Bitcoin has hit an all-time high of $56,926 (S$76,000) and a market cap of US$1 trillion.

But, Bitcoin is not the only cryptocurrency available.

There’s a whole world of cryptocurrencies outside of Bitcoin and it is as wild as it gets.

Intrigued?

Here is all you need to know about altcoins!

TL;DR: Beginner’s guide to Altcoin Cryptocurrencies

| Altcoin | Price (USD) | Market Cap (USD) | Daily Traded Volume (USD) | Circulating Supply |

|---|---|---|---|---|

| Ether (ETH) | $2,005.78 | $230.3 billion | $31.4 billion | 114.8 million ETH |

| Binance Coin (BNB) | $277.82 | $42.8 billion | $10.3 billion | 154.5 million BNB |

| Polkadot (DOT) | $39.58 | $37.3 billion | $3.7 billion | 922.9 million DOT |

| Cardano (ADA) | $1.13 | $35.3 billion | US$9 billion | 31.1 billion ADA |

| Tether (USDT) | $0.99 | $34.1 billion | US$125.4 billion | 34.1 billion USDT |

What are Altcoins (Alts)?

Altcoins or alts for short are simply cryptocurrencies that are not Bitcoin .

The word altcoins is a portmanteau for the words alternative coins.

So basically, any other cryptocurrency that is not Bitcoin falls under the category of altcoins.

According to leading data cryptocurrency data aggregator CoinMarketCap , there are over 8,200 altcoins that are currently listed.

If you have been following Bitcoin’s meteoric rise with the coin hitting a historic US$1 trillion market cap recently, you might be wondering; is there a need for altcoins?

Well, the answer is not too complex. Bitcoin is not without its flaws.

Typically, altcoins will attempt to make a superior version of Bitcoin or create a coin with different functionality.

Let’s explore the categories now.

Categories of Altcoins

When it comes to altcoins, you should know that there are different categories of altcoins and that some altcoins might fall into multiple categories.

These categories include:

- Mining-based cryptocurrencies: Coins created by a mining process where new coins are minted by solving complex math puzzles to unlock new blocks ala Bitcoin.

- Stablecoins: Coins that are pegged to external currencies in a bid to reduce volatility.

- Security Tokens: Coins that are a digital tokenised form of traditional stock/security/equity. These coins are connected to a business and are often released via initial coin offerings. Like traditional stocks, these coins tend to payout some kind of dividend or represent a stake in a business .

- Utility Tokens: These coins can be exchanged for services or products and are typically sold during an ICO.

Before you invest in altcoins, here are some cons you should be aware of.

Risks of Altcoins

- High risk: Altcoin investing is extremely risky as most altcoins tend to lose their value over time.

- Hugely volatile: The price of altcoins is almost entirely dependent on demand and supply that is independent of any real-world asset or medium. This means that you can expect huge price movements in the short-term.

- More susceptible to price manipulation: Altcoins tend to be more susceptible to price manipulation as the small market capitalisation and trading volume of these altcoins mean that inflows and outflows of smaller amounts of capital can greatly move the price.

- Loss of functionality: Altcoins might lose their value and become obsolete when the technology behind these altcoins becomes outdated or replaced.

- Consumer Protection: Unlike traditional banks, cryptocurrency doesn’t have any official safeguards or insurances.

- Regulatory issues: Because the asset class is so new, governments and banks have not yet formed a coherent fiscal policy for them. Therefore, there’s always a risk that their taxation status, trading rules, or even outright legality, could change overnight.

- Scam and fraud fisk: As altcoins are unregulated, they might be more susceptible to scams and fraud. Take this Singaporean who lost $130,000 to a fake bitcoin trader for example.

ALSO READ: How cryptocurrencies can replace other pay options

Neutral

- Interdependence with Bitcoin: Research has shown that the price of altcoin and Bitcoin are closely interlinked. This interdependence is more pronounced in the short run compared to the long run.

Potential rewards of Altcoins

- Risk-return tradeoff: The higher the risk the higher the potential reward. But, that is a big if as it is generally harder to calculate the risk-return tradeoff with altcoins.

- High returns: On balance, if you do your research well, you will be handsomely rewarded It is not uncommon to find altcoins that go up more than 100x in a few months. But,it is challenging to identify the right projects that will grow exponentially in the future.

It is not advisable to invest in something that you’re not familiar with, so I would encourage you to read beyond this article if you are interested in investing in cryptocurrencies.

Before deciding to invest in altcoin do your due diligence and research the altcoin thoroughly before investing in any altcoin.

With that out of the way, here are the top five non-Bitcoin cryptocurrencies by market capitalisation (as of Feb 20, 2021) for you to consider and do your due diligence on.

FYI: Altcoin market capitalisation = Total circulating supply of altcoins X the price of each coin (based on the exchange rate with fiat currencies like the USD).

These are also some of the more popular altcoins which are generally more stable and have a large community behind them.

ALSO READ: 5 digital currencies you can invest in besides bitcoin (And their performance in 2020)

1. Ether (ETH)

Founded in 2015, Ethereum is one of the longest-lasting decentralised open-source blockchain platform that allows users to execute smart contracts and build applications.

In addition, you can actually create other cryptocurrencies off the Ethereum platform.

As such, Ether (ETH) is the Ethereum platform’s native token.

ETH is often referred to as the silver to Bitcoin’s gold as it is the next biggest cryptocurrency by market capitalisation after Bitcoin

Unlike Bitcoin, ETH functions more as a source of energy for smart contracts.

