Assets at cryptocurrency investing firm Grayscale have shot up to almost $38bn — for crypto enthusiasts, a sign of accelerating institutional interest in what has long been a speculative bet. But analysts say the build-up has been fuelled in part by a lucrative hedge fund trade that exploits a quirk in its flagship product.

US-based Grayscale’s trusts have become favoured tools for institutional investors betting on red-hot cryptocurrency markets without the costs, complexities and risks of holding digital tokens outright. Last year, the company attracted $5.7bn in new client funds.

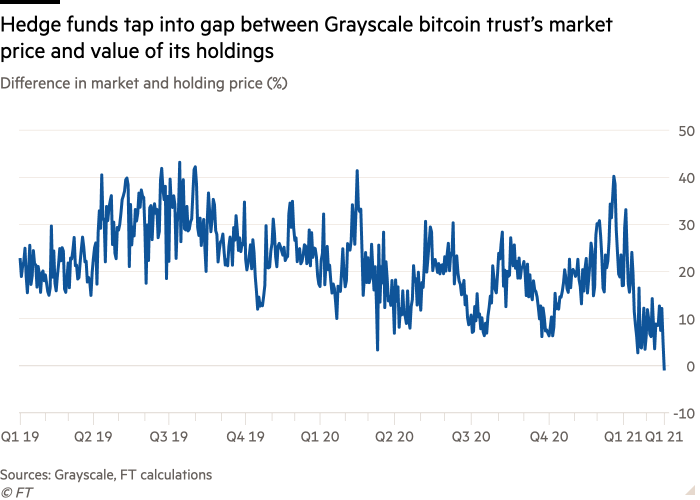

Those strong inflows created a gap between the value of bitcoin that Grayscale holds and that of its main investment vehicle, according to analysts and data reviewed by the Financial Times. Analysts say hedge funds use this difference to their advantage through a trade accessible only to large or affluent investors.

Grayscale operates investment vehicles that resemble exchange traded funds. They provide exposure to cryptocurrencies but can be traded throughout the day on a public market and are priced in dollars. Assets in Grayscale’s main bitcoin trust surged to around $36bn last week before pulling back this week to about $32bn on the back of a sharp decline in the price of bitcoin. The group’s overall assets under management registered $37.9bn on Tuesday.

Individual investors buy into Grayscale’s trusts much as they would an exchange-traded fund, in relatively small amounts at market prices.

However, “accredited investors” who pass income or asset tests can access the trust through private placements, buying large blocks of shares at a price equivalent to the amount of the cryptocurrency in their slice of a trust, as long they agree to a lock-up period that typically spans several months, according to a prospectus seen by the FT.

The funds can pay for the shares in bitcoin, which Grayscale increasingly needs because the digital tokens are becoming more scarce on the public market. However, the shares cannot be redeemed for bitcoin or hard currency — meaning the only way for any investors to exit the trade is by selling the shares to other investors.

“Grayscale is Hotel California at the moment,” said David Fauchier, a fund manager at London-based Nickel Digital. “Bitcoin can flow into Grayscale but not out. You sell the shares after six months, buy or borrow bitcoin and do it again.”

Hedge funds have been able to reap significant returns by holding their shares until the lock-up period ends, and then flipping them at the going market price. They have also been able to leverage these bets significantly and replicate them in another cryptocurrency, ethereum, where Fauchier said the trade yielded as much as 700 per cent of returns.

The Grayscale bitcoin trust always traded at a premium to the value of its assets in 2020 and had continued to do so until this Tuesday, according to FT calculations based on Grayscale data. The spread between the market and holding price was about 18 per cent on average last year, hitting peaks of 40 per cent on some days. It broke down entirely on Tuesday as the bitcoin price tumbled.

“If you buy it at a 20 per cent premium then sell it at 5 per cent, it’s not such a great trade,” said Dan Morehead, chief executive officer and co-chief investment officer of Pantera Capital, one of the first dedicated crypto investment companies in the US.

Inflows into Grayscale have become a measure of institutional investment in the digital currencies market, with analysts tracking appetite for the shares as a proxy for bitcoin’s growth in traditional portfolios. But the trade has raised the possibility that at least part of the popularity is due to the arbitrage trade rather than longer-term bets on the performance of bitcoin.

Michael Sonnenshein, Grayscale’s chief executive, said the trust did not break out the proportion of hedge fund trades from its overall inflows, but he said handing over bitcoin for a slice of the shares had historically been “a popular option for our clients who already own digital currencies.”

“There is a ton of money that has gone into these trusts but as the unlocking period approaches the premium could come under pressure,” said Fauchier.

Additional reporting by Chelsea Bruce-Lockhart and Federica Cocco