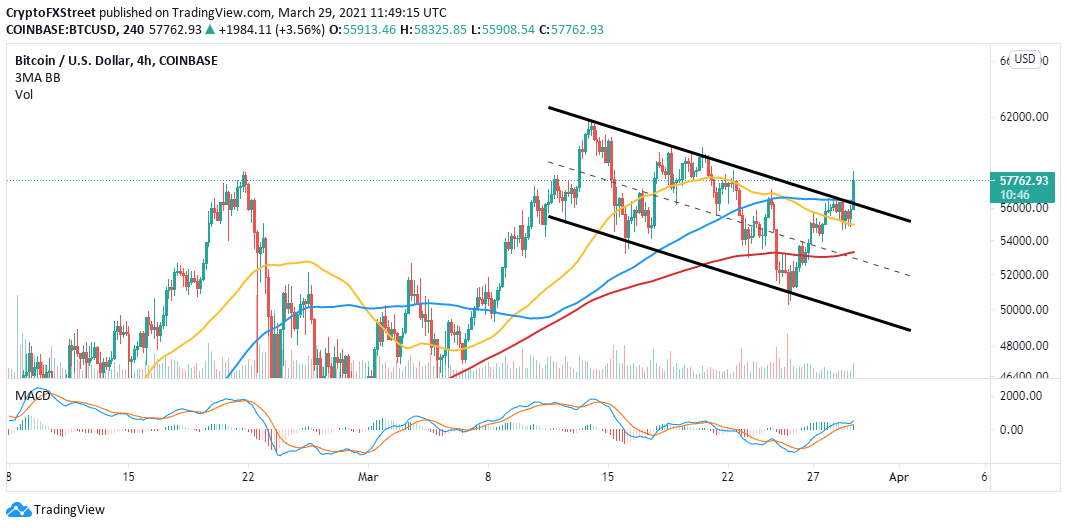

Bitcoin lifts as the gap to $60,000 shrinks

Bitcoin rallied above a descending parallel channel after bouncing off support at $50,000. The former resistance at the 100 SMA on the four-hour chart delayed movement, but bulls managed to overcome the hurdle, leaving open-air exploration toward $60,000.

At the time of writing, the bellwether cryptocurrency exchanges hands slightly above $58,000 as the uptrend builds. The next resistance is envisioned at $59,000, which, if broken, may push BTC to $60,000. Price action past $60,000 will trigger buy orders as the fear of missing out (FOMO) grips investors.

BTC/USD four chart

It is essential to realize that the upswing to $58,000 would be invalidated if Bitcoin fails to secure support above $58,000. Moreover, the 100 SMA functions as another support. Sustained the price above this level will avert a correction back to $50,000.

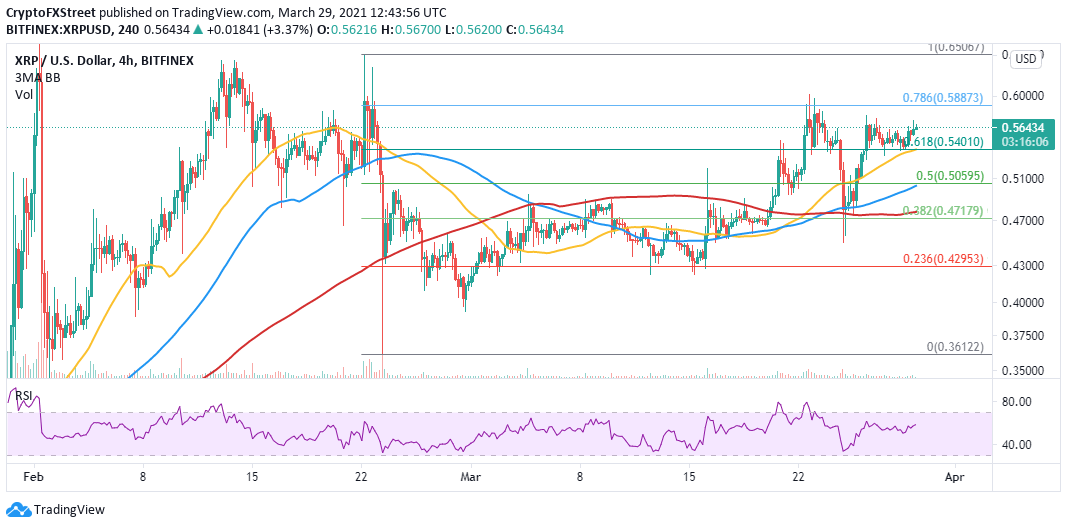

Ripple could gain more ground in breaking past $0.6

The cross-border token continues to nurture the uptrend, as reported. Support at the 61.8% Fibonacci and by association $0.55 reveals market stability. Price action beyond $0.6 would a considerable milestone, recognizing the massive resistance at this level.

At the time of writing, the least resistance path is upward based on the RSI on the four-hour chart. The trend strength indicator eyes the overbought region as buyers target levels above $0.6. Ripple is expected to break out to higher levels on breaking the stubborn hurdle at $0.6.

XRP/USD four-hour chart

The international remittance token must secure the position above $0.55 to avert another correction back to $0.4. The 50 SMA on the four-hour chart and the 61.8% Fibonacci level are in line to provide anchorage, but losses will come into the picture if the price slips below the confluence.