The bullish trend remains the main scenario; however, not all coins from the top 10 list are ready to keep the growth.

Top 10 coins by CoinMarketCap

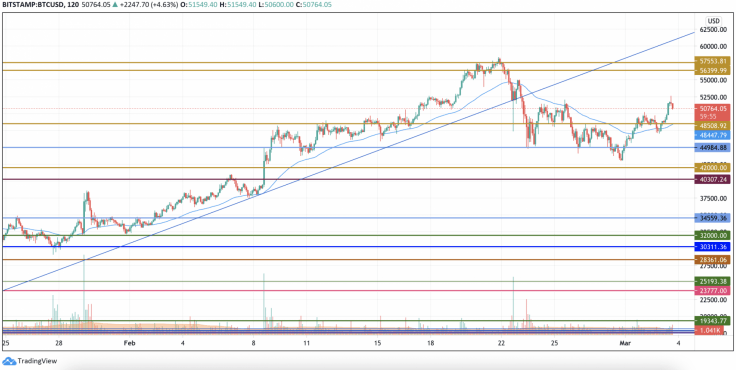

BTC/USD

Yesterday, trading volumes were below average, and the Bitcoin (BTC) price consolidated sideways with support at $48.30. In the evening, sellers pushed through this support and returned the pair to the area of average prices. But over the past night, the pair was able to recover to the zone of yesterday’s consolidation.

BTC/USD chart by TradingView

The lack of support from a large buyer does not allow the pair to overcome the psychological resistance at around $50,000.

If today, it is not possible to increase the volume of purchases, the pair might continue to consolidate, with the lower border of the sideways range expanding to the support area of $46,000.

Bitcoin is trading at $50,973 at press time.

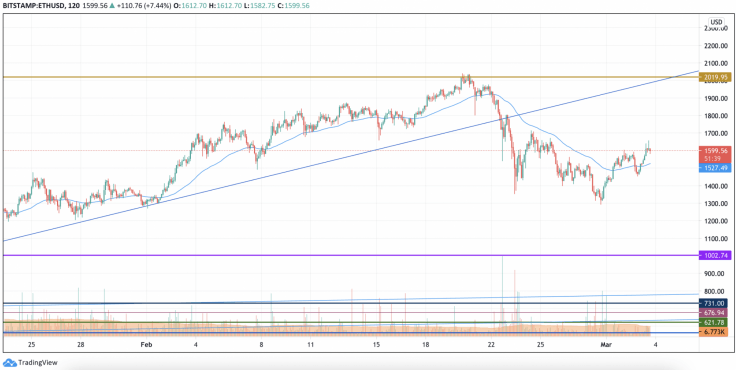

ETH/USD

Yesterday, buyers could not overcome the resistance at $1,600 and, on small volumes, the Ethereum (ETH) price gradually rolled back below the two-hour EMA55.

ETH/USD chart by TradingView

At night, the decline stopped around $1,480 and, by morning, with the low activity of market participants, the pair is trying to gain a foothold above the level of average prices. If the moving average EMA55 can provide support to buyers, then attempts to break through the resistance of $1,700 will be repeated. If sellers achieve a slight advantage in the market today, a retest of the $1,400 support is possible.

Ethereum is trading at $1,593 at press time.

XRP/USD

Yesterday, low buying activity kept the XRP price from leaving the boring sideways range in which it has been stuck since last week.

XRP/USD chart by TradingView

At the end of the day, sellers needed to exert some effort to push the price further away from the upper border of the channel. The pair pierced the support of $0.430, but remained within a narrow range. This morning, the sideways trend may continue, but buyers will once again try to gain a foothold above the four-hour EMA55.

XRP is trading at $0.4445 at press time.