Following Tesla’s entry into digital assets, ETH proceeded to touch a new all-time high of $1,820.

- Ether futures contracts are now live on the Chicago Mercantile Exchange (CME).

- Since the start of the year, Ether’s value has increased by over 100%, eclipsing even the gains made by Bitcoin.

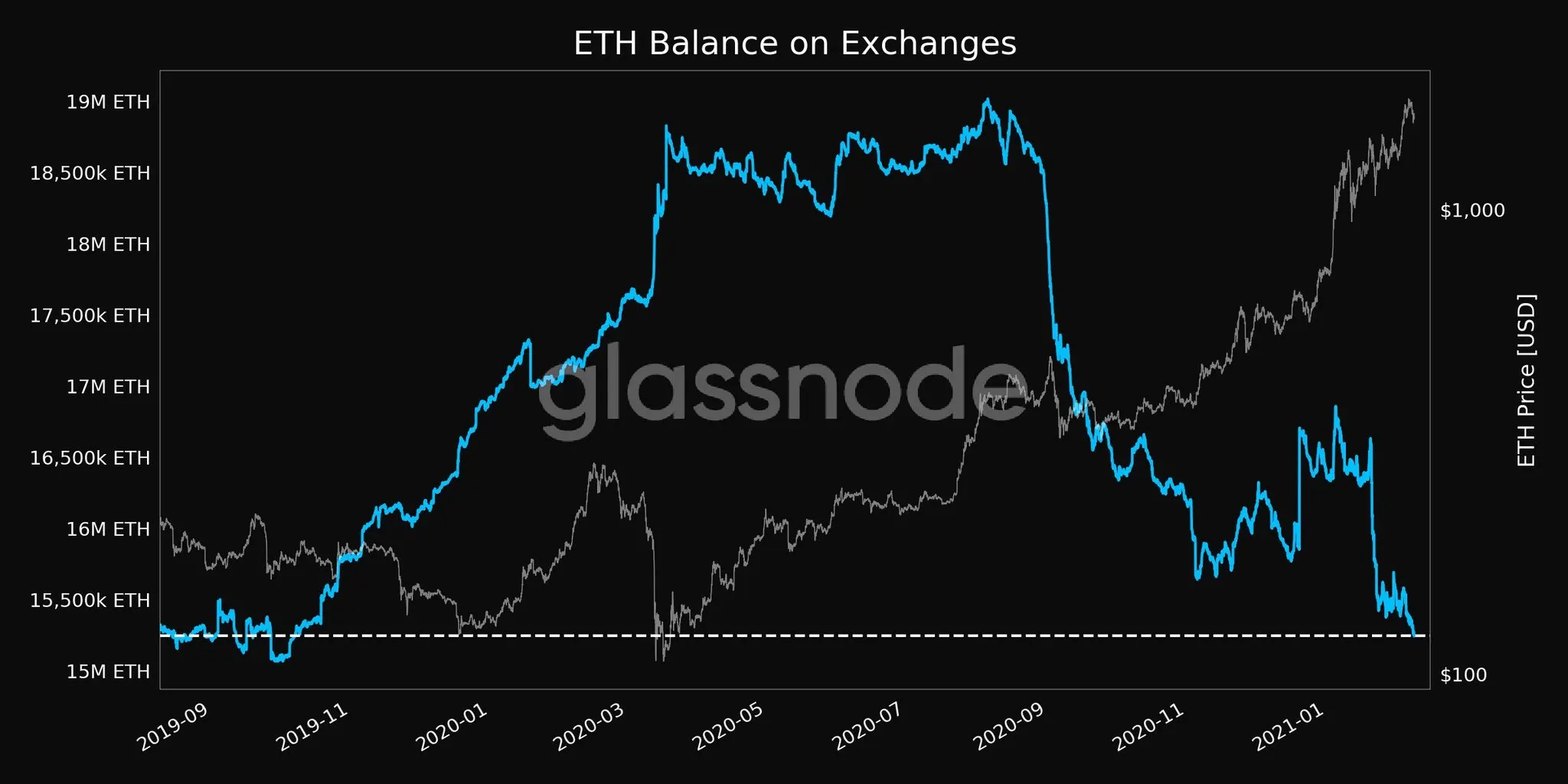

- ETH balances across all cryptocurrency exchanges plummeted to new all-time lows on Feb 8.

Ethereum has been on a roll since the start of the year, with the second-largest cryptocurrency by total market capitalisation currently sitting at $1,800 for more than 12 hours running. As a result, the digital asset is now exhibiting a 7-day profit of 18% as well as monthly gains of over 40%.

This most recent surge seems to have come in the wake of Elon Musk announcing Tesla’s $1.5 billion Bitcoin investment as well as the launch of CME Ether futures.

