- Reports of cryptocurrency scams more than doubled in January

- Authorities may not have the resources to keep up with the sheer number of fraudulent bitcoin promotions that have proliferated across social media

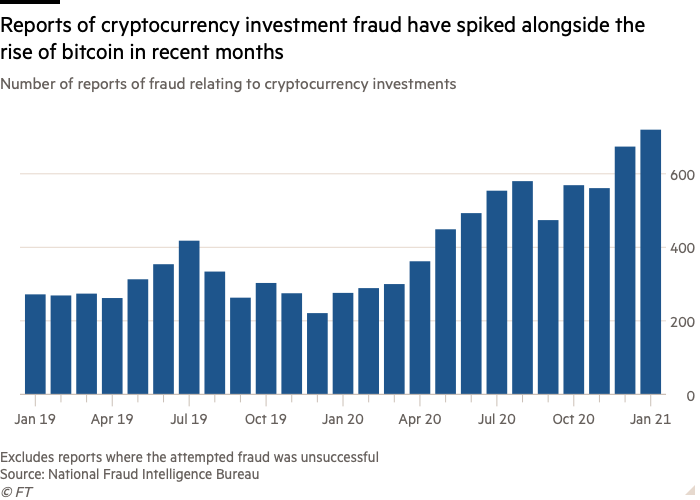

Cryptocurrency scams have soared in recent months, new figures reveal, as victims report losing millions every week to criminals seeking to capitalise on the bitcoin craze.

As the value of bitcoin rallies, the findings have prompted warnings that the get-rich-quick frenzy is leaving new investors vulnerable to scammers, potentially overwhelming authorities with far more cases than they can deal with.

Data obtained from Action Fraud, the national fraud-reporting service, show that in the 12 months to December, reports of scams relating to cryptocurrency investments surged 57 per cent year-on-year, to 5,581. In January, as bitcoin continued its ascent to record highs, the number of reports more than doubled compared to the same month in 2020, to reach 720 – equivalent to about 23 every day.

In total, victims said they lost £113m last year to cold callers and other criminals promoting fraudulent cryptocurrency investments, according to the data received through a freedom of information request sent by the Investors’ Chronicle. Some £14.3m was declared stolen in January alone – suggesting an average loss of almost £20,000 per scam.

The astronomic rise of bitcoin, promoted by advocates as one of the most secure assets to invest in, has prompted a flurry of advertising by cryptocurrency investment firms looking to win over new customers. But it has also spurred opportunism from more nefarious actors, who have made use of online platforms where financial promotions often elude regulatory scrutiny. In 2018, both Facebook (US:FB) and Google (US:GOOGL) decided to ban all bitcoin ads on their websites, amid concerns that many were being used to mislead investors.

But since then, both companies have repeatedly been accused of hosting ads for fraudulent investment schemes on their websites, some of which have used fake bitcoin endorsements from celebrities. Last July, scammers reaped more than $100,000 after hacking several high-profile Twitter (US:TWTR) accounts and posting messages promising followers to double their money if they sent funds to an anonymous bitcoin address.

Concerns have also been raised by reports that cold callers are now attempting to coerce elderly people into investing in fake cryptocurrency schemes, as bitcoin gains more mainstream recognition beyond its traditionally younger followers. Research by the Financial Conduct Authority found that 22 per cent of cryptocurrency investors were aged over 55 in 2020, compared with just 7 per cent in the previous year.

“There are more opportunities for fraud in cryptocurrencies,” said Sam Tate, partner and head of white-collar crime at City law firm RPC. “Some people have made a lot of money out of cryptocurrency and that is drawing vulnerable investors.”

Last month, RPC said it obtained figures from the FCA showing that the number of enquiries the financial regulator opened into unauthorised cryptocurrency businesses actually fell in the year to June, from 59 during the previous 12 months down to 52. The law firm warned that the FCA was probably only investigating the tip of the iceberg when it came to illegal cryptocurrency-related activity.

“The question is: what is happening with these [Action Fraud reports] that might act as a deterrent to fraudsters? There is a real question around the funding for fraud investigation and whether sufficient resources can be put towards specifically crypto crime,” said Tate, pointing to the £100m that was earmarked in yesterday’s Budget for investigating coronavirus-related fraud. “Where is the additional funding [for tackling cryptocurrency scams]?

Responding to the figures obtained by the IC, superintendent Sanjay Andersen, head of the National Fraud Intelligence Bureau, said: “UK policing and its partners, such as the Financial Conduct Authority… know the devastating impact investment fraud can have on victims, both financially and emotionally. We work closely together, in a whole-system approach, to disrupt criminal activity by shutting down websites and bank accounts, and build cases against the people carrying out these scams to bring them before the courts.”

He added: “Criminals will go to great lengths to persuade you they are knowledgeable and professional, offering you big returns for little investment and effort. But remember, if a deal sounds too good to be true, it probably is.”