Bitcoin’s impressive price rise has made headline over the last several months. Here’s a look at three things investors might not know about the cryptocurrency.

Despite being one of the most in-demand assets of 2020, there is still a lot of mystery surrounding bitcoin and cryptocurrencies in general.

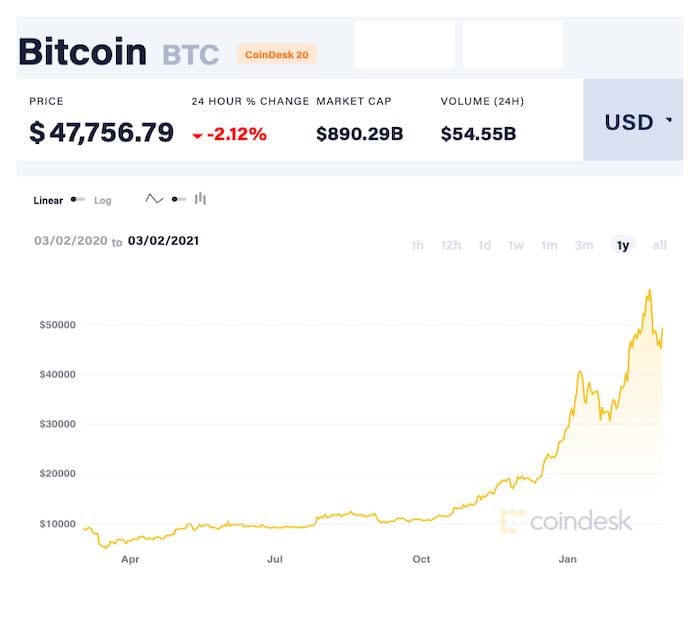

Rising from US$4,000 in March 2020 to more than US$57,000 in February 2021, bitcoin has soared 1,175 percent, topping out with a market cap of more than US$1 trillion.

The rapid rally prompted investment bank Citigroup (NYSE:C) to state that bitcoin has hit a watershed moment that may result in it becoming the currency of global trade.

“There are a host of risks and obstacles that stand in the way of bitcoin progress,” Reuters quotes the bank as saying in early March. “But weighing these potential hurdles against the opportunities leads to the conclusion that bitcoin is at a tipping point.”

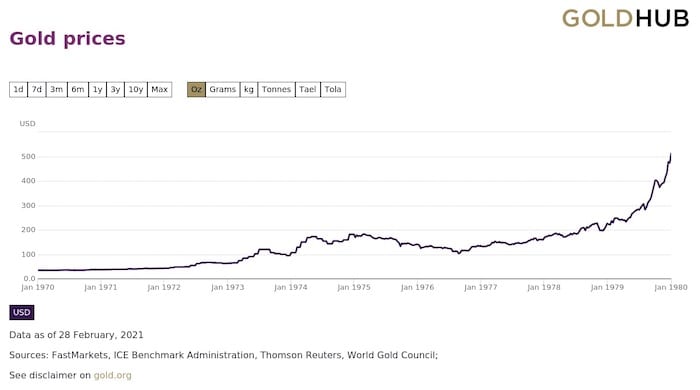

Last November, the American bank projected that bitcoin could reach US$300,000 by December 2021. It called the digital cash the “new gold,” comparing its performance to that of the yellow metal in the 1970s.

Gold price performance, 1970 to 1980. Chart via the World Gold Council.

Between January 1, 1970, and January 1, 1980, the value of gold rocketed 1,326 percent, rising from US$35.17 per ounce to US$512.

Bitcoin price performance, March 2020 to March 2021. Chart via CoinDesk.

Bitcoin price performance, March 2020 to March 2021. Chart via CoinDesk.

With bitcoin mimicking some of the trends that have benefited gold in its ascent to record territory (US$2,063 in August 2020), the Investing News Network took a look at some of the lesser-known things regarding this emerging asset class. Read on to learn more.

1. Bitcoin is not legal tender

One of the hindrances to bitcoin’s early growth was the ability to actually spend it anywhere. While the tech savvy sang the praises of the digital money, most were confused as to what they would do with it.

