On Thursday, February 25th, the ETH is correcting, trading at 1,618 USD.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

- Tech analysis of ETH/USD.

- Bordier & Cie ScmA started trading crypto.

- Ethreum dropped significantly upon renewing the high.

On W1, ETH/USD keeps correcting in an uptrend. The aim of the decline might be the next Fibonacci level – 38.2%. The MACD histogram is above zero, which means that growth should resume soon. The signal lines of the indicator have crossed the zero line and keep growing, additionally supporting the trend. The Stochastic is in the overbought area on the verge of forming a Black Cross, which will signal further correction before resuming growth. Judging by all the factors, the quotations will first correct, then go on developing the uptrend, aiming at 2,030 USD.

Photo: RoboForex / TradingView

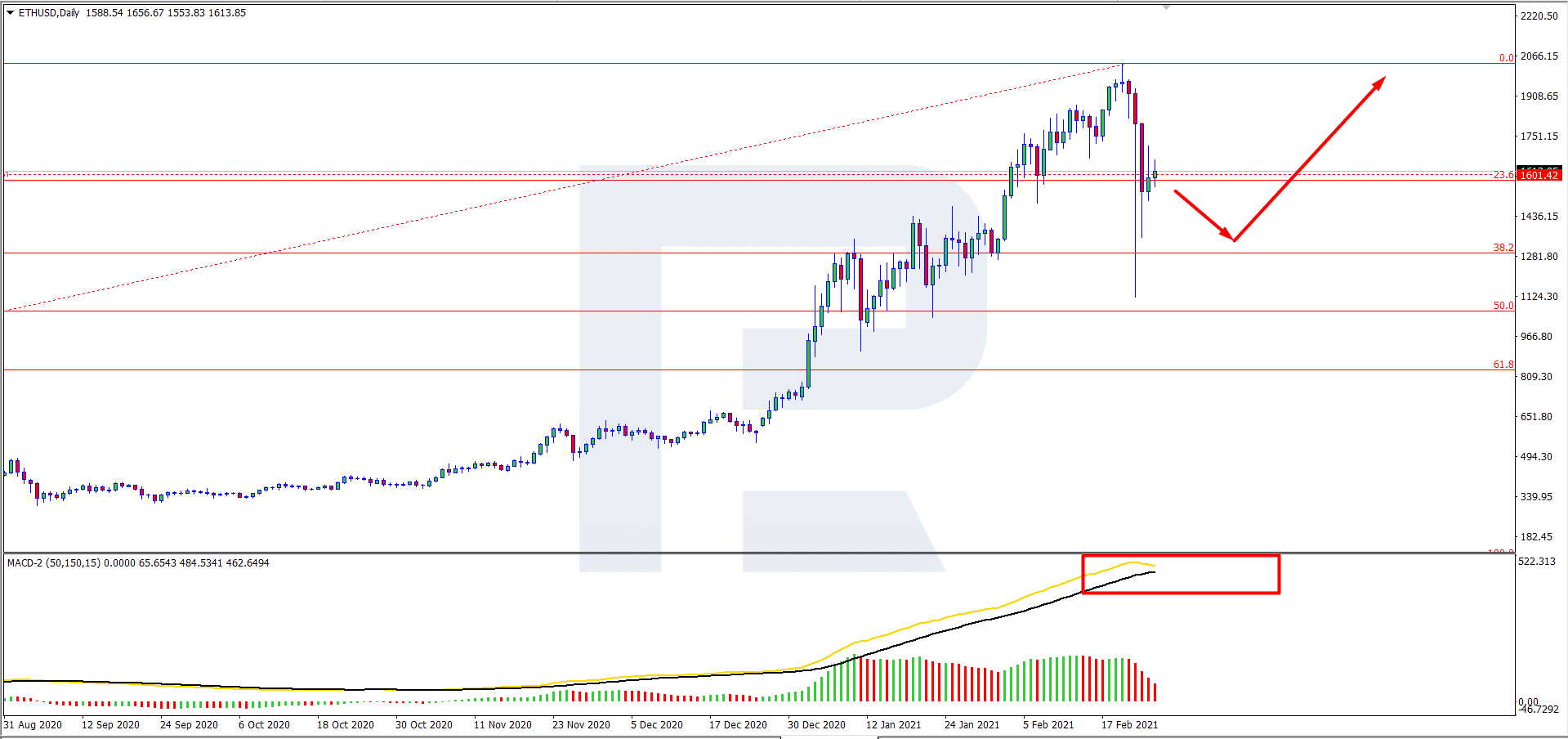

On D1, the situation is similar to that on W1: the pair keeps correcting after growth. The aim of the pullback here is the support level of 38.2% Fibo. The MACD histogram keeps declining, enhancing the signal for a correction. The signal lines can soon form a Black Cross, again, giving another reason for the pair to correct. The aim of the growth after the pullback is over will be 2,030 USD.

