Grayscale Investments has surpassed the milestone of $30 billion in net crypto assets under management (AUM). The company says the tremendous growth is due to institutional investors, particularly hedge funds.

- Grayscale revealed Friday that its net total crypto assets under management now stands at $30.4 billion. In the lead is Grayscale Bitcoin Trust, which currently has over $24 billion in AUM, followed by the Ethereum trust with more than $5 billion in AUM.

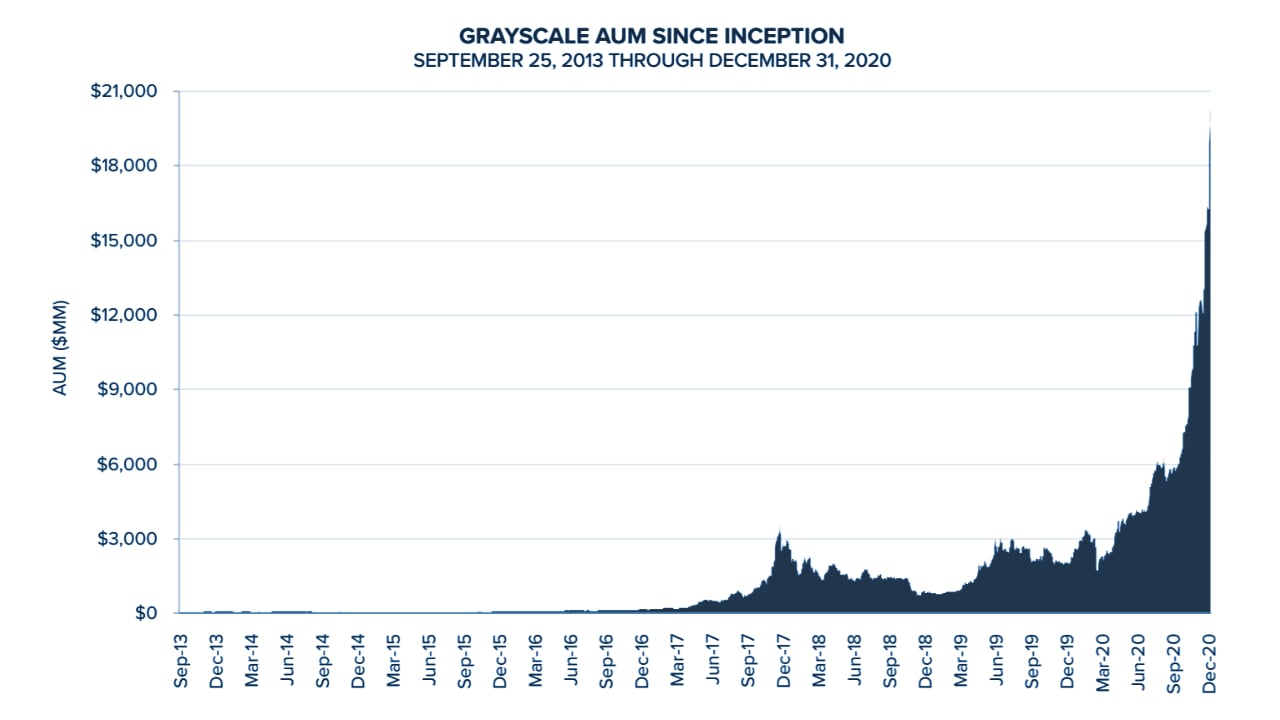

- Last year, Grayscale started off with just $2 billion in assets under management and ended the year with more than $20 billion, representing a 900% increase.

- Grayscale attributed the massive growth to investments from institutional investors, particularly hedge funds. CEO Michael Sonnenshein says: “There’s no longer professional risk of investing in the digital currency asset class — there’s probably more career risk in not paying attention to it.”

- In its Q4 2020 report, the company wrote that “Institutions are here,” adding that in the fourth quarter institutions accounted for 93% of all the capital inflows during the period, or approximately $3 billion. “The average commitment among institutions is also growing at a significant pace,” Grayscale detailed, noting that “The average commitment from institutions was $6.8 million, up from an average of $2.9 million in 3Q20.”

- Grayscale now offers nine different cryptocurrency investment products after discontinuing its XRP trust. The remaining products are Grayscale’s Bitcoin Trust, Bitcoin Cash Trust, Ethereum Trust, Ethereum Classic Trust, Horizen Trust, Litecoin Trust, Stellar Lumens Trust, Zcash Trust, and the digital large-cap fund.

- Out of all the crypto products offered, only three are not publicly traded on OTC markets: the Horizen Trust, Stellar Lumens Trust, and Zcash Trust. Shares of the remaining trusts and the large-cap fund are now unrestricted and sold via any brokerage account.

What do you think about Grayscale’s growth? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.