Are US retail investors really spending their stimulus cheques on Bitcoin?

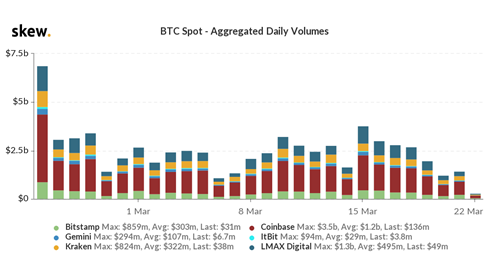

Bitcoin fiat exchange volume has fallen and is lower year-over-year. Obviously it’s harder to have higher exchange volume when comparing price levels, but in aggregate there are more market participants with even more dry powder behind them now.

Also, there may not be many investors adding risk here, nor are many long-term ‘hodlers’ selling.

Buyers here may be from the boomer generation, late to the game but want in on the action, who still use traditional intermediaries such as brokers, and continue to invest through traditional vehicles like trusts and non-existent ETFs.

Even if prudent investors were able to spot the premium through those, they still aren’t willing to on-ramp their old fiat onto the new exchanges that accept them.

Let’s think about the buying power of a $1,400 cheque. A main question among new Bitcoin entrants is how much upside from this level, and the main issue for them is unit size. Bitcoin would have to trade well above $100k for them to double-up. Easier gains might be made elsewhere in this volatility asset class, but one would have to look deep into another blockchain network.

It’s a similar story for Ether, currently seeing the weakest volume in all of Q1 2021. Investors seem jealous that it can’t break new highs, while Bitcoin can, which moved through $60k a couple weekends ago and touched several times, but fails to hold.

However, for a cryptocurrency that is only worth three cents of BTC, Ether has surprisingly relatively high notional volume, averaging $500m a day compared to $1.3bn a day for Bitcoin, at Coinbase.

Ethereum network users are continuously upset over gas fees, but currently, there is no better alternative. Other layer one blockchains exist, but the decentralised apps and smart contracts aren’t fully up and running yet, nor are they gaining market adoption and share. Developers may consider building their layer two on a new network due to current issues, but those should likely take time.

NFTs live and breathe on Ethereum, and so do the most popular DEXes, and thus access to alt coins. NFT buyers likely already own ether and are willing to trade, but purely buying ether for NFTs also won’t move the market. However, investing in alt or meme coins does involve trading crypto.

Retail investors want to explore these, whether expensive jpeg/gif, meme coins, or not, if directed towards crypto investments, their stimulus cheques will likely be spent on “the next Bitcoin.” Many of these new entrants are upset they missed some of the earlier rides, and are shooting for the moon with their diamond hands.

Also, the institutions providing repetitive reinvestments and interest bearing accounts are expanding their offerings, another avenue for money to be steered away from Bitcoin and Ether.

So, while the money printing machines continue to go ‘brrrrrrr’, this doesn’t automatically mean Bitcoin and all other cryptos are heading higher in the near-term. Long-term optimism for BTC and ETH still persists, but participants with cash in hand from the helicopters above are seeking undue risk and rewards.

Although spot volumes have been sliding, futures and options are either steady or increasing. Funds may also be spent on these leverageable positions or used to pay for call premium on moonshots or downside protection.

With exchanges also offering 100x leverage, newly-born day traders may opt to risk their windfall on derivatives with magnified gains rather than a slower rewarding spot market.

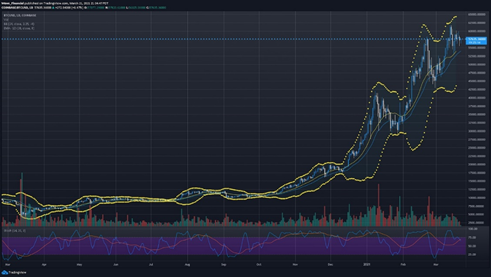

BTC continues on its down-leg from new highs of $61,700 and unable to stay above it’s previous all time high of $58.4k. We could see the market drift lower and with weak buying activity around the $54k down to $52.5k range, and stronger support between $48k down to $45k.

ETH tried to hold its value between the $1,700 and $1,800 range but was dragged down along with the rest of the crypto space with BTC’s move. We could see the resistance earlier in the year at the $1,300 to $1,500 range turn into support, as it may be cheap enough for gas and on-chain items, or attractive enough as a funding currency for alts.

About Justin Chuh, Senior Trader at Wave Financial

Prior to joining Wave Financial Justin Chuh was at proprietary trading technology business HC Tech where he was a FX trader for seven years. Justin is a CFA Charterholder, member of CFA Society Los Angeles and graduated from Arizona with a BS in Business Economics and Management. Justin is responsible for trading Bitcoin and other digital assets that make up Wave’s assets under management, ensuring that their trading strategies cover fund inflows and redemptions.

About Wave Financial LLC

https://www.wavegp.com/

Wave Financial LLC (Wave) is a Los Angeles and London based investment management company that provides institutional and private wealth digital asset solutions. Led by a team of highly experienced financial services professionals, Wave provides investable funds via their diverse investment strategies applied to digital assets and tokenized real assets. Wave also offers managed accounts for HNWIs and family offices seeking tailored digital asset exposure, bespoke treasury management services, and early-stage venture capital and strategic consultation to the digital asset ecosystem.

Wave is regulated as a California Registered Investment Advisor (CRD#: 305726).

Important Disclosures and Other Information

Nothing in this material should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. Past performance is no guarantee of future results. Wave Financial LLC is a registered investment adviser, registered with the state of California (CRD#: 305726). Registration with the state authority does not imply a certain level of skill or training. Additional information including important disclosures about Wave Financial LLC also is available on the SEC’s website at www.adviserinfo.sec.gov. Or, learn more information about Wave Financial at www.wavegp.com.

The ecosystem landscape included in this post is intended to provide generalized guidance; nothing in this analysis is intended as tax advice, investment advice, a recommendation or an introduction to particular funding or capital resource.