Dump of February 15 has proved again that even on the online markets bulls get exhausted running such a long distance.

The market was able to recover quickly and on all major cryptocurrencies we have noted a large bottom wick on a 4H candle. In general, such price action clearly states that the bullish sentiment remains and buyers are ready to push the price higher after a short rest.

Currently almost all major altcoins are following the same pattern and from the first glance it might look like a beginning of the downtrend. While Bitcoin sets a new all-time-high at $51700 today, other coins like NEO and Cardano are still trapped in a triangle and are fighting to break the resistance to continue the bullish run, EOS was able to break it.

NEO and EOS both are in the process of upgrading their networks, Neo is working on the launch of the NEO 3 and EOS is working on improving the EOSIO 2.1 releasing the RC of this update. Cardano, on the other side, had launched their Fund4 of the Project Catalyst with $1 million worth of ADA to improve an on-chain governance on Cardano.

The technical analysis of all three tokens against the US Dollar suggests that all three still look bullish, though NEO and ADA are struggling in breaking their resistances.

As seen on the chart above, Cardano is in a danger zone below the dynamic resistance of February 11. In order to continue the bullish run, ADA/USD must close above $0.87650. There is great support from EMA50 and MA200 on an hourly chart, MA100 is acting as a resistance by the time of writing of this article, whereas MACD and RSI signal the bullish continuation. If the breakout is confirmed, the impulse will lead the price up to $0.97630 and $1.06 above this level.

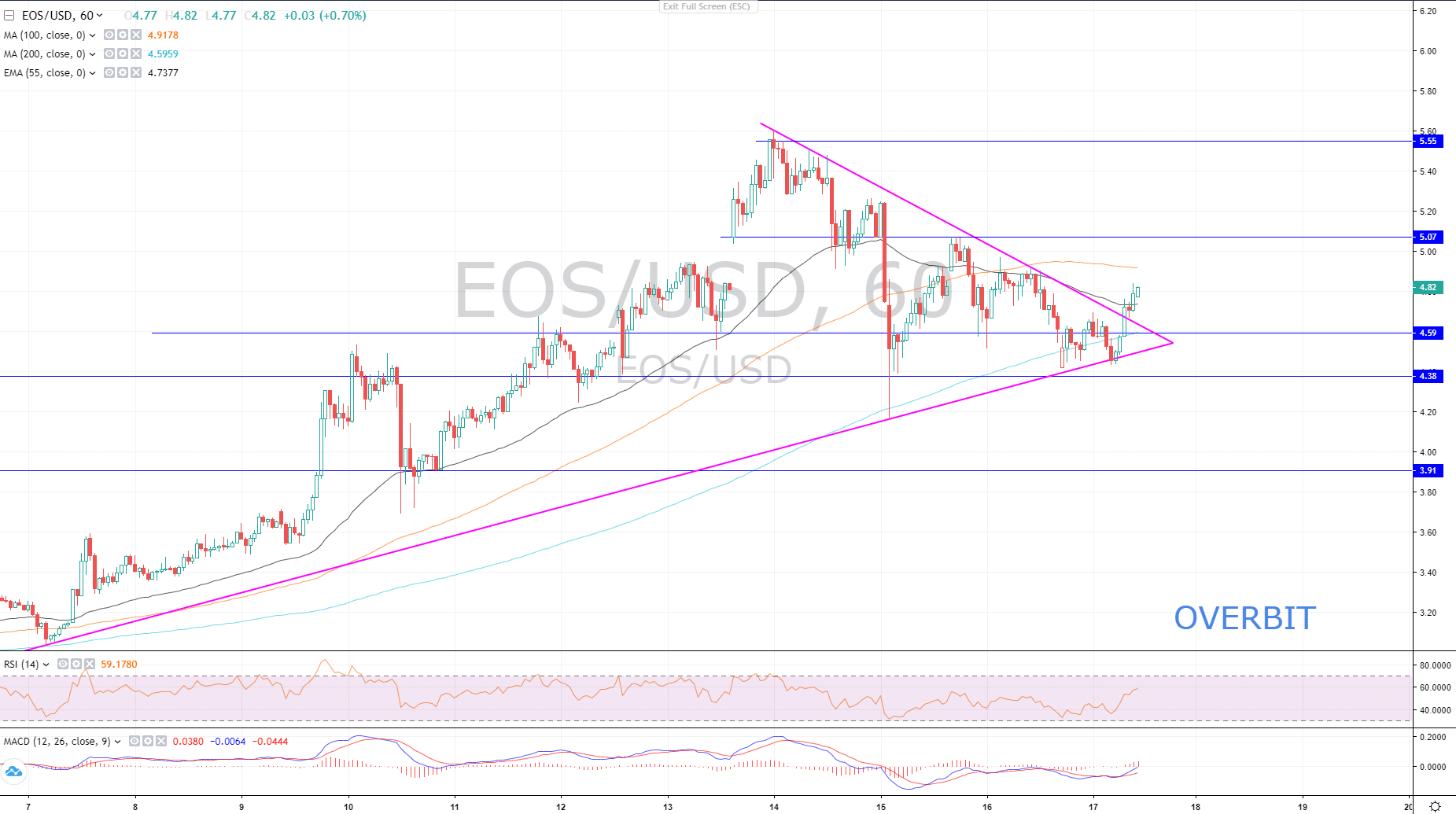

EOS/USD is above the dynamic resistance, and currently remains silent after a retest of the dynamic resistance as support.

