- Monero and Zcash have been trading inside massive uptrends since March 2020.

- Both cryptocurrencies have just defended crucial support levels and aim to resume uptrends.

- In the past week, privacy coins have been underperforming in comparison to others.

Monero price had a massive 50% spike at the beginning of 2021 but plummeted shortly after hitting a low of $121.8 on January 22. Zcash, on the other hand, had an even stronger pump of 122% and continues to trade 70% higher than at the start of January.

Monero price defends crucial support level and aims for $170

On the 3-day chart, Monero price has just defended the 50-SMA three days in a row, a support level that has served as a strong fundamental pillar since April 2020. The next resistance level that bulls need to crack is the 18-SMA at $149 to see higher highs.

XMR/USD 3-day chart

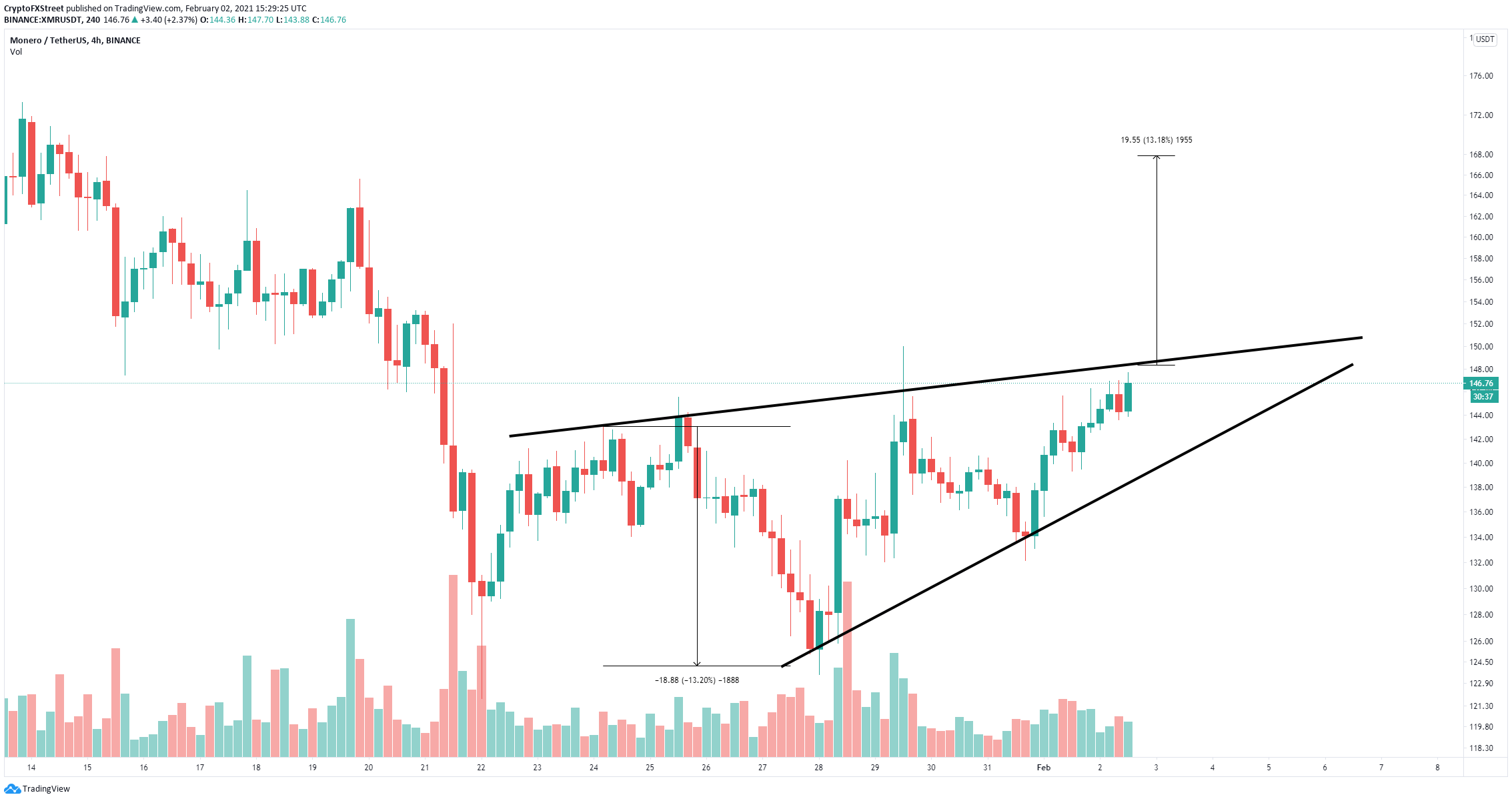

This resistance level coincides with the upper trendline of an ascending wedge pattern on the 4-hour chart. A breakout above this point has a price target of $170, using the height of the pattern as a reference.

