Even with the Berlin update and EIP 1558 looming large on the horizon, there seems to be no near-term solution for Ether’s scalability and transaction fee woes.

- Despite its recent cooldown, ETH is still exhibiting an average 12-month gain of over 500%.

- Grayscale has continued to ‘buy the dip’, with the digital asset manager adding another 3,347 ETH to its balance sheets.

- Since the start of the year, ETH gas fees have been surging to all-time highs, with simple transaction fees as high as $40 during periods of extreme congestion.

After scaling to around the AU$2,050 mark late yesterday afternoon, Ether proceeded to dip to as low as AU$1,873, showcasing a slide of nearly 10% within a matter of just a few hours. Since then, the premier altcoin has been able to establish some more positive momentum, currently sitting at a price point of AU$1,974.

In the midst of all this volatility, Grayscale, the world’s largest crypto assets manager, proceeded to add a cool 3,347 Ethereum — touted to be worth approximately US$5.2 million — to its crypto coffers, bringing its weekly Ether purchase haul to 19,355 ETH.

It also bears mentioning that since the start of the year, the asset manager seems to have doubled down on its decision to accumulate Ether at a rapid pace, with the company having accrued a whopping 243,519 ETH — estimated to be worth more than US$380 million — over the course of the last 30 odd days.

Lastly, even though BTC and ETH make up more than 90% of Grayscale’s total crypto haul, the firm is now diversifying its portfolio having recently purchased a number of other prominent cryptocurrencies like Chainlink, Polkadot, Cardano and EOS as well. As a result, the company’s digital assets under management (dAUM) now lay close to the US$37 billion region

No immediate resolution for gas fee issue in sight

As Finder has repeatedly pointed out time and time again, a number of prominent crypto projects have been exiting the Ether ecosystem in favor of other blockchains that are compatible with the Ethereum Virtual Machine (EVM) so as to minimize their transaction throughput and gas fee-related pains. On the subject, Gunnar Jaerv, chief operating officer of digital and traditional asset custodian, First Digital Trust, pointed out:

“It seems unlikely that the Ethereum ecosystem could reduce gas fees until Ethereum 2.0. However, many other projects out there are working on layer 2 solutions (Ethereum Scaling Solutions) such as Plasma, ZK Rollups, Optimistic Rollups, and more, to increase efficiency and lower gas fees.”

In his view, the solutions these future developments provide to the Ethereum ecosystem will help in the creation of the only truly decentralized smart contract platform that’s able to scale, as and when required, that too within acceptable fee limits. “At the end of the day, Ethereum is here to stay as it still has the largest community of developers and engineers who continue to build projects on it”, he added.

Antonio Vazquez, head of communications at Hermez Network, a decentralized zero-knowledge rollup (zk-rollup), highlighted that there are many upgrades coming to Ethereum that will make it more competitive in the short term, even though they may not be able to solve many of the major issues currently limiting the platform from scaling to a level that enables mass adoption.

In this regard, the Berlin update is due between April and May, and right now the Ethereum Improvement Proposal 1559 is being discussed, a proposal that will make the network burn transaction fees instead of giving them to miners. Vasquez opined:

“Looking ahead, there are a lot of aces up Ethereum’s sleeve to keep up with demand. Regarding DeFi going multi-chain, is just a natural development. Most innovations are born in Ethereum, then move to other chains, and DeFi is no different. In my view, the more competition in the space, the better it’ll get, and we’ll reach mainstream adoption sooner.”

High processing fees are becoming the norm but for how long?

