Cryptocurrencies blasted through the last quarter of 2020, and the total crypto market capitalisation reached record highs. Bitcoin almost tripled in value over the quarter, followed by many of the alternative coins (‘altcoins’) such as Ethereum which doubled in value, and the trend has continued into 2021.

A significant driver for the crypto rally has been the increasing institutional interest and the growing enthusiasm about DeFi (‘decentralised finance’), by which entrepreneurs in the crypto industry can re-create standard financial instruments outside the control of companies or governments. The DeFi industry has evolved from Ethereum as an initial application to ‘stablecoins’, which are pegged to a fiat currency such as the USD, and to more advanced solutions.

Furthermore, the initial stage of the upgrade to Ethereum, ETH 2.0, was launched in December, seeking to increase the transaction bandwidth in a more secure and sustainable way. The question is whether these drivers are strong enough to maintain the crypto bull market throughout 2021.

The benefits of a decentralised currency

The supply of fiat money is controlled by governments and central banks through the ability to print money at their will. It has led to many cases of hyperinflation in past centuries, with the Western Roman Empire providing an early example. With a rapidly expanding empire, the expenses for military, logistics and administration kept adding up. To cover the sky-rocketing expenses, the Romans continuously minted new coins of lower silver purity, transferring the wealth away from the people and devaluating the currency. This coin debasement and resulting hyperinflation in the end contributed to the collapse of the Western Roman Empire.

The fear of a devaluation of the monetary system has historically made people look to inefficient barter methods, and in newer times to inflation-protected assets such as gold, and commodities in general. Although Bitcoin is still too volatile to be called a safe haven, the decentralised nature of cryptocurrencies attracts investors as a hedge against inflation, as was demonstrated in 2018 when Venezuela experienced one of its worst periods of hyperinflation since World War II. With Bitcoin’s limited supply of 21 million BTC when all Bitcoins have been mined, it has similar properties to some scarce commodities such as gold. Using this analogy, Bitcoin can be viewed as a financial option on the collapse of the current fiat monetary system, or at least on the fact that the fiat world will degrade faster than the decentralised cryptocurrencies due to the difficulty of taking down a decentralised system.

Fixing the Ethereum bottleneck

With the limited supply of Bitcoin and the large energy costs associated with verifying transactions through mining, Bitcoin is considered more a store of value than other cryptos such as Ethereum. Ethereum also has industrial applications, like silver in the commodity space where around 50 per cent of the supply goes to industrial applications. The Ethereum network allows the creation of smart contracts – pre-programmed transactions that run automatically when certain conditions are met, as long as the necessary transaction fees are paid on the network. These smart contracts have wide applications outside the financial industry, such as in recording property ownership, processing insurance claims or managing voting systems.

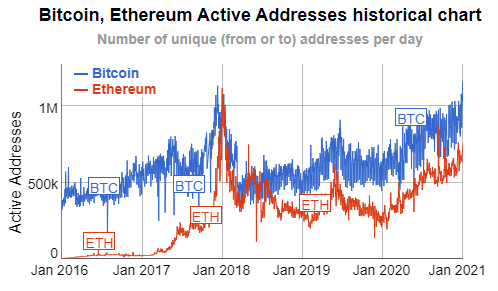

The broad spectrum of applications is currently strongly constrained, as the Ethereum network only allows processing of a small amount of transactions per second. This results in large transaction fees as participants are competing for the bandwidth, so the ETH 2.0 upgrade is crucial for the growing network. The volume of users on the Ethereum network, measured by the number of unique active addresses, is still far away from the peak activity in late 2017, in contrast to Bitcoin where the number of active addresses is reaching new highs.

Apart from significantly boosting the bandwidth, the ETH 2.0 upgrade will move the verification process away from energy-intensive miners, who do not necessarily need to have an investment in ETH themselves. The replacement will be a staking framework in which holders of ETH can decide to stake a part of their own ETH and participate in the validation process. By doing so they will receive rewards by newly issued ETH, but lose a part of their stake if they in any way try to alter the transactions. The continuous flow of new issuances makes ETH inflationary by nature and a long-term holder who do not actively participate in staking will experience a leakage in value. The overall aim of Ethereum is however to keep inflation at a sufficiently low level to have enough validators and thus keep the network safe.

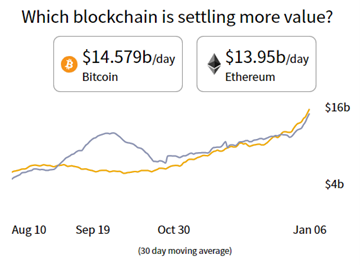

According to Money-movers.info, the daily settled value on the Ethereum network surpassed the Bitcoin network back in September, demonstrating the application-wise use of ETH in contrast to BTC. However, Bitcoin reclaimed the lead close to the year-end, expressing the red-hot interest for investors to participate in the BTC bull run and the impact of high ETH fees.

Using crypto-exposure analogously to options

In the current financial markets, investors have to look to equities and equity-linked instruments for achieving positive returns. Although crypto investors in 2020 likely have gained large profits, the huge volatility in the cryptocurrencies necessitates caution when trading. This was exemplified in mid-March last year where BTC and ETH lost close to half of their value over a day when the markets panicked on rising global Covid-19 infection numbers. Apart from being a hedge against inflation, an investment in the crypto industry can be seen as similar to adding an option to your portfolio as a bet, which have a probability of being reduced to zero value or to give a many-fold return.

Looking into 2021 and past the speculative investors, the positive sentiment in the crypto space relies on increased mainstream adoption, as well as on successful developments of technological infrastructure to keep pace with the rising network demands. At the same time, the threats of regulatory challenges and hackers finding a backdoor are still lurking on the horizon.

In 2020, cryptocurrencies started moving from being obscure to being institutional. Two things are driving this: the opportunity to stake 3 to 5 per cent of your portfolio on something which could deliver a many-fold return, and the insane amount of fiat money in circulation. The younger generations, and now increasingly money managers, are willing to bet that technology will outlast money with no collateral value.

Anders Nysteen is a senior quantitative analyst at Saxo Bank