A long-awaited public offering of Coinbase Global Inc. appears near after the cryptocurrency trading platform filed paperwork with the Securities and Exchange Commission on Thursday.

Coinbase

COIN,

plans to list on the Nasdaq Inc. exchange

NDAQ,

under the ticker symbol “COIN,” with the aim of employing a nontraditional direct listing to take itself public as soon as next month. A direct listing means it won’t raise any new money, similar to approaches used by Palantir Technologies

PLTR,

Slack Technologies

WORK,

and Spotify Technology

SPOT,

in recent years.

Here’s what to know about the popular trading platform ahead of its public offering.

What is Coinbase?

The Silicon Valley crypto exchange was co-founded in 2012 by Brian Armstrong, 38, who runs the platform chief executive. Fred Ehrsam, a Coinbase director, also helped to create the company.

There are two class of Coinbase shares. Armstrong owns 11% of the Class A shares and 22% of the Class B shares, while Ehrsam owns 11.4% of the Class A and 9% of the Class B.

According to Forbes, Armstrong’s networth is currently $6.5 billion based on his ownership in the company, which is likely to increase if the direct listing goes off successfully.

Coinbase bills itself as a bet on the rapidly growing cryptoeconomy, which starts with the No. 1 crypto asset bitcoin but goes well beyond that, Armstrong and company argue.

Coinbase S-1

Bitcoin prices

BTCUSD,

have gained attention as it has soared to repeated records, most recently touching a recent peak above $58,000 over the weekend before beginning to give up some gains in recent trade.

Last week, bitcoin hit a market value of $1 trillion and even though the asset created by a person or persons known as Satoshi Nakamoto represents about 70% of the total crypto market, there are still a number of other popular crypto assets trading on Coinbase, including ether

ETHUSD,

on Ethereum’s blockchain, Bitcoin Cash

BCHUSD,

and Litecoin

LTCUSD,

to name a few.

Who else owns Coinbase?

Venture-capital firm Andreessen Horowitz, is the largest owner of Coinbase, boasting about 25% of Class A shares and14% of Class B. And Marc Andreessen, head of the venture capital outfit, sits on Coinbase’s board.

Coinbase has an ambitions echo those of Robinhood Markets

“Coinbase is company with an ambitious vision: to create more economic freedom for every person and business,” Armstrong wrote in a letter appended to the company’s public-filing paperwork with the SEC.

Biggest risk factor

No doubt the biggest risk factor in Coinbase is that it is a bet on an unproven asset class that was created just over a decade ago. Coinbase attempts to make it clear that its fate is linked to the prospects for Bitcoin and ethereum and the thousands of other alternative coins that have been written into existence.

But a decline in interest and tough regulations in the U.S. and elsewhere could wallop the exchange platform.

Here’s now Coinbase explains it:

“There is no assurance that any supported crypto asset will maintain its value or that there will be meaningful levels of trading activities. In the event that the price of crypto assets or the demand for trading crypto assets decline, our business, operating results, and financial condition would be adversely affected. A majority of our net revenue is from transactions in Bitcoin and ethereum. If demand for these crypto assets declines and is not replaced by new demand for crypto assets, our business, operating results, and financial condition could be adversely affected,” Coinbase writes in its S-1 filing.

One other interesting risk factor embedded in Coinbase’s S-1 filing is the identification of Satoshi Nakamoto and the transfer of that person or persons stash of coins. Nakamoto has never been definitively ID’d.

According to reports, or crypto lore, Nakamoto mined as many as 1.1 million bitcoin, which would be worth $46 billion at today’s values. That stash has thus far remained untouched, according to those who track the blockchain associated with those early blocks.

How large is Coinbase?

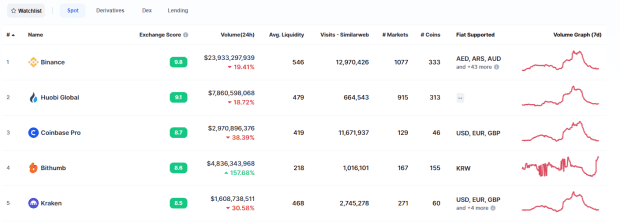

The crypto exchange platform ranks No. 3 among the largest digital asset exchanges in the world, according to data site CoinMarketCap.com. That ranking puts it behind Binance, based in Seattle and Huobi Global, a Seychelles-based cryptocurrency exchange that was founded in China.

CoinMarketCap.com

In the U.S. Coinbase is by far the most well-known crypto platform but there are competitors, including Gemini, run by Tyler and Cameron Winklevoss, who famously used their Facebook Inc.

FB,

settlements to invest in bitcoins.

Kraken is another popular crypto platform and direct competitor in the U.S.

Odds & Ends

The company in its public filing offered a number of homages to the founder or founders of bitcoin and the digital currency age in its submission.

For example, it listed the genesis block associated with Satoshi Nakamoto at “1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa,” whose white paper back in 2008 set bitcoin in motion. (Additionally, a “Satoshi” is the smallest unit of bitcoin—0.00000001 BTC).

The company offers no physical address for its headquarters in California, citing the COVID-19 pandemic, which has forced a number of companies to have most, if not all, of its staffers work remotely. For that reason, Coinbase refers to itself as “a remote-first company.”

However, having no address to some was viewed as aligning with the decentralized nature of blockchain and bitcoins.

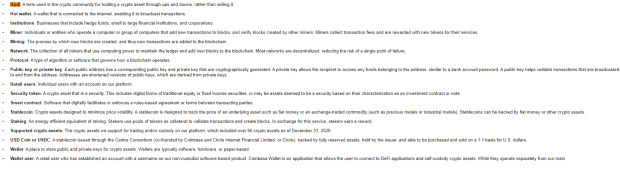

The company also offered a handy primer on cryptocurrency terms, including defining terms like “hodl,” which have become popular in crypto circles. Hodl was accidentally coined in a 2013 Reddit and means long-term holder of an investment.

Read: Don’t fight the FUD: HODL onto this list of bitcoin terms you need in your vocabulary

SEC

Armstrong crypto charity

Back in 2018, Armstrong kicked off GiveCrypto.org, which makes direct cash transfers to people living in poverty.

“People who invested early in crypto have amassed an enormous amount of wealth in a relatively short amount of time. Yet the reputation of the crypto community has been dominated by images of ‘bros in Lambos,’ whose antics get a lot of attention,” wrote Armstrong in a separate blog post on Medium in 2018.

Armstrong has reportedly donated at least $1 million to GiveCrypto.