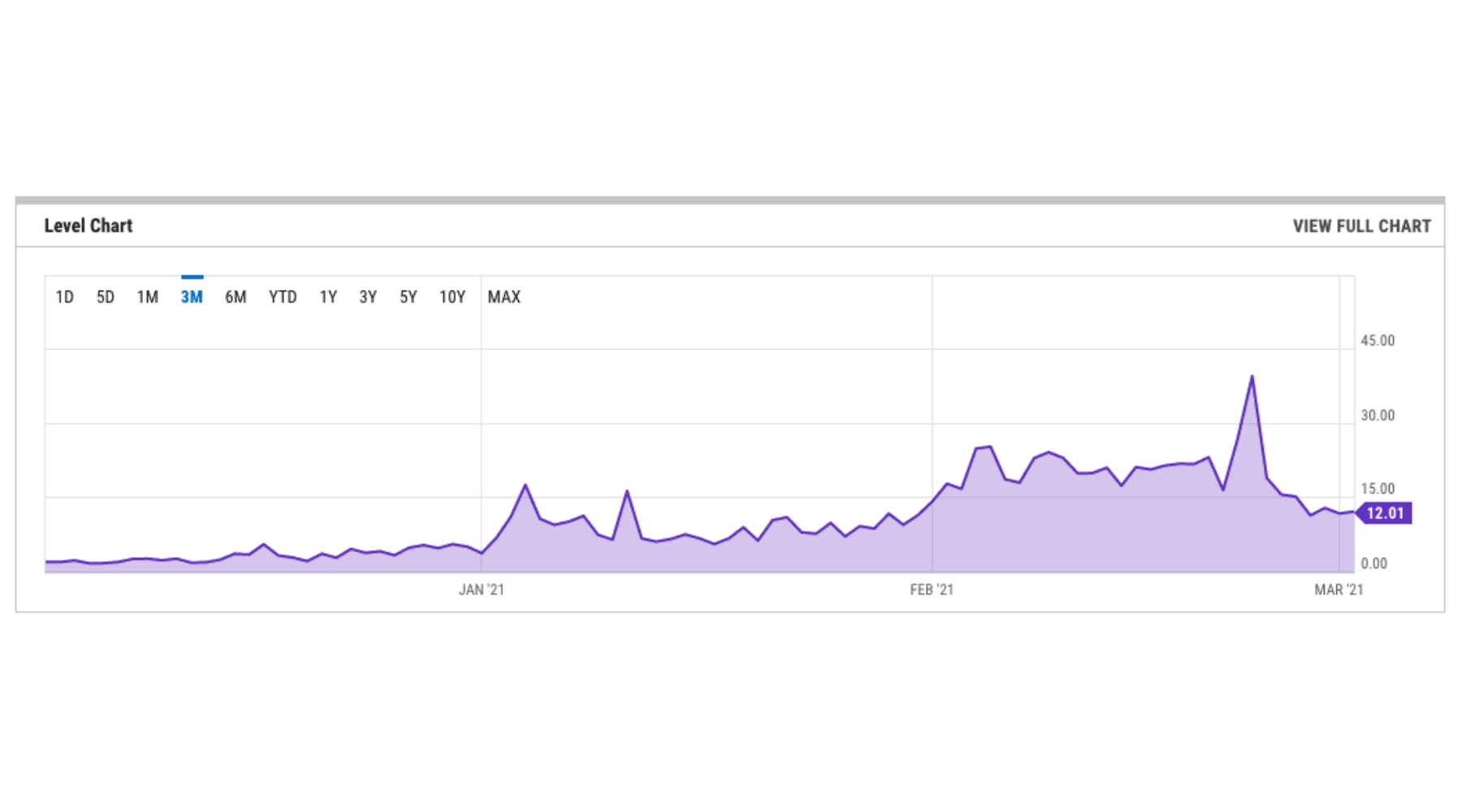

It is no secret that Ether’s transaction (tx) fee rates have been quite exorbitant for some time now, with the situation having become almost normal at this point. For example, over the course of the last couple of months, the average USD fee for facilitating a tx (within the ETH ecosystem) has stayed close to the $12 mark, with prices rising by as much as 3-4 times during periods of congestion.

Ethereum Average Gas Price Over the Last 90 Day Period (Source: YCharts)

It is also worth noting that while most gas fee surges last for an average of about 30-60 minutes, there have been certain periods where prices have gone as high as US$40, making it extremely difficult for the average investor to make use of the platform for any practical purpose.

Despite scalability hurdles, progress continues

In spite of the various technical roadblocks that are being faced by Ethereum at the moment, the platform continues to be utilized by a number of mainstream players. Most recently, tech-giant Amazon just announced the general availability of Ethereum on its managed blockchain.

As per a post released by Amazon Web Services, or AWS, users will now be afforded the ability to “provision Ethereum nodes” as well as connect seamlessly to the blockchain’s mainnet as well as the Ropsten and Rinkeby testnets — via the AMB (Amazon Managed Blockchain) ecosystem.

Last but not least, as part of the latest development, Amazon claims that users will be able to gain streamlined and secure access to the network through the use of “standard open-source Ethereum APIs.”

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, keep your crypto safe with a hardware wallet and dive deeper with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies including at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Picture: Finder