- Bitcoin retest support at $45,000 after failing to break the resistance at $52,000

- A break above the range between $48,000 and $49,500 will bring back a bullish impulse.

- Ethereum forms a bullish technical pattern as gains to $1,700 linger.

- Ripple is on a growth path to $0.75 as long as bulls reclaim the ground above $0.5.

The cryptocurrency market has taken a hiatus after a gruesome week of overbearing declines. Bitcoin failed to break the resistance at $52,000 but headed south, resting the support at $45,000. As we usher in the weekend, the bellwether cryptocurrency is getting ready for another attack mission toward $52,000.

Ethereum was rejected at $1,700, culminating in another dip to $1,400. Meanwhile, a rebound is underway as buyers stream back into the market. On the other hand, the cross-border cryptocurrency Ripple missed breaking above $0.5, paving the way for declines to $0.4. Like, BTC and ETH, XRP is preparing for an upswing.

Bitcoin technical could flip bullish

Bitcoin is trading at $46,465 at the time of writing. The ongoing uptrend comes after a bounce from a double-bottom pattern. On the upside, bulls’ uphill task is to break above the resistance between $48,000 and $49,500. Trading above this zone will allow bulls to shift their focus to $52,000 (critical hurdle) and perhaps jumpstart the uptrend toward $60,000.

BTC/USD 4-hour chart

The upswing to $52,000 may fail to occur if the resistance range between $48,000 and $49,500 remains unbroken. BTC will be forced to retest the support at $45,000, but if the buyer congestion weakens, we can expect the price to fall to $42,000.

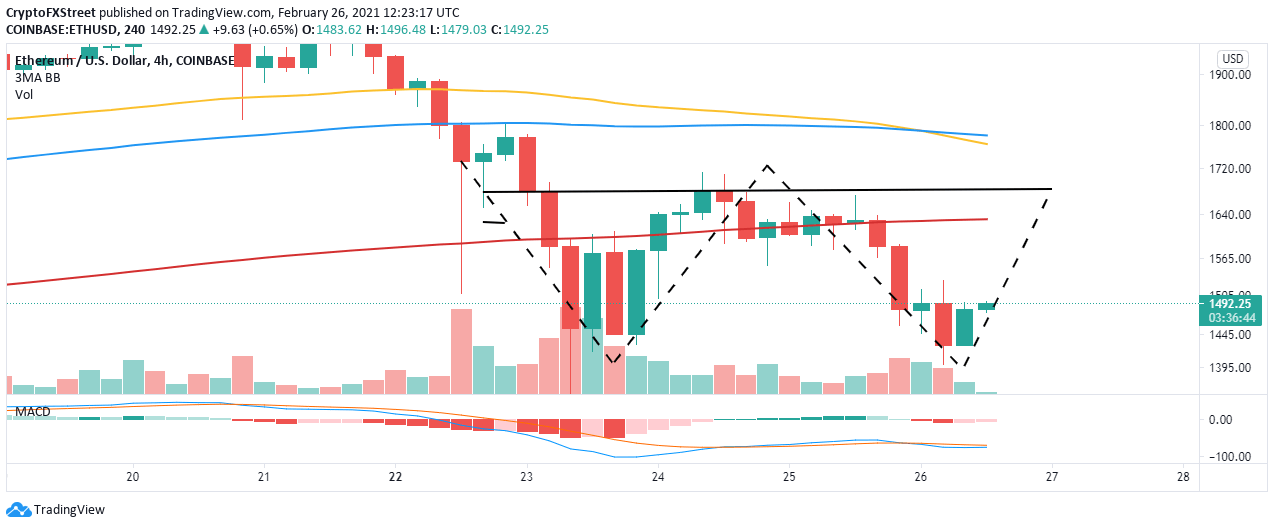

Ethereum nurtures a technical pattern breakout

The pioneer smart contract token has bounced off support at $1,400 for the second time in the same week. The first rebound defended the crypto from falling further after spiraling from highs above $2,000 but fizzled out at $1,700. Ether dropped to $1,400 again on Friday, though bulls are pushing for recovery.

In the meantime, Ether is trading slightly below $1,500. A breakthrough at this level will leave bulls with open-air to explore. Resistance is foreseen at the 200 SMA, currently at $1,630, while trading beyond $1,700 will set Ethereum on a trajectory toward $2,000.

ETH/USD 4-hour chart

The Moving Average Convergence Divergence (MACD) unveils that a sideways action will take precedence in the near-term, especially if ETH fails to break $1,500. If declines soar due to bulls getting exhausted, Ether may backtrack to $1,400 and perhaps tumble to $1,200 before a significant recovery occurs.

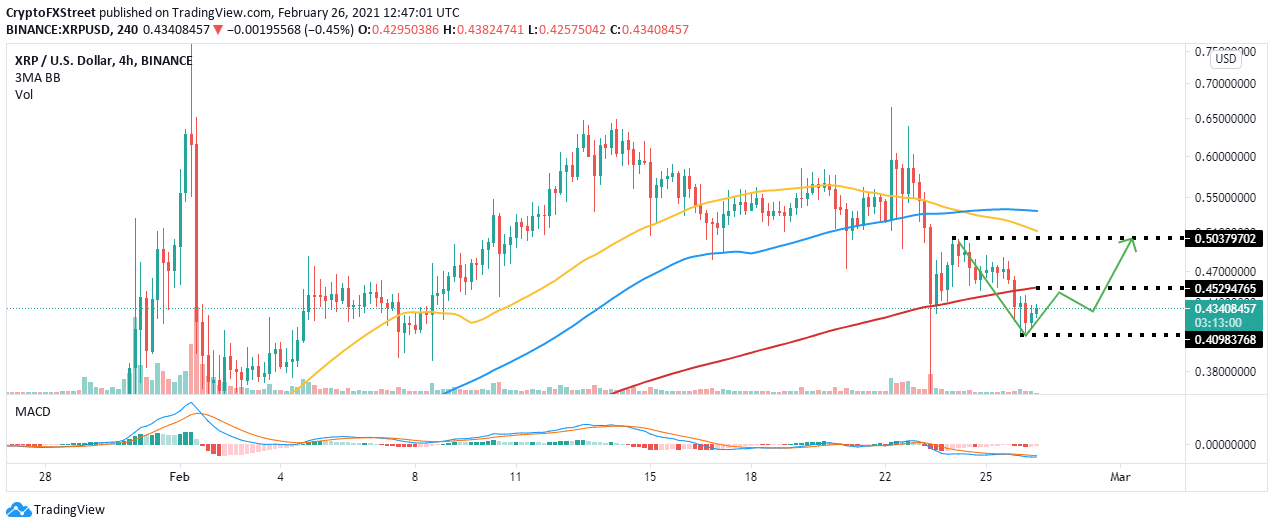

Ripple bulls eye $0.5 as springboard to $0.75

Since the breakdown earlier this week, the international money remittance token has not broken above the seller congestion zone at 40.5. However, support at $0.4 has been retested, giving way to the ongoing recovery.

XRP is teetering at $0.43 as bulls battle for a breakout beyond $0.5. The 200 SMA may delay the uptrend but once cracked, the bullish leg will head north $0.5. This zone is vital for the bulls because as support, attention will move to higher price levels, probably at $0.65 and $0.75, respectively.

XRP/USD 4-hour chart

It is worth mentioning that the MACD is within the negative territory. Besides, the MACD line (blue) is stuck underneath the signal line, implying that bulls are not fully in control. Therefore, any correction signs could trigger losses back $0.4, thus endangering the upswing to $0.5 and $0.75.