Photo: RoboForex / TradingView

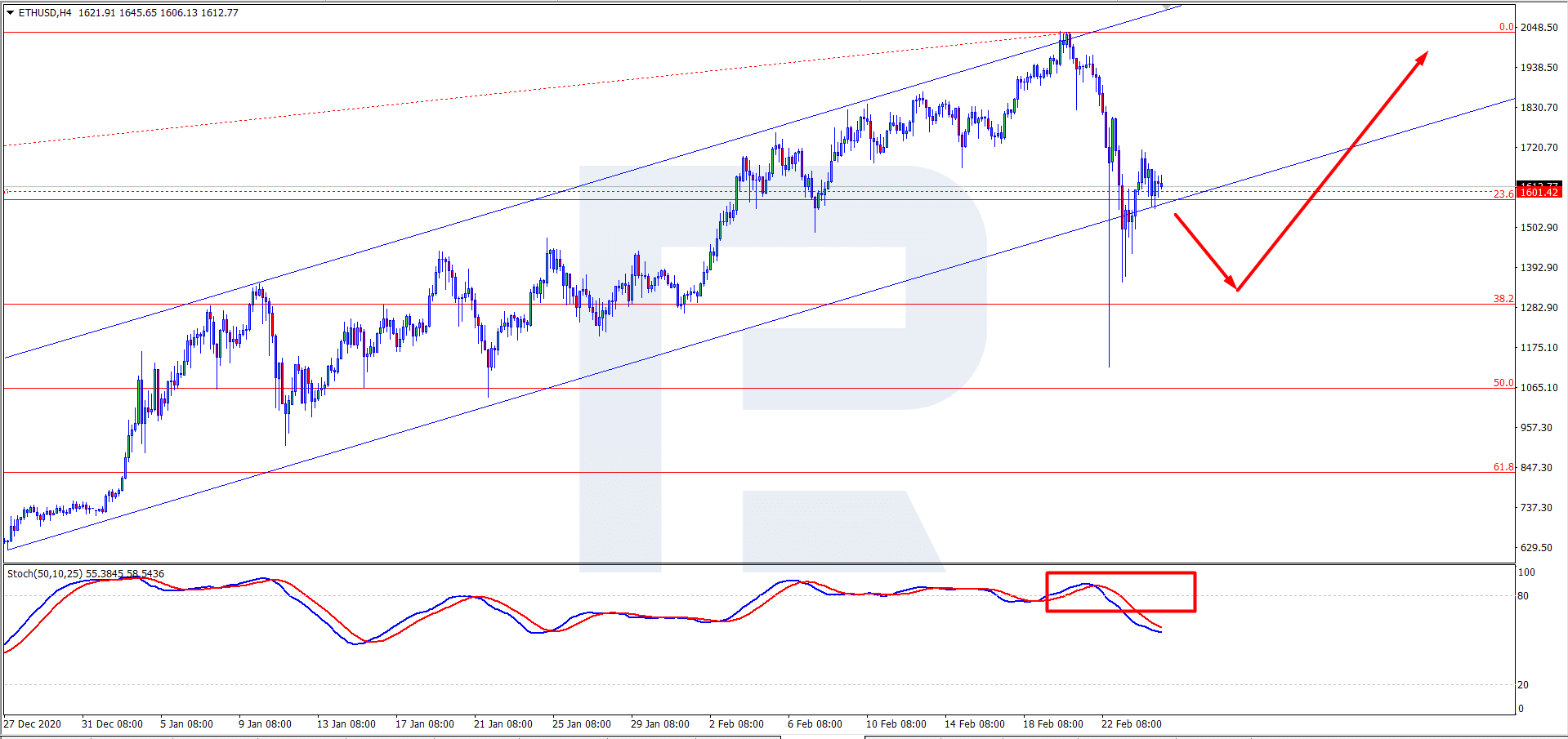

On H4, the picture is similar to that on D1: the quotations have broken the borders of the ascending channel. After another pullback is over, the pair can easily resume the uptrend. The Stochastic keeps declining upon forming a Black Cross, giving another signal for a correction. The aim of further growth is the same as on the larger timeframe: 2,030 USD.

Photo: RoboForex / TradingView

Famous Swiss bank Bordier & Cie SCmA now gives its clients an opportunity to trade crypto, including Bitcoin Cash, BTC, ETH, and Tezos. The bank used the opportunities of the Sygnum B2B system to form the necessary infrastructure. Apart from trading, you can also store the ETH.

Upon renewing the all-time high at 2,000 USD, the ETH started correcting. Then, on February 20th, the capitalization of the ETH reached 233 billion USD for the first time in history. The sky-rocketing in Ethereum was triggered by the rally in the BTC: the price of the crypto flagship renewed the high at 56,600 USD.

During the rally, Binance put on a halt withdrawal of the ETH and tokens: it reported system overload and explained that the safety of the clients’ assets was its priority. This sometimes happens to large exchanges when the number of requests for fund withdrawal avalanches – companies make a pause for processing the requests correctly.

For this article, we’ve used ETHUSD charts by TradingView.

Disclaimer: Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Dmitriy Gurkovskiy is a senior analyst at RoboForex, an award-winning European online foreign exchange forex broker.