Litecoin price – Litecoin price – Crypto Sell-Off Risk Rose With Bitcoin price; 2 Alt-Coins To Buy On The Dip | Fintech Zoom

Litecoin price – Crypto Sell-Off Risk Rose With Bitcoin price; 2 Alt-Coins To Buy On The Dip

This article was written exclusively for Fintech Zoom

- Yellen and Lagarde’s statements were warning signs

- Bitcoin‘s over-30% correction

- Top ten-listed Litecoin could have plenty of upside potential

- TRON is highly speculative but might pay off big time

- Number 1 rule for investing in the cryptos

Gravity may have been pressuring since the price of the digital currency rose to a high of $42,730 per token on Jan. 8, but the price still remains far above the late 2017 high of $20,650. As with most markets, the risk of a correction increased with the price of the digital currency.

Currency markets tend to exhibit low price volatility. Governments manage traditional foreign exchange instruments to provide stability, which instills confidence. Cryptocurrencies, however, are far from conventional as they are a direct challenge to government control. In many ways, the digital currency asset class rejects individual governments and a move towards the globalization of money. With fixed supplies and prices established by supply and demand, the digital currencies move higher and lower without any government influence or control. Government events and policies impact the price levels, but control is only in the hands of buyers and sellers of the over 8,300 tokens currently in cyber-circulation.

Bitcoin is the leader of the asset class. It is the only token that trades on a futures exchange. However, , the second-leading crypto by market cap, will have its futures listed on the CME in February. We are likely to see continued volatility in the asset class. Two digital currencies, and , could receive growing interest over the coming weeks and months as the asset classes’ profile continues to rise.

Yellen and Lagarde’s statements were warning signs

Central banks and governments worldwide have cautioned against the cryptocurrency asset class. Just after the Bitcoin price rose to an all-time peak of $42,370 per token and the overall crypto market cap eclipsed the $1 trillion level for the first time, the President of the European Central bank sounded some warnings on potential legal issues involving digital assets. Christine Lagarde told reporters:

“It’s a highly speculative asset, which has conducted some funny business and some interesting and totally reprehensible money laundering activity. It’s a matter that needs to be agreed at a global level, because of there is an escape, that escape will be used. So, I think…that global cooperation, multilateral action is absolutely needed, whether it’s initiated by the G7, moved into the G20 and then enlarged. But it’s something that needs to be addressed.

During her Senate confirmation hearing last month, the new US Treasury Secretary, Janet Yellen, clarified her own stance on cryptocurrencies:

“Cryptocurrencies are a particular concern. I think many are used…mainly for illicit financing and I think we really need to examine ways in which we can curtail their use and make sure that anti-money laundering (sic) doesn’t occur through those channels.”

The President of the ECB and the US Treasury Secretary sent a chill through the crypto asset class with their comments. They did not mention their primary concern, which is also the fear of other governments worldwide, that digital currencies threaten the control of the money supply. Both seemed to indicate that lots of regulations are on the horizon.

However, the underlying philosophy of Bitcoin and the over 8,350 other cryptos is that they are meant to be a libertarian challenge to the central bank and government power over money. As liquidity and stimulus have reached historic levels, fiat currencies have lost value.

Bitcoin‘s over-30% correction

In the aftermath of the US and European comments, Bitcoin’s price fell below $30,000 briefly but recovered and was sitting at over $38,000 on Feb. 4.

Source: CQG

The chart shows the over 30% plunge in Bitcoin from the Jan. 8 high to the low on Jan. 22 at $29,330. The market cap fell below the $1 trillion level before moving back over $1.1 trillion this week. We should expect more volatility in the digital currencies as government officials move towards regulating the market.

Meanwhile, it will not be long before governments begin issuing legal tender in the form of cryptocurrencies. However, the fixed number of tokens circulating poses a challenge for managing the economy with standard monetary and fiscal policy tools.

As more people worldwide begin accepting the Bitcoin revolution, other digital currencies are likely to flourish, creating markets for swapping and arbitrage, just as in the traditional foreign exchange arena.

Top ten-listed Litecoin could have plenty of upside potential

Litecoin (LTC) is a peer-to-peer cryptocurrency and open-source software project released under the MIT/X11 license. The MIT license is a permissive free software license originating at the Massachusetts Institute of Technology in the late 1980s. X11 is the current version of the X Window System, the de facto standard graphical engine for Linux and other Unix-like operating systems.

Litecoin was an early Bitcoin spinoff or altcoin, starting in October 2011. Technically, Litecoin is nearly identical to Bitcoin.

