Data is a gold mine for a company.

If managed well, it provides the clarity and insights that lead to better decision-making at scale, in addition to an important tool to hold everyone accountable.

However, most companies are stuck in Data 1.0, which means they are leveraging data as a manual and reactive service. Some have started moving to Data 2.0, which employs simple automation to improve team productivity. The complexity of crypto data has opened up new opportunities in data, namely to move to the new frontier of Data 3.0, where you can scale value creation through systematic intelligence and automation. This is our journey to Data 3.0.

The complexity of crypto data has opened up new opportunities in data, namely to move to the new frontier of Data 3.0, where you can scale value creation through systematic intelligence and automation.

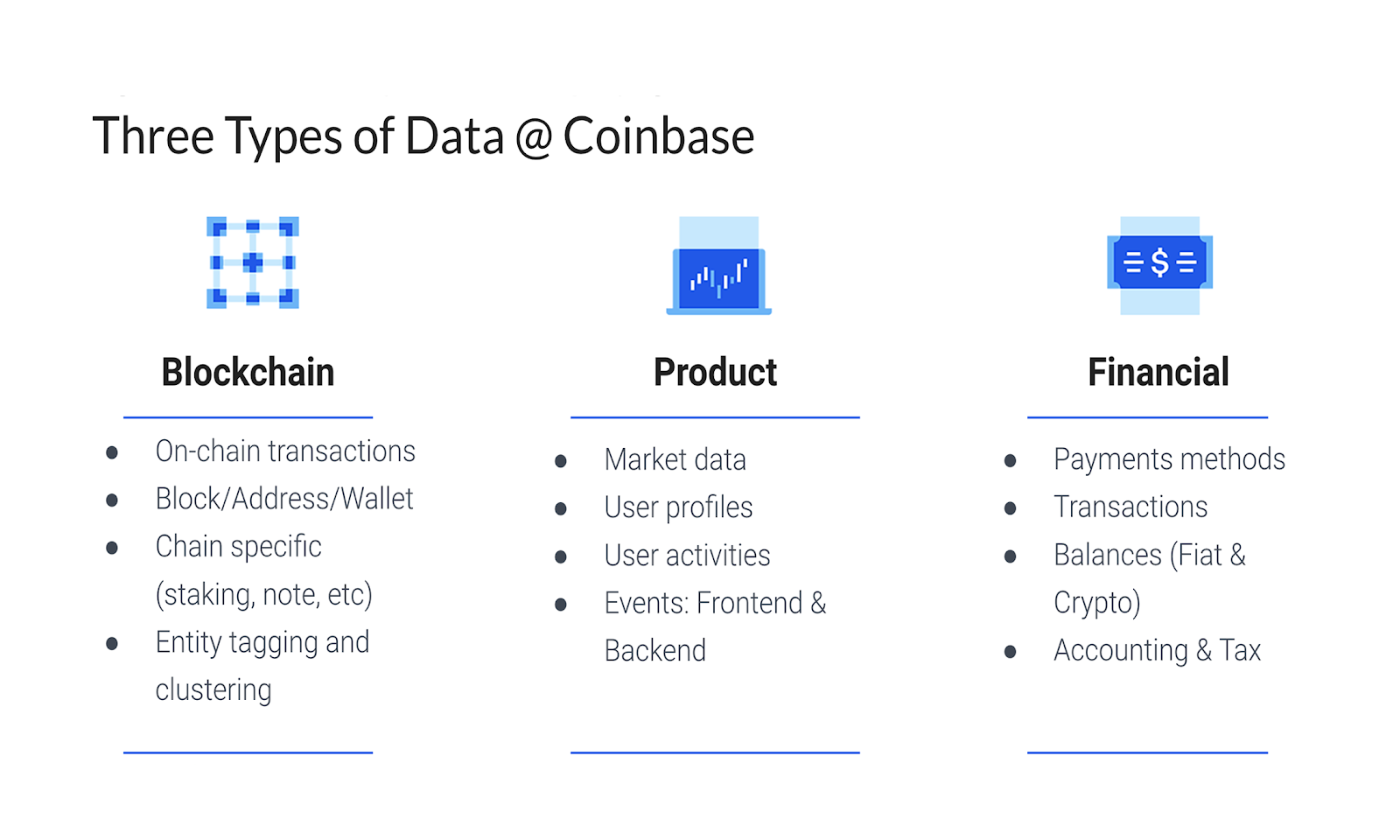

Coinbase is neither a finance company nor a tech company — it’s a crypto company. This distinction has big implications for how we work with data. As a crypto company, we work with three major types of data (instead of the usual one or two types of data), each of which is complex and varied:

- Blockchain: decentralized and publicly available.

- Product: large and real-time.

- Financial: high-precision and subject to many financial/legal/compliance regulations.

Image Credits: Michael Li/Coinbase

Our focus has been on how we can scale value creation by making this varied data work together, eliminating data silos, solving issues before they start and creating opportunities for Coinbase that wouldn’t exist otherwise.

Having worked at tech companies like LinkedIn and eBay, and also those in the finance sector, including Capital One, I’ve observed firsthand the evolution from Data 1.0 to Data 3.0. In Data 1.0, data is seen as a reactive function providing ad-hoc manual services or firefighting in urgent situations.