Yesterday the ETH grew noticeably, and on Tuesday, March 2nd, it keeps looking for a foothold, trading at 1,541 USD. The market looks clearly positive.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

On D1, ETH/USD keeps trading under 23.6% Fibo. The MACD histogram is below zero and keeps declining, which is a signal for a correction. Meanwhile, the signal lines of the indicator have formed a Black Cross, which is another reason for a pullback. Judging by the previous dynamics, the quotations might correct to the support at 38.2% before breaking through 0.00% Fibo. When the correction is over, the uptrend will be aiming at 2,030 USD as before.

Photo: RoboForex / TradingView

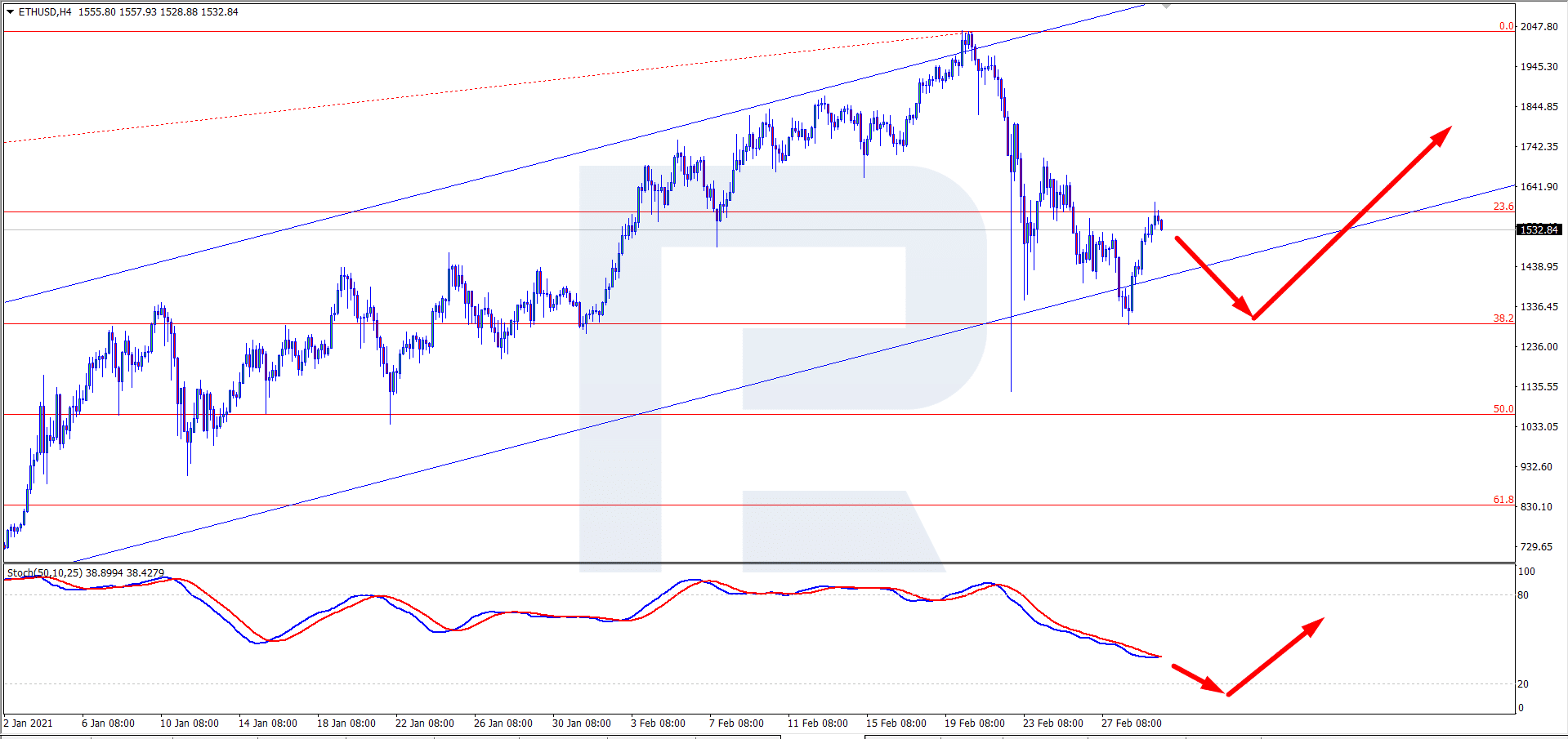

On H4, the situation is similar to that on D1: the quotations are under 23.6% Fibo. After forming another pullback, the coin has all the chances for resuming the uptrend. The Stochastic keeps declining upon forming a Black Cross, which is yet more support of a correction before further growth. The aim of the growth is the same as on D1 – 2,030 USD.

Photo: RoboForex / TradingView

Strategically speaking, buyers are again focused on the ETH, but the market is lacking any fresh triggers for purchases. Investors keep a close eye on the new ascending of the BTC, and the ETH altcoin follows it closely. Meanwhile, the factors that are known by the market but have not lost the edge keep stimulating the coin.

For example, MicroStrategy bought the BTC for 1.02 billion USD, thanks to which the portfolio of the cryptocurrency is now evaluated as 4.3 billion USD. Another thing is Square buying the BTC for 170 million USD after it has already invested in the crypto. The fact that large companies are diversifying their investments by buying crypto and believe in its future growth makes the market of virtual currencies more agile than anything else.

With all this news, the fact that NVIDIA launched a processor for mining the ETH which is not suitable for gaming got somewhat shaded.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.