- Both Bitcoin and Ethereum saw a major surge on the 29th January

- While Bitcoin’s growth comes as a consequence of it being mentioned by Elon Musk, ETH grew in correlation

- Both coins have strong potential to go higher in 2021

Bitcoin price skyrocketed as the weekend approached

In January 2021, Bitcoin went through a lot, making for an action-filled start to the year. The first week was marked by strong growth, while the second week saw the coin hit a new all-time high and then crash by around $10,000. In the third week, the coin mostly traded sideways, which continued into the last week of the month.

On 29th January, the coin skyrocketed from $32,000 to $38,647 after BTC was mentioned by Elon Musk on Twitter.

Musk has had numerous interactions with the crypto industry in the past, and usually in his well-known joking manner. However, when the world’s richest man changed his Twitter bio to “#Bitcoin,” and also commented “In retrospect, it was inevitable,” the coin’s price started skyrocketing.

Bitcoin doesn’t stay still for long, and sooner or later, its price tends to coil up and push into new price territory. The only problem is that nobody knows which way it will go. Fortunately, it went up, although it did soon return to its former levels.

It is also likely that the recent GameStop short squeeze made people consider the crypto industry a bit more carefully. After all, the short squeeze did demonstrate how fragile and unfair the financial system can be. In a decentralised environment, the entire incident could have been avoided — including the censorship of WallStreetBets, a group that stood up in defense of GameStop.

A report by Glassnode CTO, Rafael Schultze-Kraft, noted that Bitcoin’s price inflows in the past 30 days leading to 25th January were bigger than its total market cap in 2017 as well as in 2019.

Schultze-Kraft also demonstrated how institutional interest in BTC is higher than ever, noting that in the first 28 days of 2021, there were around 26,000 BTC mined. Meanwhile, Grayscale holdings in 2021 have gone up by 40,000 BTC. “That’s who you’re selling to, when you’re selling now,” he added.

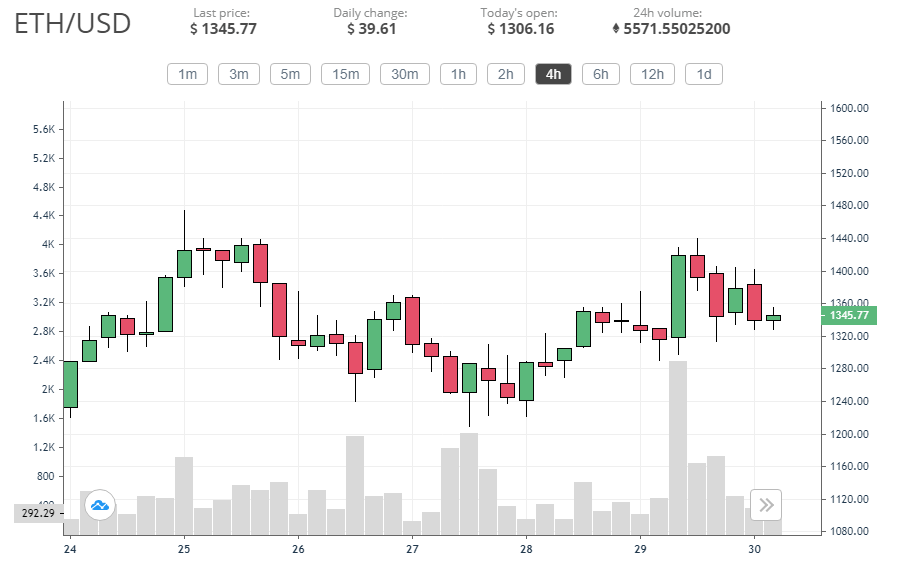

ETH price back to mid-$1300 levels after a brief dip

While Bitcoin was trading sideways last week, Ethereum saw a bit more activity. The coin’s price started with a rise from $1,220 on 24th January, to a new all-time high at $1,474 on 25th January. After that, the coin saw a correction that took it all the way down to $1,210, according to CEX.IO data.

It reached this low level on 27th January, which was followed by another growth to $1,375 only 24 hours later. The coin was just about to see another correction, when the Bitcoin and Dogecoin surge happened after both coins were mentioned by Elon Musk.

The rally that caused DOGE to surge by 420% and BTC to go up by 20% also caused a significant growth of ETH. It was brief, and as it turned out, only temporary. However, it did see ETH price surge up to $1,439. As the dust began to settle, Ethereum did see a correction, although only to $1,329.

Ethereum did not see many major developments over the past week, but it did see a new partnership of the Ethereum Foundation and Reddit. The two teamed up to boost scaling and resources, according to recent reports.

And, of course, its DeFi sector did continue to push upwards, as its TVL reached a new all-time high at $27.273 billion earlier today. Other than that, Ethereum’s high price is mostly a result of demand and expectations of the future surge, as the world still waits for Ethereum 2.0 to arrive in full.

Where will BTC and ETH go from here?

Bitcoin seems to have lost momentum somewhat over the past few weeks. Ever since it reached its ATH at $42,000, which was followed by a $10,000 drop, Bitcoin has been relatively calm. I believe, however, that the coin has more room to grow in Q1, and that it will hit $50,000 before the end of March 2021.

After that, we expect it to keep going to $80,000 by early summer. The summer itself will likely be a calmer period, when the coin will gather its strength for further growth, which will come as the year approaches its close. By the time 2021 comes to its end, We expect BTC to hit $90,000, as its stock-to-flow model indicates.

As for Ethereum, the coin has already exceeded our expectations, as we believed it would reach $1,300 by the end of Q1, when in reality, it managed to pass this level multiple times. Even now it sits above it, albeit only slightly. However, this might present the coin with a new opportunity, as we expect it to reach $2,000, and then at least $2,200 in Q2 of this year.

The real growth, however, is expected to arrive in Q4, when we expect ETH to surge all the way up to $4,900. The launch of Ethereum 2.0 will likely be crucial for this development.