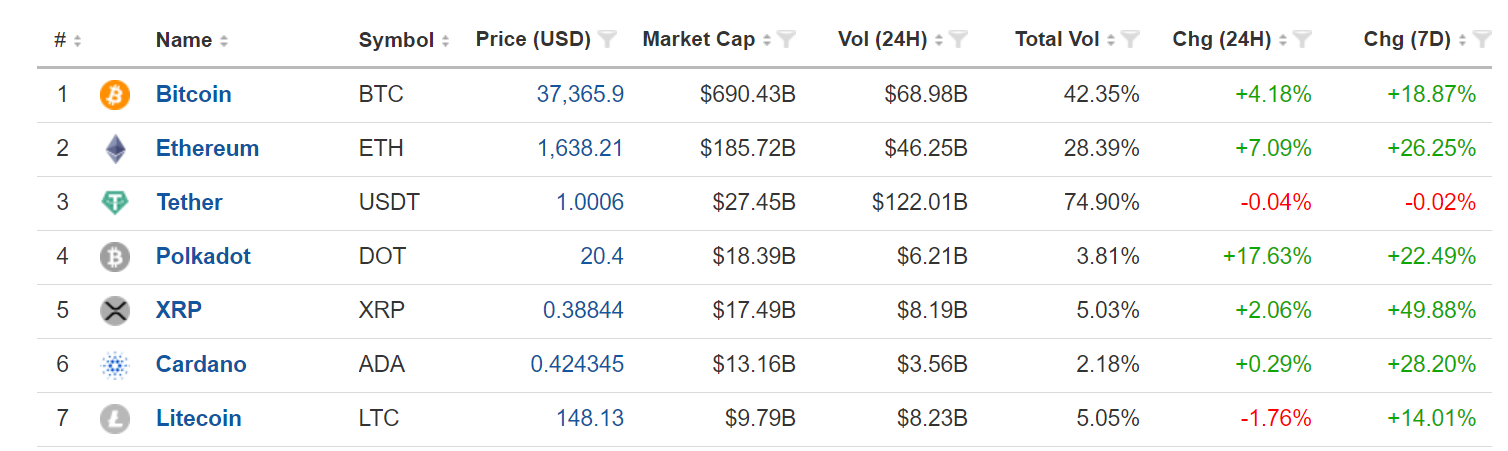

Litecoin or LTC is the seventh leading digital currency out of over 8,380 different tokens in circulation.

Source: Fintech Zoom

As of Feb. 4, LTC had a market cap of $9.79 billion at time of writing, approximately 0.89% of the entire asset class. At $148.13 per token at time of writing, LTC did not follow Bitcoin to make a new high above its late 2017 peak.

Source: Coinmarketcap

The chart shows that LTC traded from a low of below $2 to a high of over $355 per token; the high came in December 2017.

In some ways, LTC has more utility than Bitcoin because transactions are verified four times faster. As the seventh leading cryptocurrency, those who believe that the asset classes’ market cap will rise likely think that Litecoin is inexpensive at under $155 compared to Bitcoin at the $37,000 level.

TRON is highly speculative but might pay off big time

TRON is a Blockchain-based decentralized operating system based on a cryptocurrency native to the system. The token’s symbol is TRX. TRX aims to build a free, global digital content entertainment system with distributed storage technology that allows easy and cost-effective digital content sharing.

TRX was initially created as a token based on Ethereum, but it migrated to its own network in 2018. Tron Coin or TRX is a next-generation social media outlet where users can create and share content with anyone worldwide. TRX is the currency that pays for the content.

TRX is the twenty-first leading digital currency with a market cap of around $2.434 billion that holds about 0.20% of the asset classes’ market cap. TRX was trading at the $0.03382 level on Feb. 4.

Source: Coinmarketcap

Since 2018, TRX has traded from a low of $0.001791 to a high of between $0.20 and $0.21. The high came in early 2018, just after Bitcoin reached its first milestone at the over-$20,000 level.

TRX is an exciting investment candidate because it allows content producers to host content on their platform without any middlemen, such as Netflix (NASDAQ:), taking any cut or commission. TRON is a peer-to-peer technology where creators have complete ownership without any second party intermediaries.

TRON announced a partnership with Samsung (OTC:) in late 2019. TRX could attract lots of interest given its low price level. Remember, Bitcoin was at only 6 cents per token in 2010. A $100 investment then would be worth over $55 million today.

Number 1 rule for investing in the cryptos

The golden rule for investing in cryptos is to buy during periods of weakness and never invest more than you are willing to lose.

Governments and regulators will use all their powers to retain control of the global money supply. With over 8,380 tokens in circulation, and rising, many alt-currencies will go bust, and investors will lose everything they pay for their tokens. A diversified approach to investing in a portfolio of cryptos is the most conservative method for this highly volatile and risky asset class.

The tokens with the most substantial market caps are likely to do the best and attract the most volume and investor interest. When storing cryptos in a wallet, don’t lose the key because all of your tokens can disappear into cyberspace if you forget the password.

The digital currency revolution has arrived, but the asset class remains small as its’ market cap is less than half the size of Apple’s. Investing a small percentage of your portfolio in digital currencies could pay off in the coming years.

However, the risk of a total loss remains high as governments are likely to put up more than a few roadblocks over the coming months and years.

Litecoin price – Crypto Sell-Off Risk Rose With Bitcoin price; 2 Alt-Coins To Buy On The Dip

Litecoin price – Litecoin price – Crypto Sell-Off Risk Rose With Bitcoin price; 2 Alt-Coins To Buy On The Dip | Fintech Zoom