XMR/USD 4-hour chart

However, a rejection from this resistance level can push Monero price down to the lower trendline at $140 in the short-term.

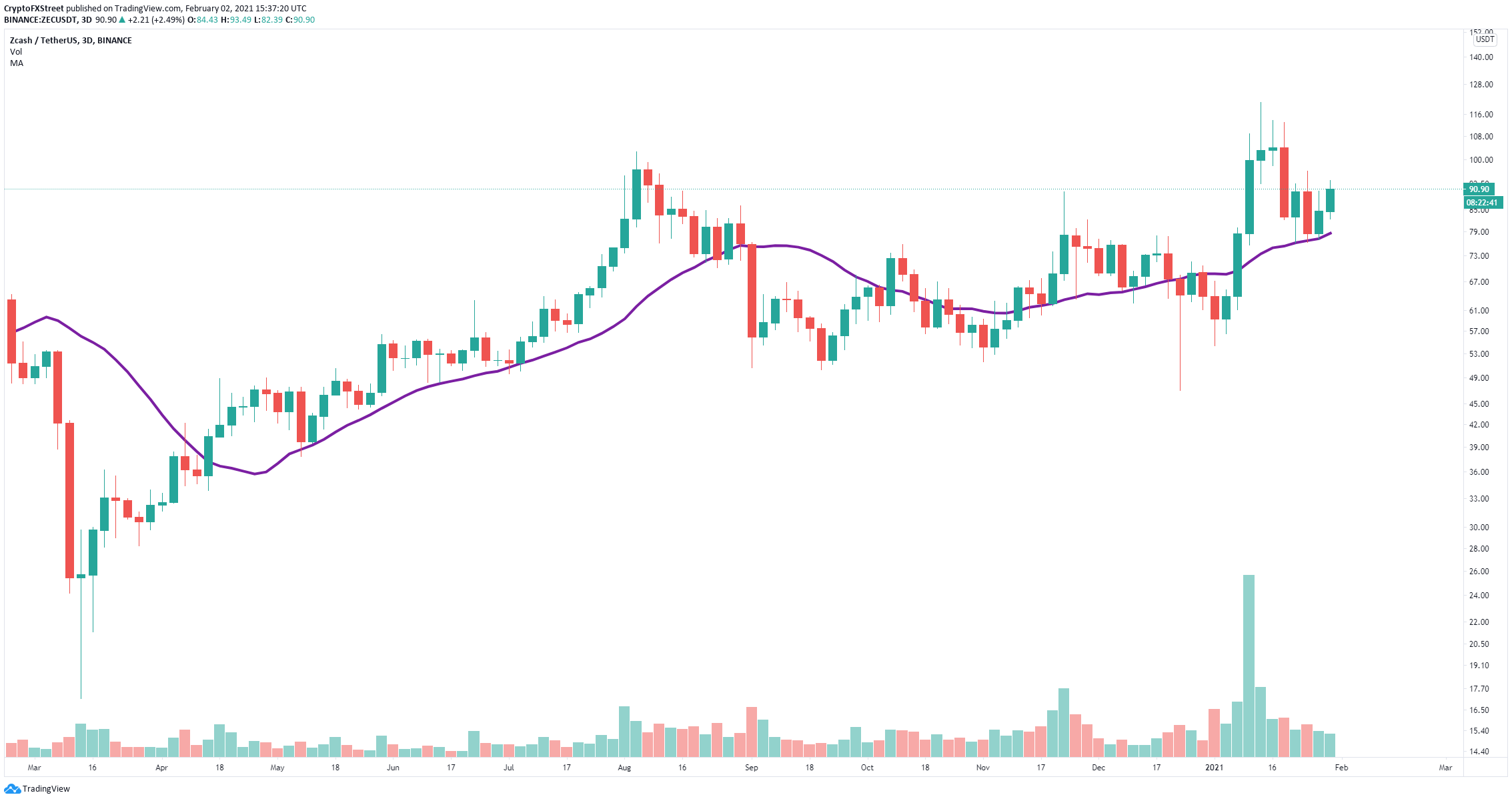

Zcash price rebounds from crucial support level towards $120

Zcash price already climbed above the 18-SMA on the 3-day chart and rebounded from this level, climbing 21% in the past week from a low of $77 to a high of $93.4.