Supported by MA200 and EMA50 EOS/USD has to continue the uptrend to hit MA100. The closest resistance is at $5, closing above that level will get EOS to $5.60 and if pace continues to $6. MACD already crossed the signal line and RSI is yet below the “overbought” area.

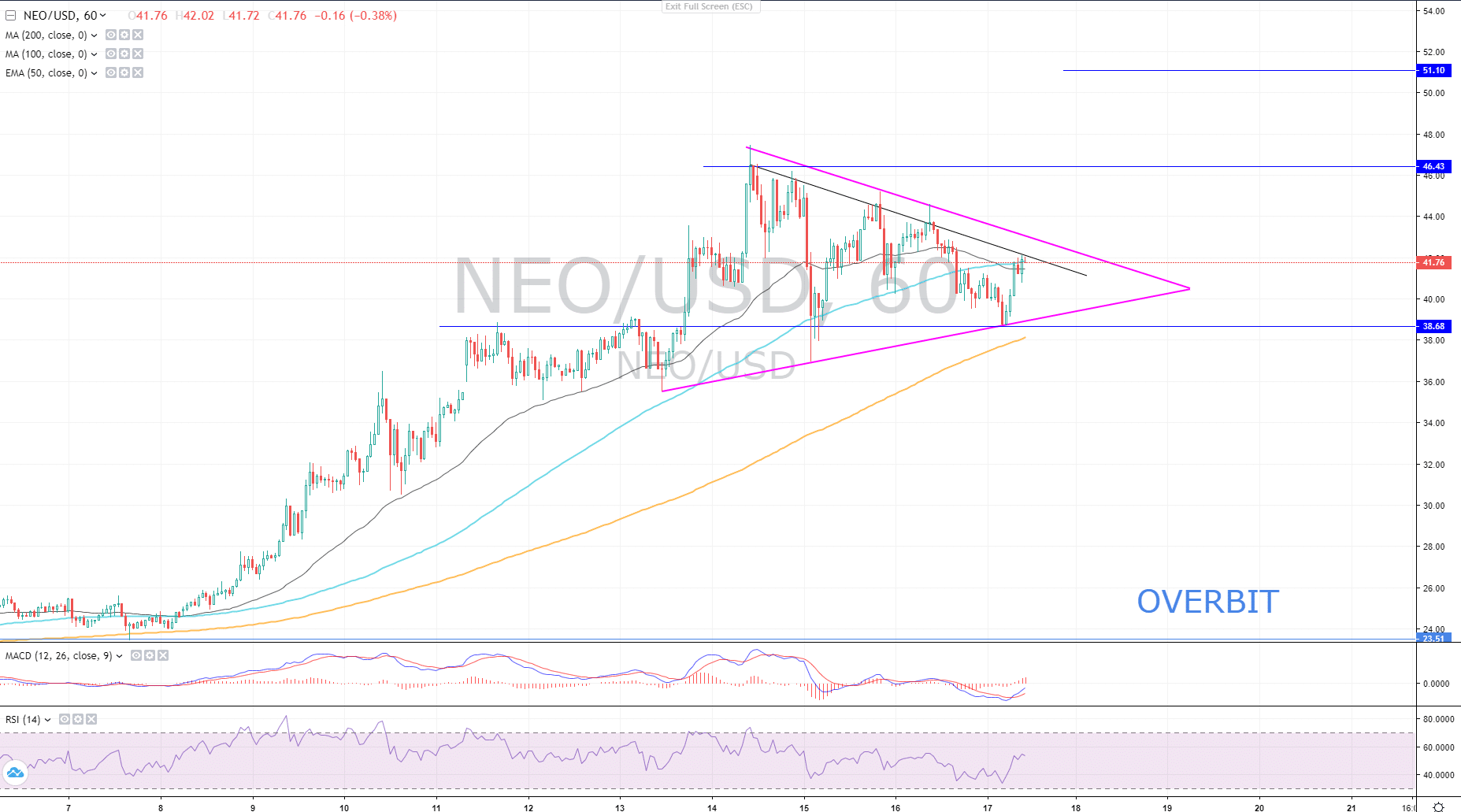

NEO/USD is yet to reach dynamic resistance and is slightly behind the ADA and EOS on a “bullish” marathon.

The pair has touched a local short-term resistance on an hourly chart, closing above EMA50 and MA100. MACD is above the signal line and is below the 0 threshold meaning, if buyers push the price above the dynamic resistance and above $43, the price could climb towards $51 after a test of the major resistance at $46.43. On the other hand, NEO might retrace from this level to test the dynamic support at $39.10 once more and proceed upwards from there.

There is a big announcement day from the US today as Retail sales, CPI and Core CPI data will show the purchasing power of the US population and highlight the projects on the economic recovery of the US. Positive data will strengthen the US Dollar, hence slight correction might be expected.

Senior Vice President at Overbit. Technical analyst, crypto-enthusiast, ex-VP at TradingView, medium and long-term trader, trades and analyses FX, Crypto and Commodities markets.