Now the list of companies that accept bitcoin as payment is beginning to grow, reaching the likes of Microsoft (NASDAQ:MSFT), Tesla (NASDAQ:TSLA), Visa (NYSE:V) and MasterCard (NYSE:MA).

Widespread adoption will be key in moving the value of bitcoin higher; however, it’s important for potential bitcoin adopters to be aware that the world’s first cryptocurrency is not considered legal tender. That means bitcoin is not an acceptable payment method for debt.

“Only the Canadian dollar is considered official currency in Canada,” notes the Canadian government on an information page about digital currencies. “Digital currencies are not supported by any government or central authority, such as the Bank of Canada.”

The complexity associated with bitcoin is a factor that may prevent the asset from ever becoming legal tender. What’s more, the very nature of bitcoin may also be an obstacle to its growth. Born out of the 2008 financial crisis, bitcoin is a response to perceived untrustworthiness in banking and financial systems. These very systems would need to be part of its mainstream adoption.

2. Bitcoin isn’t as private as it seems

In its early days, bitcoin was often associated with the black marketplace, the Silk Road. The crypto asset, believed to be untraceable, was an ideal way for criminals to move their wares.

As bitcoin’s image became cleaner, its untraceable transactions gave a sense of added security. However, these private transactions may not be as secure or untraceable as many believe.

For example, in late 2020, it was reported that US$1 billion worth of bitcoin linked to the Silk Road had been moved from a bitcoin wallet. It was traced using bitcoin’s cornerstone technology, blockchain.

In the 2008 white paper that introduced bitcoin to the world, creator Satoshi Nakamoto described an immutable, universal ledger that would track and record every bitcoin transaction. The ledger, powered through blockchain, would prevent double spending of bitcoin.

So how does tracing happen? Because bitcoin is not a tangible asset, it is stored digitally, often in bitcoin wallets, which can be housed independently on a private USB stick or at a bitcoin wallet firm.

The concept of a bitcoin wallet is that each user has two access keys. One is a public key that the owner can use to allow other bitcoin users to send or make deposits into their wallet. The other, a private key, is only known by the owner, allowing them to withdraw and move bitcoins from the wallet.

If a person has access to a bitcoin user’s public key, they are able to view every public transaction performed by the key owner, which is equivalent to having access to every receipt from every purchase the person has ever made.

The US$1 billion Silk Road bitcoin move was traced using the bitcoin address 1HQ3Go3ggs8pFnXuHVHRytPCq5fGG8Hbhx. According to Elliptic, a company focused on blockchain analytics and compliance for crypto assets, before the November 2020 transaction, that account held the fourth largest amount of bitcoins globally.

3. Bitcoin is not insured

Bitcoin, like cash or gold, is a bearer instrument, meaning whoever possesses it owns it. However, because bitcoin isn’t government tender or insurable like gold, there is little recourse if it is stolen.

It is estimated that US$1.15 billion in bitcoin has been stolen since 2014. Of that amount, very little has been recouped and none was insured. Most notable is a US$500 million theft from the Japanese exchange Coincheck in 2018.

There are rumblings that crypto insurance is on the way, but in the meantime many bitcoin owners using wallet firms or storage companies will be out of luck in the event of theft. If the system they use is hacked and their bitcoins are stolen, there will be little they can do unless the company has previously agreed to repay any stolen crypto — and also has the financial means to do so.

There’s also the problem of people who have lost their private keys and can’t access their own bitcoins.

“There’s estimates that up til now as much as 20 percent or more of all the bitcoins that are out there are either lost or inaccessible because people have forgotten passwords,” said John Wilson, co-CEO and managing partner of Ninepoint Partners.

Wilson’s firm recently launched the Ninepoint Bitcoin Trust (TSX:BITC.UN) thinking that investors confused by the bitcoin market would prefer a simpler, streamlined way to enter the space.

The world’s first two bitcoin ETFs also launched in 2021 with the same goal in mind.

Securing bitcoin wallets and transactions will become increasingly important as widespread adoption of the crypto asset continues. This will also be compounded by the fact that of the 21 million bitcoins in existence, 18.5 million have already been mined.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.