ZEC/USD 3-day chart

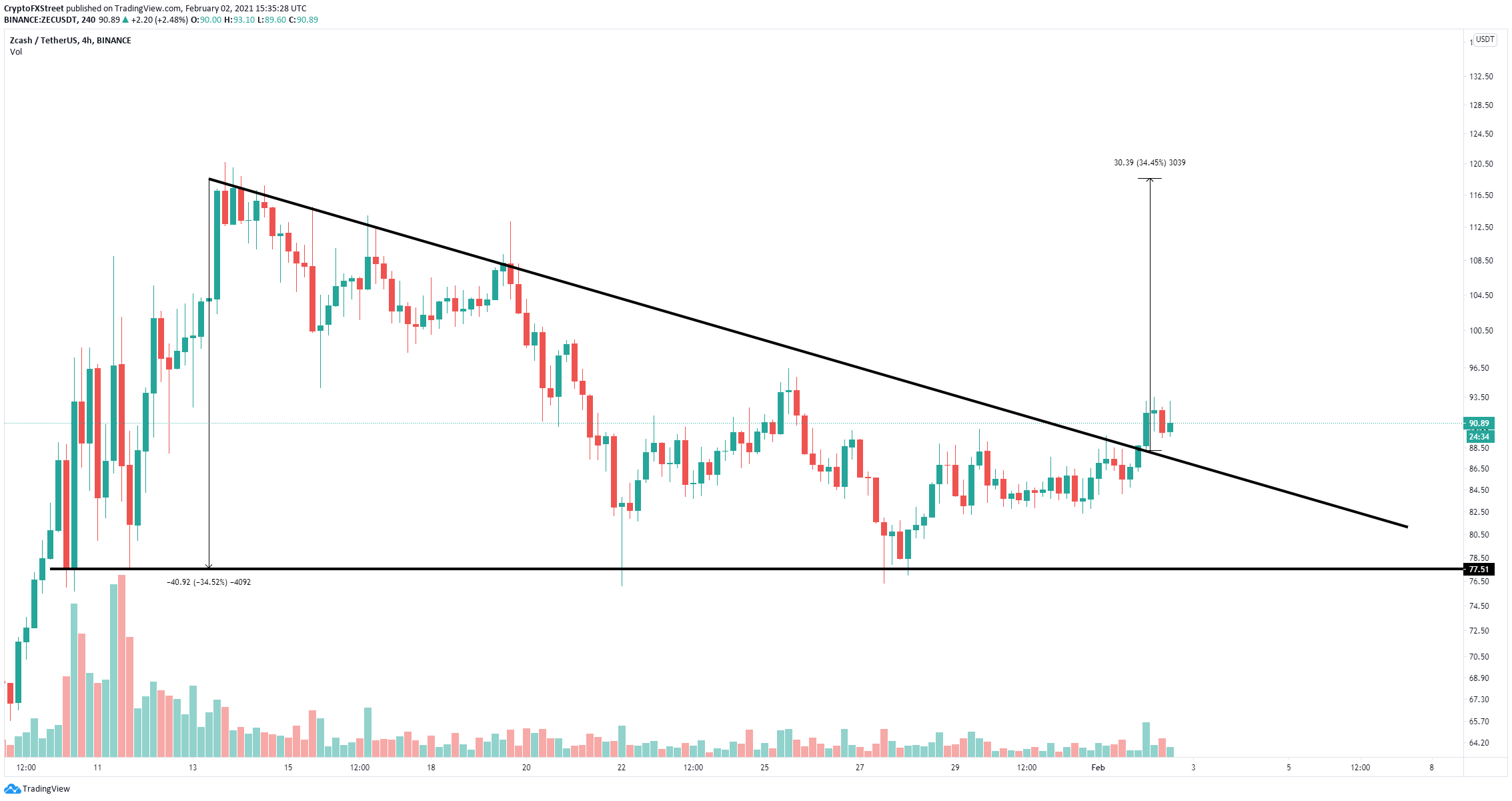

Zcash price had a significant breakout from a descending triangle pattern on the 4-hour chart, with a 34% price target towards $120. However, it’s important to note that after such a breakout, assets tend to drop to the previous resistance trendline to re-test it.

ZEC/USD 4-hour chart

The previous descending triangle resistance trendline is located at $86, which means that Zcash price could fall towards this level first before another leg up above $93.