The cryptocurrency acts as a fuel that allows smart contracts to run unlike bitcoin, which is meant to be a unit of currency on a peer-to-peer payment network.

Market capitalisation: US$230.3 billion

Volume (how much traded in 24 hours): US$31.4 billion

Circulating supply: 114.8 million ETH

Current price: US$2,005.78

2. Binance Coin (BNB)

Binance coin (BNB) was created back in July 2017 and currently functions as the in house token from the Binance cryptocurrency exchange.

Initially, the coin was operating from the Ethereum blockchain with the token ERC-20. But subsequently, the coin became the internal currency of Binance’s own Binance Chain blockchain.

In terms of functionality, you can use BNB to trade and pay transaction fees on Binance.

To incentivise users to use the token, Binance gave discounts if you use BNB.

You can also trade and exchange BNB with other coins like Bitcoin, Ethereum, Litecoin and more.

Market capitalisation: US$42.8 billion

Volume (how much traded in 24 hours): U$10.3 billion

Circulating supply: 154.5 million BNB

Current Price (As of Feb 20, 2021): US$277.82

ALSO READ: A Tesla for a bitcoin: Musk drives up cryptocurrency price with $2b purchase

3. Polkadot (DOT)

DOT is the native token of the Polkadot platform which was founded in 2016.

The token was created for the purpose of carrying out the key functions of the heterogeneous blockchain Polkadot platform.

The key functions of DOT include:

- Providing governance for the network,

- Operating the network

- Creating parachains by bonding DOT.

The protocol for this platform was developed by Dr. Gavin Wood, the co-founder of Ethereum. Essentially, the Polkadot platform was created to enable private customised side chains to link to public blockchains

Market capitalisation: US$37.3 billion

Volume (how much traded in 24 hours): US$3.7 billion

Circulating supply: 922.9 million DOT

Current orice (As of Feb 20, 2021): US$39.58

4. Cardano (ADA)

Cardano was launched in 2017 by Ehtereum and BitShares co-founder Charles Hoskinson.

Cardano is a proof-of-stake public blockchain platform and cryptocurrency network for smart contract development.

In other words, it functions as a social and financial operating system.

The internal token for Cardano is ADA, named after English mathematician Ada Lovelace.

ADA looks to resolve the flaws of other cryptocurrencies by focusing on interoperability.

The coin is also technologically advanced as it is able to process financial transactions in mere seconds.

Market capitalisation: US$35.3 billion

Volume (how nuch traded in 24 hours): US$9 billion

Circulating supply: 31.1 billion ADA

Current price (As of Feb 20, 2021): $1.13

ALSO READ: Bitcoin climbs towards all-time high after topping $25k

5. Tether (USDT)

Tether is a Stablecoin that is backed by real assets: i.e. fiat currencies, like the USD and Euro.

Each Tether token is pegged to the underlying fiat currency backing it with a 1:1 ratio. This means that Tether is backed 100 per cent by actual assets in the Tether platform’s reserve account.

As each Tether is pegged to real-world fiat currencies, it is not as volatile as other cryptocurrencies.

The coin allows businesses like exchanges, financial institutions and payment companies to use fiat-backed tokens on blockchains.

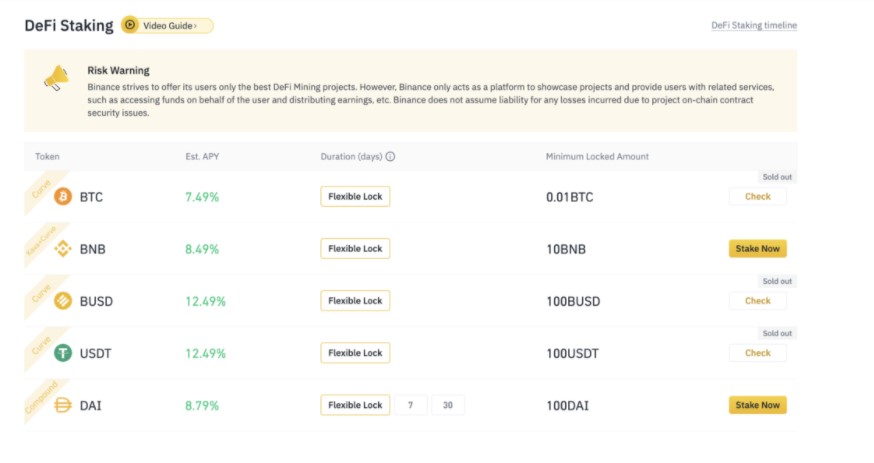

While not strictly an investment per se, you can earn rewards from the process of crypto staking.

How this works is that you hold a certain cryptocurrency like USDT in a crypto wallet to support a specific blockchain network’s security and operations.

The cryptocurrency is locked or put away. In return, you get staking rewards which usually come in the form of more cryptocurrency.

For example, you can stake USDT on a cryptocurrency exchange like Binance and earn 12.49 per cent p.a. on the cryptocurrency.

Market capitalisation: US$34.1 billion

Volume (how much traded in 24 hours): US$125.4 billion

Circulating supply: 34.1 billion USDT

Current price (As of 20 Feb 2021): US$0.99

Once you have done your due diligence you might want to check out our guide to buying Bitcoin and other cryptocurrencies in Singapore !

This article was first published in Seedly.