Similarly, experts believe that another push could have possibly come as a result of the recent Robinhood-GameStop debacle, which in the minds of many investors across the globe has clearly highlighted the need for more democratised financial offerings.

Providing his insights on the subject, Jay Hao, CEO of cryptocurrency exchange OKEx, told Finder that while Tesla’s big announcement has quite clearly had an impact on Ether’s value, the situation could change quite quickly, adding:

“Several prominent analysts including JPMorgan noted that futures could have a bearish impact on ETH price as investors could hedge their exposure on the ETH that they physically held. Moreover, the 2017 rally on BTC and its subsequent price fall at the same time that futures were introduced does not seem to be a coincidence.”

That being said, he does not believe that CME futures will be bearish for ETH overall, as in the long run, they can help institutional players obtain better exposure to the Ethereum ecosystem, thereby having a positive effect on the currency as well as on its development in general. “Short term, we may always expect to see some volatility but the general upward trend appears to be clear,” he added.

A similar opinion is shared by Pankaj Balani, CEO of cryptocurrency exchange Delta, who believes that the CME’s decision to list ETH futures should definitely increase market participation in Ether in the near-to-mid term. That being said, he pointed out to Finder that at this point in time, the market seems to be lacking any clear direction and that the Chinese New Year has not made matters any better since this period has historically been marred by a lot of bearish activity. Balani further added:

“ETH futures provide a good opportunity for those who own Ether spots to hedge their positions, as a result, we might see some shorting activity come through.”

ETH balances on CeFi exchanges continue to plummet

With the rise of DeFi, an increasing number of crypto owners are now beginning to truly grasp the concept of “not your keys, not your coins”. This is probably best highlighted by the fact that with each passing day, the number of people moving their Ether out from various cryptocurrency exchanges seems to be increasing at a rapid pace.

In this regard, data released by blockchain analytics firm Glassnode seems to suggest that since the start of 2021, offloading of Ether from various centralised platforms to cold storage solutions and other DeFi ecosystems has happened rather quickly, with the total number of coins being held in exchange addresses falling to a 16-month low of 15,243,945 on Feb 8.

Ether reserves across all centralised exchanges (source: Glassnode)

As is clear from the chart presented above, since August 2020 more and more users have been taking direct custody of their coins, with the numbers showcasing an ETH reserve decline of a whopping 8% over the last month alone.

Gas fee-related issues continue to mount

Even though the Ethereum ecosystem seems to be thriving at the moment, the platform’s native gas fee rates have been surging quite heavily in recent weeks. Users have to either choose to simply pay premium transaction rates till ETH 2.0 devs sort out the issue or switch to other blockchains that are compatible with the Ethereum Virtual Machine (EVM). On the subject, Jan Strandberg, co-founder of DeFi platform Yield.app, highlighted to Finder:

“For the time being, it’s quite reasonable to expect ETH gas prices to remain high since they rise in relation to Ether’s USD value. It’s possible we could see a bit of Ether’s diaspora move to other networks and check out new developments taking place there. This would actually help ease the pressure on Ethereum’s network, which currently hosts a vast majority of DeFi’s total value locked (TVL).”

That being said, he does believe that the gas issue is not an insurmountable one, especially with various Layer 2 solutions fast gaining traction as well as the Ethereum Improvement Proposal-1559 – which seeks to radically reform Ethereum’s fee market – looming large on the horizon.

On the topic of Layer-2 solutions being used to help ease out Ethereum’s network congestion problems, Hao believes that EVM compatible solutions may be a smart choice for many users since they allow for smart contracts (deployed on the Ethereum network) to be used on other blockchains that command substantially lower transaction fees as well as allow for far higher TPS ratios (i.e. transaction throughput rates). “So, a transaction that costs $10 on Ethereum on average would cost a few cents on OKExChain,” he highlighted.

Interested in cryptocurrency? Learn more about the basics with our beginner’s guide to Bitcoin, dive deeper by learning about Ethereum and see what blockchain can do with our simple guide to DeFi.

Disclosure: The author owns a range of cryptocurrencies at the time of writing

Disclaimer:

This information should not be interpreted as an endorsement of cryptocurrency or any specific provider,

service or offering. It is not a recommendation to trade. Cryptocurrencies are speculative, complex and

involve significant risks – they are highly volatile and sensitive to secondary activity. Performance

is unpredictable and past performance is no guarantee of future performance. Consider your own

circumstances, and obtain your own advice, before relying on this information. You should also verify

the nature of any product or service (including its legal status and relevant regulatory requirements)

and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may

have holdings in the cryptocurrencies discussed.

Picture: Getty